Record-Breaking $18 Billion Bitcoin and Ethereum Options Set to Expire Today

The largest Bitcoin and Ethereum options expiry in history, totaling $18 billion, hints at market optimism yet raises concerns about potential volatility.

The market enters the final days of 2024 with a new record for the largest Bitcoin options expiry in history. Today, a total of $18 billion worth of Bitcoin and Ethereum options contracts will expire.

Exciting and unexpected developments may be ahead for options traders and investors.

What Does the Record-High Crypto Options Value Indicate?

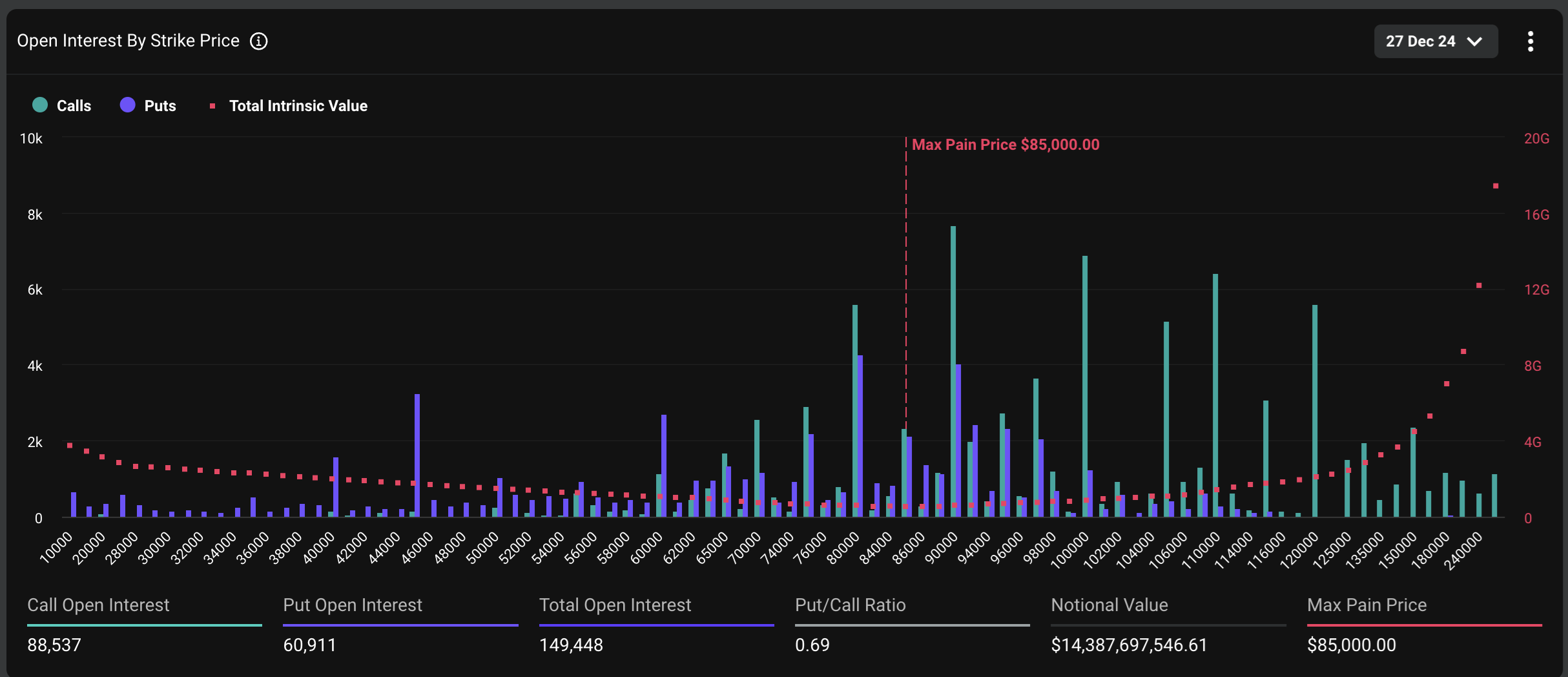

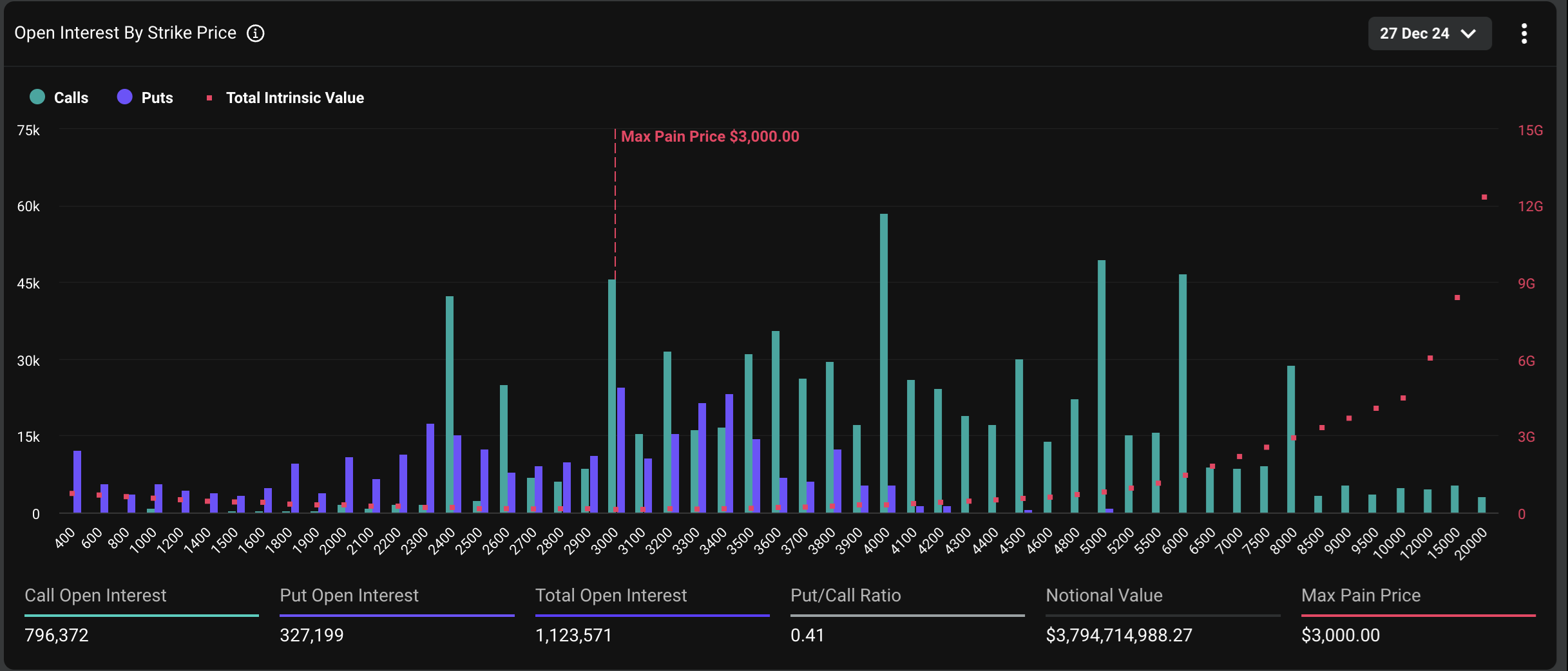

According to data from Deribit, this Bitcoin options expiry includes 88,537 contracts—four times more than last week. Similarly, Ethereum options contracts expiring today total 796,021, which is 4.5 times higher than the previous week.

The total value of expiring Bitcoin options has reached a record $14.38 billion, while Ethereum’s options total $3.7 billion. The higher the value of expiring options, the greater the traders’ expectations for profit and the rising demand for risk hedging.

Expiring Bitcoin Options. Source:

Deribit

Expiring Bitcoin Options. Source:

Deribit

For Bitcoin, the expiring options have a maximum pain price of $85,000 and a put-to-call (P/C) ratio of 0.69. In theory, a low P/C ratio (below 1) reflects positive sentiment, as more call options (bets on price increases) are being purchased, indicating bullish expectations. However, compared to historical data, Bitcoin’s P/C ratio has been trending upward throughout the final quarter of the year, potentially signaling increased hedging sentiment.

“Demand for downside protection has been rising for a few weeks now, perhaps partially fueled by players looking to protect their 2024 calendar year performance metrics. The put/call ratio on December 27 options open interest doubled from 0.35 in October to over 0.70 currently,” David Lawant, Head of Research at FalconX, commented.

Meanwhile, Ethereum options contracts have a maximum pain price of $3,000 and a P/C ratio of 0.41. This ratio has decreased from 0.97 at the end of October, reflecting growing bullish sentiment toward ETH.

Expiring

Ethereum Options. Source:

Deribit

Expiring

Ethereum Options. Source:

Deribit

At the time of writing, BTC and ETH are trading at $96,300 and $3,300, respectively, significantly above the aforementioned maximum pain prices. The maximum pain price refers to the price level at which all investors holding options contracts (both call and put options) experience the most losses (or “pain”) at expiry.

Some investors and analysts use maximum pain price as an indicator to predict potential price directions. The reasoning is that markets often gravitate toward the price to optimize profits for options sellers (typically large financial institutions).

“With the market heavily leveraged to the upside, any significant downside move could trigger a rapid snowball effect. All eyes are on this expiry to define the narrative heading into 2025,” Deribit commented.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.