Trump win fuels bitcoin derivatives boom as futures open interest surges over $60 billion

Bitcoin futures open interest has surged since Donald Trump’s election win.Bitfinex analysts observe this as “organic growth,” dismissing fears of a correction despite increased leverage.

Since Donald Trump’s U.S. presidential election victory on Nov. 5, bitcoin futures open interest has risen sharply, signaling increased trading activity and market speculation. Despite the surge, analysts from Bitfinex maintain that leveraged trades are not at risk of an imminent market correction.

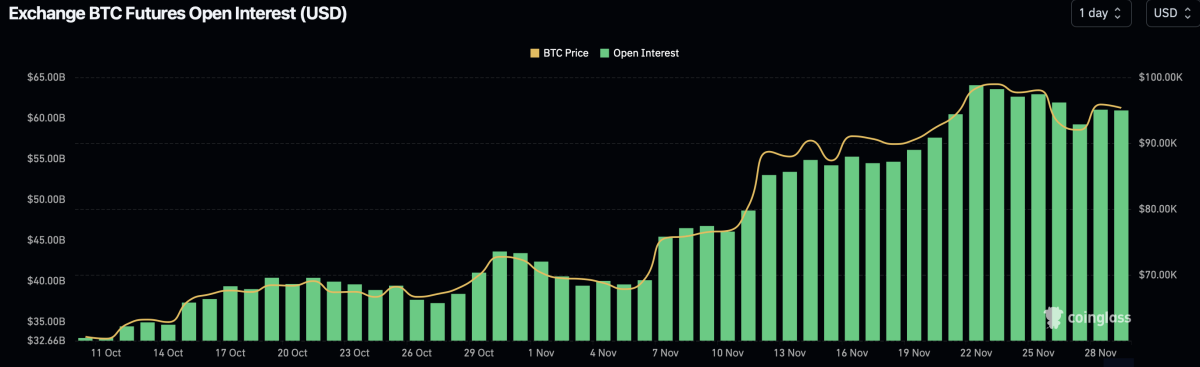

Bitcoin futures open interest jumped from $39 billion on Nov. 5 to currently stand at $60.9 billion, according to data from Coinglass. This represents a substantial increase in the value of positions tied to bitcoin derivatives contracts, many of which involve leverage.

Bitfinex analysts explained to The Block that the build-up in open interest appears organic, driven by expectations of future price appreciation. “Leverage build-up is a common tool for traders, including institutions, to position for anticipated price movements,” they said.

They also noted a slight reduction in open interest as of Nov. 22, particularly around the $94,000 level, where significant sitting orders were filled. “We don’t see the recent leverage build-up as anything out of the ordinary. The price retesting the $93,000 region was a normal pullback,” the analysts added.

Bitget CEO Gracy Chen believes Trump’s election victory has acted as a catalyst for the heightened leverage in the market. "The high leverage in the market proves that investors are beginning to value the market based on technical and regulatory improvements and the surge in open interest is a good thing, fueled by the conviction of a better environment under Trump that can help bitcoin thrive," Chen told The Block. However, Chen noted that price corrections, potentially in the form of long squeezes, are possible due to bitcoin's inherent volatility and could serve to stabilize the market when leverage becomes excessive.

Bitcoin futures open interest has surged since Donald Trump won the U.S. presidential election. Image: Coinglass

Ethereum outperforming bitcoin over the past week

While bitcoin reclaimed the $95,000 level after the release of the latest PCE price index, ether has emerged as the standout performer. Ether has rallied over 5% on Nov. 27 to a high of $3,600, with analysts pointing to a capital rotation from bitcoin to ether.

“Bitcoin dominance has dropped from its high of 61.5%, and the ETH/BTC pair is holding strong, currently at 0.03760, up 17.8% from last week,” analysts at QCP Capital noted. They believe ether is on track to test the 0.0400 level, signaling continued strength relative to bitcoin.

Ethereum exchange-traded funds (ETFs) have also seen robust inflows, with $90.1 million added on Wednesday, marking a four-day winning streak. “Ethereum’s recent strength supports the case for a retest of its all-time high of $4,868, a potential 35.4% upside from current levels,” QCP Capital analysts added.

The global cryptocurrency market capitalization rose by 2.1% over the past 24 hours, reaching $3.4 trillion, according to data from CoinGecko. Bitcoin remains dominant at 54.7%, while ether accounts for 12.4% of the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.