BIS (Bank for International Settlements) Report: Uniswap v3 liquidity market is still dominated by a few large participants

According to Cointelegraph, the Bank for International Settlements (BIS) has released a research report analyzing the liquidity provision of decentralized exchange (DEX) Uniswap v3.

The report points out that despite being technically decentralized, the liquidity market is still dominated by a few large participants, making it difficult for retail liquidity providers (LPs) to compete with institutions.

These major players hold about 80% of the total locked value and focus on liquidity pools with high trading volume and low volatility. The study also found that retail LPs' transaction fee income and investment returns are relatively low, and they usually lose money after risk adjustment. BIS believes that this institution-dominated phenomenon challenges the concept of DEX's decentralized financial system.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

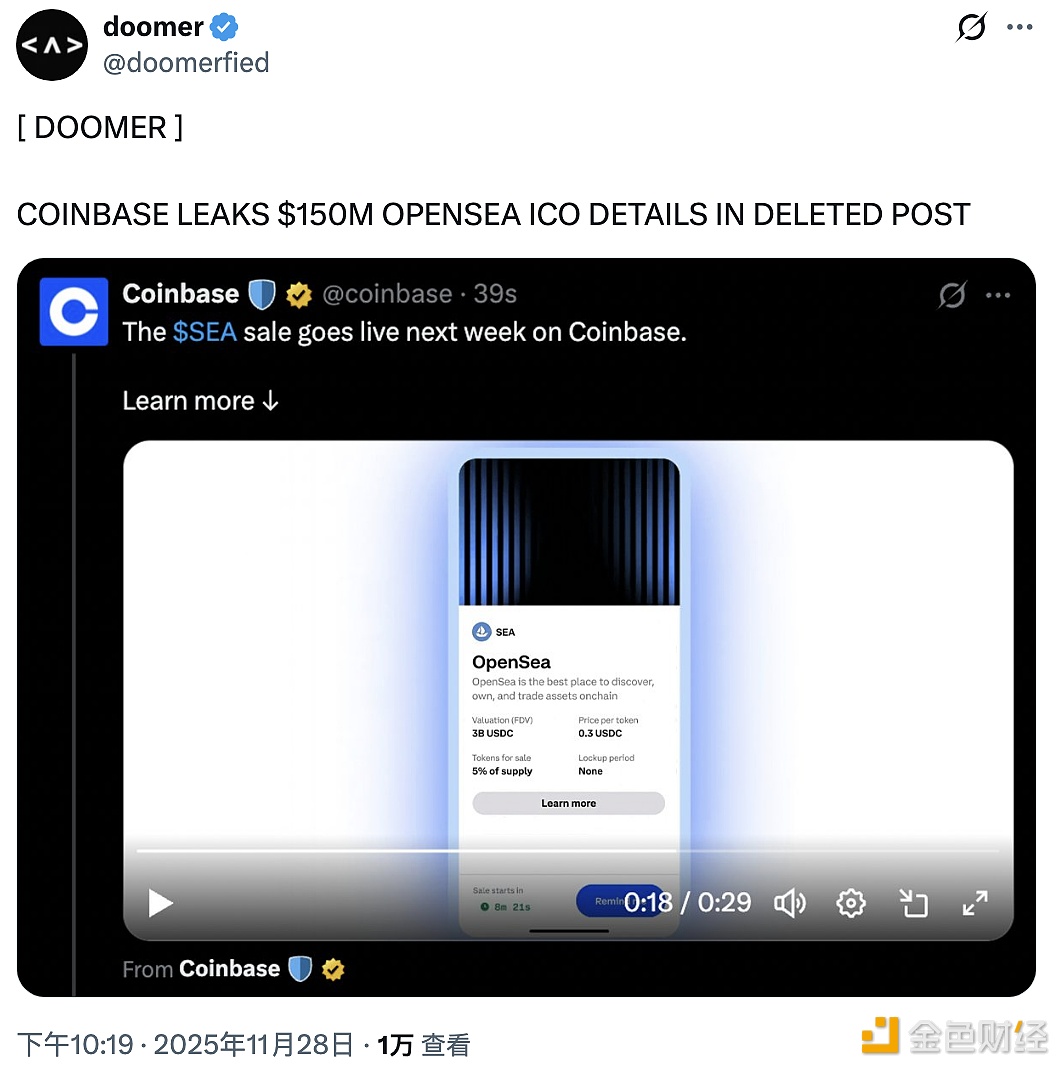

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.