Circle, the issuer of the USDC stablecoin, will move its global headquarters to New York City by 2025. In an announcement on X, company CEO Jeremy Allaire said that Circle will occupy one of the top floors of the 1 World Trade Center, a milestone move to a landmark building representing America’s status as a global economic leader.

The announcement also included a video in which the company’s executives spoke about its vision, while pro-crypto lawmakers from New York, such as Reps Ritchie Torres and Dan Goldman, also talked about the city’s crypto-friendly environment. According to the CEO, Circle’s new flagship HQ will be a “powerful convening space” rather than a traditional office.

Why is Circle moving to NYC?

Allaire explained that the move to NYC will put Circle headquarters at the center of the US financial ecosystem, providing closer proximity to key regulatory agencies and financial institutions. This aligns with the company’s plan to deepen its engagement with regulatory and financial systems.

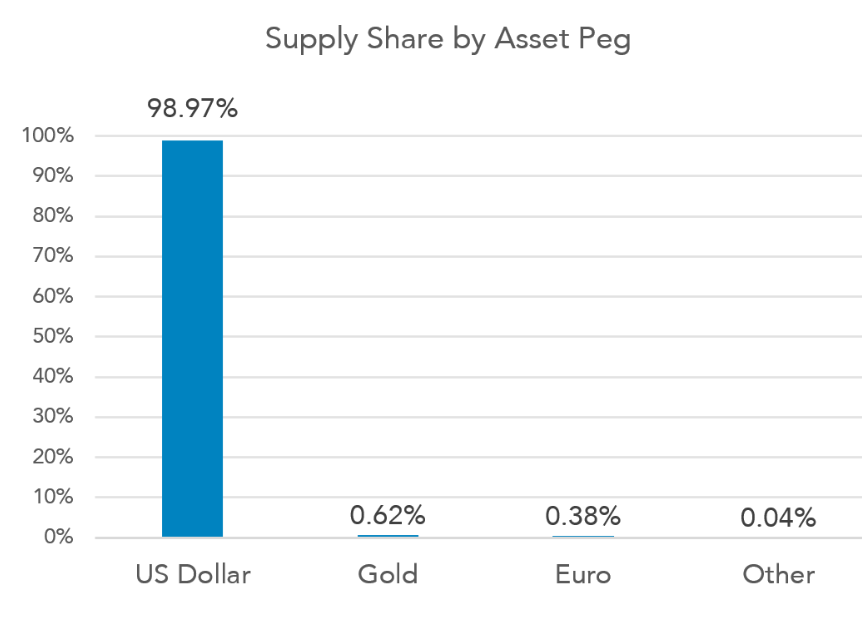

Allaire noted that this shift is significant not only for Circle but also for the entire crypto industry. He emphasized the growing role of stablecoins, such as USDC, in reinforcing the US dollar’s dominance.

Stablecoins supply by asset peg (Source: Artemis)

Stablecoins supply by asset peg (Source: Artemis)

In his view, Circle’s importance to the crypto ecosystem and the US will continue to grow along with adoption; therefore, the company needs to be at the center of it all on Wall Street.

He said :

“It became clear that we needed to plant our flag, both literally and figuratively, in the heart of Wall Street, in the most important economic center of the world, and in the great country of the United States of America.”

Meanwhile, the CEO believes the US’s perceived hostility to the crypto industry is a wrong assumption, noting that the country is already at a turning point and will soon emerge as the leader in the blockchain technology space. He adds that Circle is all about promoting American technology and wants to show the world that the best and safest tech for the new internet-based financial system is in NYC.

Allaire wrote:

“Many complain that the United States is not the right jurisdiction to build a company in our industry, and that the current government here remains hostile to this industry. I couldn’t disagree more. My view is that we are at a turning point, and that the US is about to become THE decisive leader in building and supporting this technology and financial revolution.”

Besides that, the crypto talent pool in New York City is one of the critical reasons Circle chose NYC. Allaire observed that several crypto companies are thriving within the city, which has one of the highest densities of crypto talents globally; therefore, the stablecoin issuer would fit right in.

