-

Polkadot (DOT) has surged dramatically, with a remarkable 77% rise over a four-day period, prompting questions about the potential for a pullback.

-

The altcoin’s rally comes after a sustained downturn, marking a significant recovery influenced by Bitcoin’s positive momentum.

-

According to COINOTAG, analysts have noted that while the A/D indicator suggests high demand, market conditions may force DOT to test crucial Fibonacci retracement levels.

This article explores Polkadot’s recent price rally and its implications for the cryptocurrency market, examining key support levels and demand trends.

DOT Breaks Above $10: Market Reaction and Analysis

After a bullish momentum that culminated in a price surge past the significant $10 threshold, Polkadot (DOT) has attracted the attention of traders and investors alike. The token’s price skyrocketed from $5.7 to a temporary peak, marking a significant turnaround from the lows experienced earlier in November. The positive trajectory was initially supported by Bitcoin’s upward momentum, providing a favorable environment for altcoins like DOT to flourish.

However, following the rapid climb, a pullback towards $4.75 became apparent, suggesting that some traders might be cashing in on their profits. The recent trading activity indicates that DOT was facing a challenge, with its price stabilizing around $7.87 as of the latest updates. The Accumulation/Distribution (A/D) indicator has continued to rise, highlighting consistent buying pressure despite the volatility.

Assessing Market Support Levels for DOT Investors

The current price volatility necessitates a closer examination of support levels as traders navigate this erratic market landscape. DOT traders should keep a keen eye on the Fibonacci retracement levels located at $7.09 and $6.285. These zones may serve as critical support if retracement occurs following the recent spike. Analysts advocate for caution as Bitcoin approaches its $90,000 support zone, which could influence a broader altcoin market correction.

Moreover, past performance analysis reveals that significant buying opportunities typically arise during these dips. Historical price behaviors often reflect a strong recovery trend post-correction, making such moments ideal for accumulation.

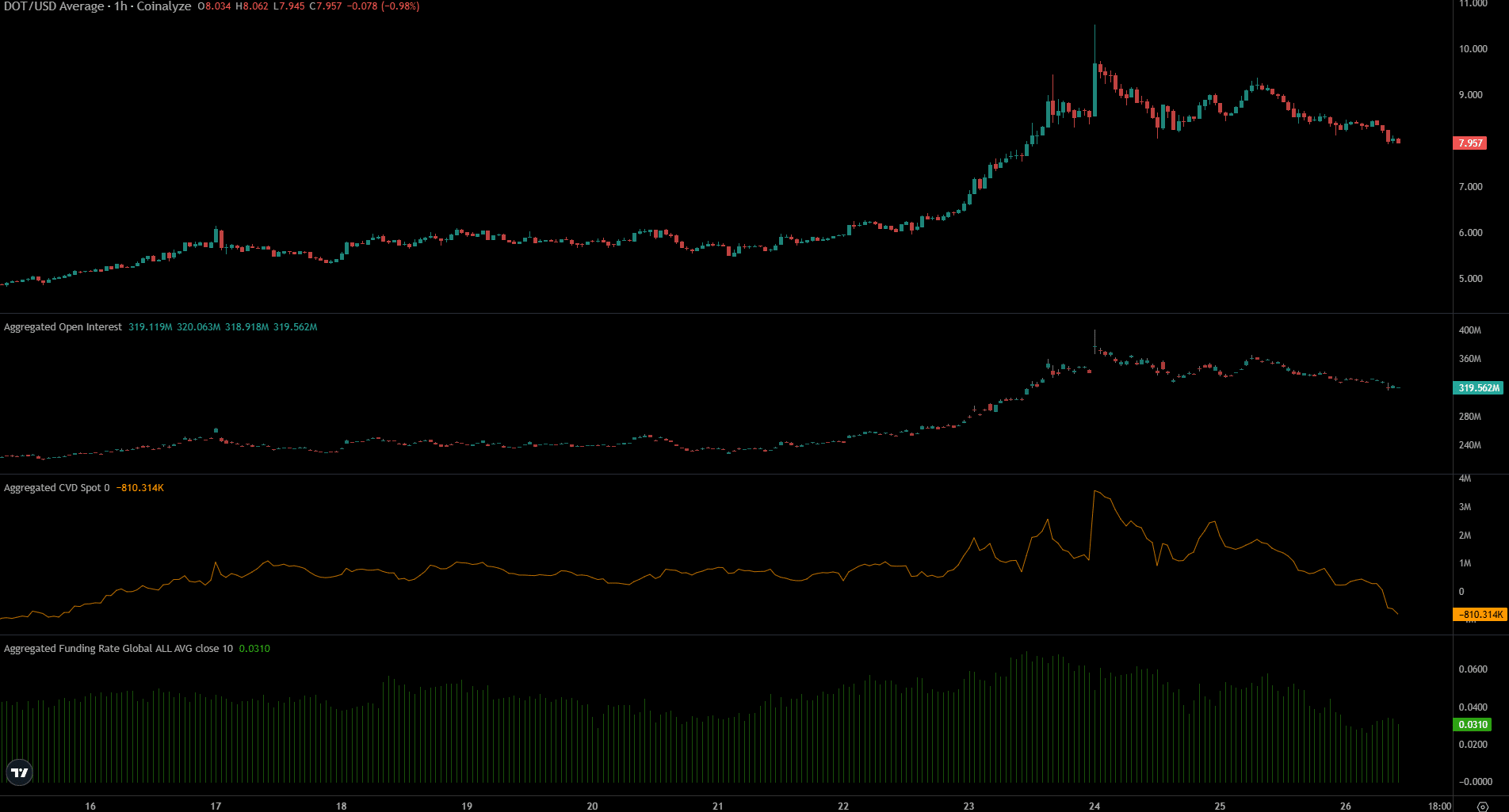

Spot CVD and Overextension: Analyzing Demand Dynamics

Source: Coinalyze

As market dynamics shift, the decline in the Spot Cumulative Volume Delta (CVD) provides crucial insight into demand trends. The Open Interest (OI) peaked at $399.8 million on November 24th, coinciding with aggressive inflows. However, this bullish sentiment proved short-lived as both OI and CVD began a downward trajectory, reflecting waning demand.

The aggressiveness of this decline, especially in the spot market, suggests heightened selling pressure, undermining the bullish sentiment seen in recent days. Although the funding rate has remained positive, the indicators hint at a cautious approach for traders moving forward.

Conclusion

Polkadot’s recent journey reflects the broader ebbs and flows of the cryptocurrency market. With significant price gains followed by potential pullbacks, it is vital for traders to monitor key support levels and market dynamics. Should price retraction occur, levels at $7.09 and $6.285 may present viable buying opportunities. Overall, while demand indicators suggest some selling pressure, the A/D continues to showcase accumulating interest. Thus, careful navigation through this volatile terrain could be fruitful for informed investors.