- Sui Foundation denies insider token sales during recent price surge allegations.

- SUI shows volatility, nearing overbought territory with a possible short-term correction.

- Liquidations surge as SUI price fluctuates, peaking during September’s short squeeze.

The Sui Foundation has denied allegations of insider trading after claims surfaced that insiders sold $400 million worth of SUI tokens during a recent price surge. The Foundation stated that no employees, founders, or investors were involved in the alleged selling, which would have violated lockup agreements.

The allegations emerged without specific wallet addresses, but the Foundation said it identified a potential wallet belonging to an infrastructure partner who holds tokens under a strict lockup schedule. The Foundation maintains that no insiders were involved in the alleged token sales.

Sui Market Overview and Trading Volatility

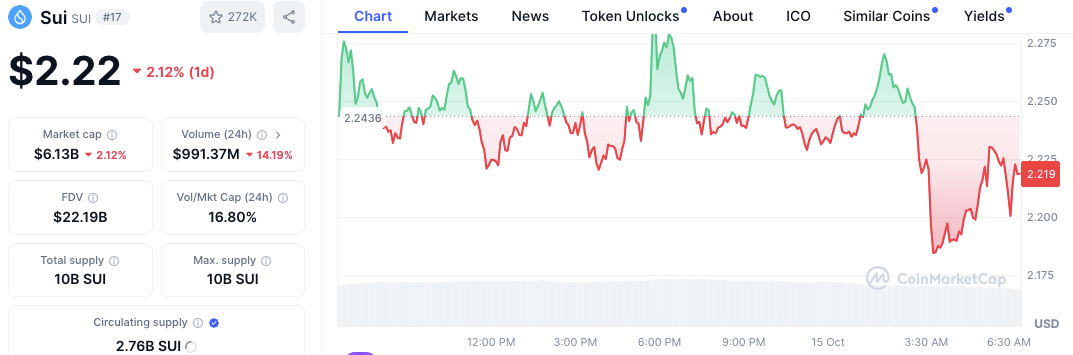

Despite this, SUI has experienced volatility in its trading behavior. During the time of writing, SUI was priced at $2.21, reflecting a 1.47% decline over the past 24 hours. This dip mirrored a decrease in SUI’s market cap, which fell to $6.10 billion.

Source: CoinMarketCap

The price fluctuated, with SUI opening at $2.24, peaking briefly above $2.27, and then dropping to a low of $2.21. Despite this short-term volatility, the overall trend since August has been bullish, with the price peaking near $2.40.

Read also : Cardano (ADA) Dips Amid SUI Hype: Buying Opportunity?

From the technical analysis, SUI’s price movements suggest a possible short-term correction. The MACD indicator shows that while the overall trend remains bullish, buying pressure may weaken. The blue MACD line is above the orange signal line, but the shrinking histogram bars suggest diminishing momentum.

Source: TradingView

Additionally, the RSI stands at 66.98 indicating that the asset is nearing overbought territory, potentially signaling further downward pressure.

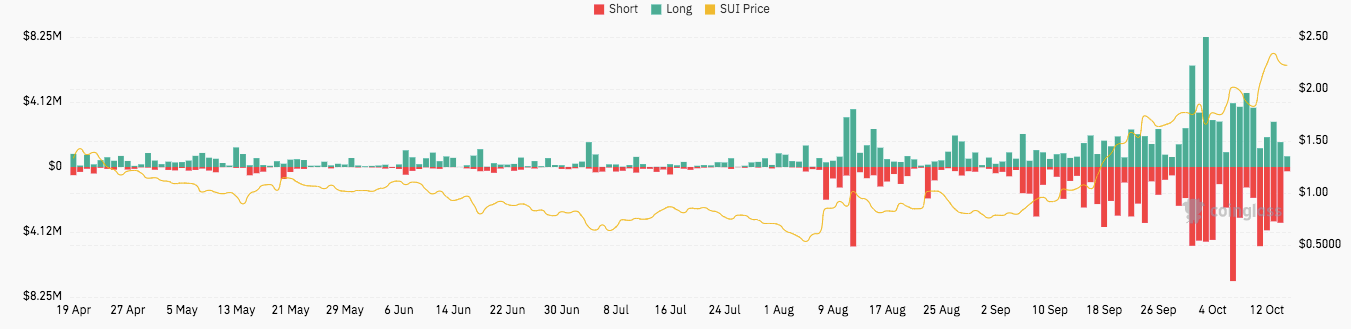

Liquidations and Volatility Increase Since August

According to Coinglass data, liquidations in SUI trading have increased since early August, particularly for traders in long and short positions. This surge in liquidations is directly correlated with SUI’s price fluctuations.

SUI Total Liquidations Chart: Source: Coinglass

In early September, short liquidations markedly rose as the price of SUI sharply increased, causing a short squeeze. As the price rose, short traders were forced to liquidate their positions, with this trend peaking in late September and early October when SUI hit $2

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.