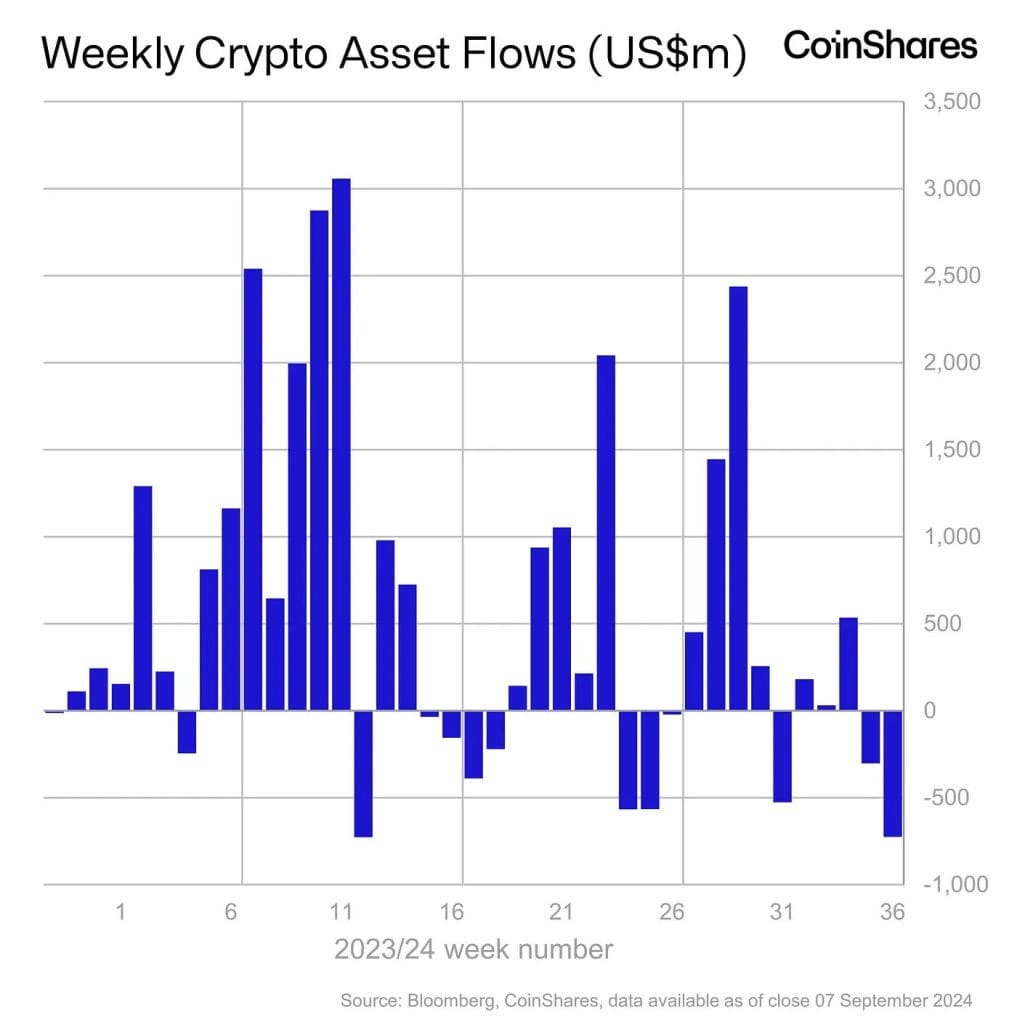

Digital Asset Products See Largest Outflows Since March, Totaling $726M

Bitcoin was particularly hard hit by the recent downturn, experiencing outflows totaling $643 million.

Digital asset investment products have experienced a significant downturn, with outflows totaling $726 million over the past week.

The figure matches the largest recorded outflow, which occurred in March of this year, CoinShares said in a recent report .

Per the report, the primary driver behind the negative sentiment was stronger-than-expected macroeconomic data from the previous week, which led to increased speculation of a 25 basis point (bp) interest rate cut by the US Federal Reserve.

Employment Data Falls Short of Expectations

However, the market sentiment showed some signs of stabilization later in the week, as employment data fell short of expectations.

This tempered some fears, leading to a divided outlook on whether the Fed might implement a larger, 50bp rate cut.

All eyes are now on the upcoming Consumer Price Index (CPI) inflation report, set to be released on Tuesday.

If inflation numbers come in lower than expected, a 50bp rate cut becomes more likely, which could have further implications for the crypto market.