Stablecoin adoption is growing

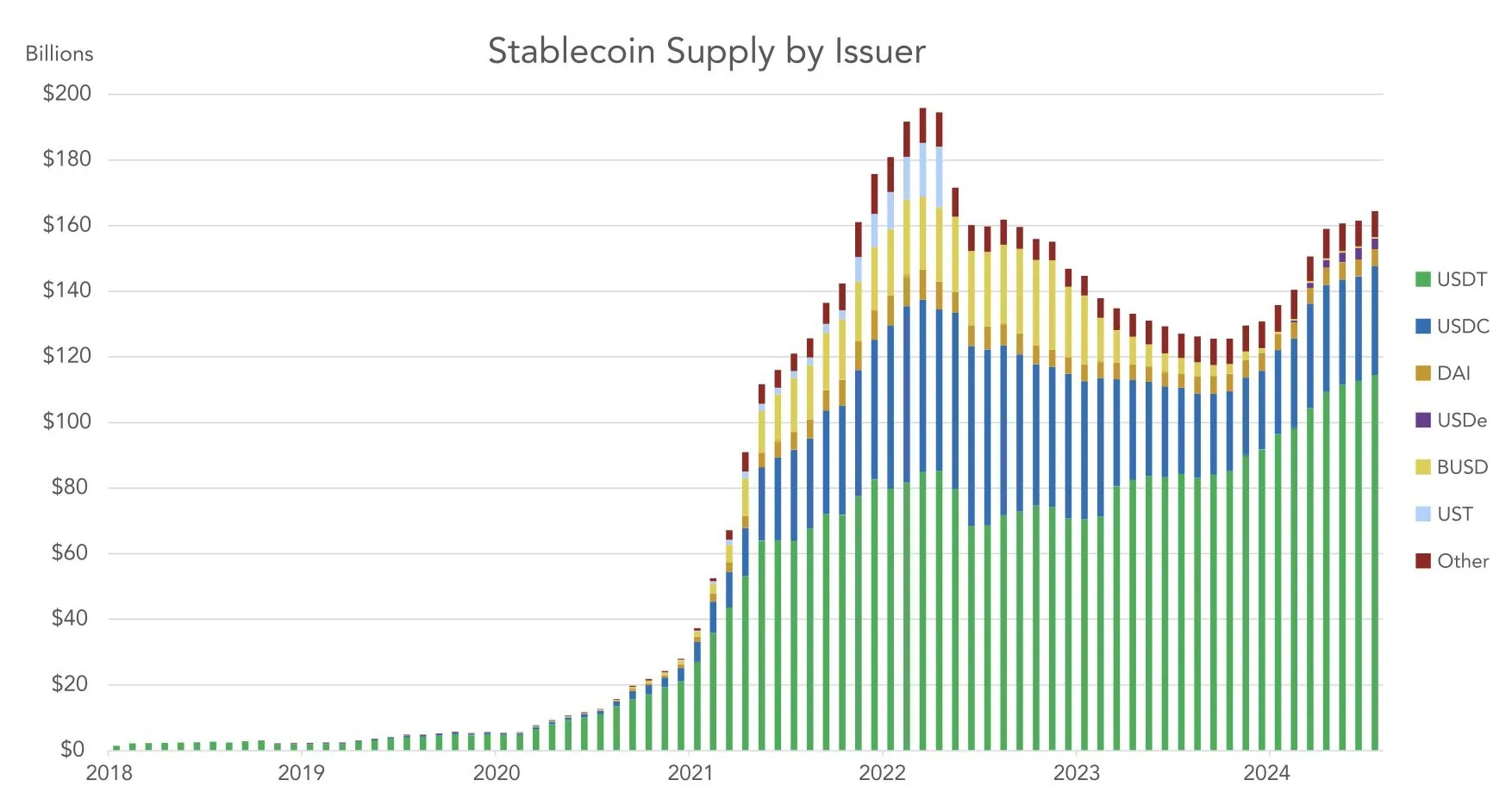

Meanwhile, Circle’s move coincides with a broader trend of stablecoin adoption globally as this digital form of fiat money becomes increasingly integrated into global financial systems. By serving as a bridge between TradFi and DeFi, stablecoins have become attractive for trade institutions, with the global banking network Swift currently working on a solution to onboard regulated stablecoins.

However, it is not just institutions that are using stablecoins. A recent study showed that individuals are actively using stablecoins, not just for crypto trading. The study found that the use of stablecoins in emerging economies varies from exposure to the US dollar to making payments, and stablecoin settlement could reach $5.3 trillion this year.

Stablecoin Supply (Source: Artemis)

Stablecoin Supply (Source: Artemis)

Circle’s US domiciliary and regulatory compliance have already made its USDC the first choice for most TradFi investors in the country. With its plan to move to NYC and deepen its relationship with regulators, Circle could further solidify its claim as the best regulatory-compliant stablecoin, enabling it to compete better with Tether USDT.