The recent outflows were overwhelmingly concentrated in the United States, which accounted for $721 million of the total $726 million.

Canada also saw significant outflows, contributing $28 million to the overall figure.

In contrast, European markets showed more positive sentiment, with inflows in some regions.

Germany led the way in Europe with inflows of $16.3 million, while Switzerland followed with $3.2 million.

Bitcoin and Ethereum Lead the Digital Asset Outflows Leaderboard

Bitcoin was hit particularly hard by the recent downturn , experiencing outflows totaling $643 million.

Interestingly, short-Bitcoin products saw minor inflows of $3.9 million, indicating that some investors are still hedging against further price drops in the leading cryptocurrency.

Ethereum also faced significant losses, with outflows reaching $98 million.

Much of this came from the Grayscale Ethereum Trust, a major player in the market.

Meanwhile, inflows from newly issued Ethereum-based exchange-traded funds (ETFs) have nearly dried up, signaling that investor confidence in Ethereum may be waning, at least for the time being. What’s more, VanEck has announced that its Ethereum Futures Exchange-Traded Fund (ETF) will be closed and liquidated , with the final trading day scheduled for September 16, 2024.

Amid the widespread outflows, Solana emerged as a rare bright spot in the digital asset market.

The cryptocurrency saw the largest inflows of any asset during this period, totaling $6.2 million.

Meanwhile, in a recent note, QCP Capital said that the crypto market has seen some stabilization following last week’s price swings, though implied volatility remains elevated.

“It seems the market is still anticipating some volatility heading into this week’s events, specifically the Trump v Harris debate (10 Sep, 9pm ET) and CPI (11 Sep, 830am ET),” the investment firm wrote.

It added that despite last week’s sharp dip, market sentiment remains cautious, particularly around the potential downside risk.

Risk reversals for both Bitcoin and Ethereum are currently skewed toward puts, reflecting traders’ apprehension.

Nevertheless, many institutions remain structurally bullish and are taking advantage of the market’s recent downturn to place longer-term bullish trades.

Notably, there has been significant buying activity for 28 March 2025 call options with strikes at 85k, 100k, and 120k, suggesting that some institutional investors see current price levels as a buying opportunity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Amundi’s Integrated Approach Connects Blockchain with Conventional Financial Regulations

- Amundi, Europe's largest asset manager, launched its first Ethereum-based tokenized money-market fund, enabling 24/7 settlements and transparent record-keeping via blockchain. - The hybrid model, developed with CACEIS, combines traditional fund operations with blockchain-based ownership, preserving regulatory compliance while expanding investor access. - Ethereum's dominance in stablecoin and RWA transfers ($105.94B in 30 days) underscores its role in accelerating tokenization, with Amundi positioning it

XRP News Today: XRP ETFs Drive Price Increases, While Solana ETFs Ease Selling Pressure

- XRP ETFs raised $587M in inflows since late November, outpacing Solana's $568M as investors favor altcoins with regulatory clarity and utility. - Bitwise XRP ETF's $107M debut and zero-fee strategy drove momentum, while Solana ETFs faced $156M weekly outflows due to network reliability concerns. - XRP's inflows acted as a "battering ram" pushing prices above $2.27, contrasting Solana's ETFs which merely dampened sell pressure without reversing its decline. - Analysts predict XRP could reach $3 by Decembe

The Federal Reserve's Change in Policy and Its Impact on Alternative Cryptocurrencies Such as Solana

- Fed's 2025 policy shifts, including rate cuts and stablecoin regulations, are reshaping altcoin markets by altering liquidity and risk appetite. - Solana's Alpenglow upgrade (150ms finality, 1M TPS) addresses scalability issues, aligning with Fed's AI-driven infrastructure focus despite network reliability concerns. - Institutional inflows into Solana ETFs ($100M AUM) contrast with retail caution (78% HODLers in red), highlighting divergent risk perceptions amid 30% price corrections. - Divergent ETF flo

Avail's Intent-Driven Nexus Addresses the Issue of Fragmented Liquidity Across Chains

- Avail launches Nexus Mainnet, a cross-chain solution unifying liquidity across Ethereum , Solana , and EVM networks. - The intent-solver model enables seamless asset transfers without technical complexities, streamlining user experiences. - Developers gain modular tools for multichain integration, reducing costs as cross-chain liquidity demand grows. - Nexus abstracts execution layers, offering unified balances and execution while addressing fragmentation challenges. - With $50B+ in cross-chain activity