Bitcoin slumps, ether flat as market digests ETH ETF launch

Bitcoin’s down Tuesday, while ETH-correlated assets like ENS and ARB see growth

Ethereum ETFs are all the rage today in crypto markets, having already posted nearly hundreds of millions in flows within hours of their launch.

By the end of the US trading day, the new funds had hit $1 billion in trading volume, per Bitwise Chief Investment Officer Matt Hougan.

Though, as Blockworks’ Ben Strack noted in the On the Margin newsletter earlier Tuesday, the volumes don’t show the net flows for the funds just yet.

Crypto markets seem to be digesting the news, with the total market cap dipping 2.2% to $2.5 trillion in the past day.

Per Coinbase , BTC’s down 3.7% over the past day at time of publication. ETH, on the other hand, is down slightly in the same timeframe.

This could be attributed to negative perception around yesterday’s BTC asset movements from the now-defunct Mt. Gox exchange, as markets watch anxiously for a potential sell-off. Based on Arkham Intelligence data, the exchange was seen moving 1,980 BTC ($132 million) to the Bitstamp exchange. Kraken has also received 48,641 BTC from the Mt. Gox Rehabilitation Trustee, to be distributed in one to two weeks.

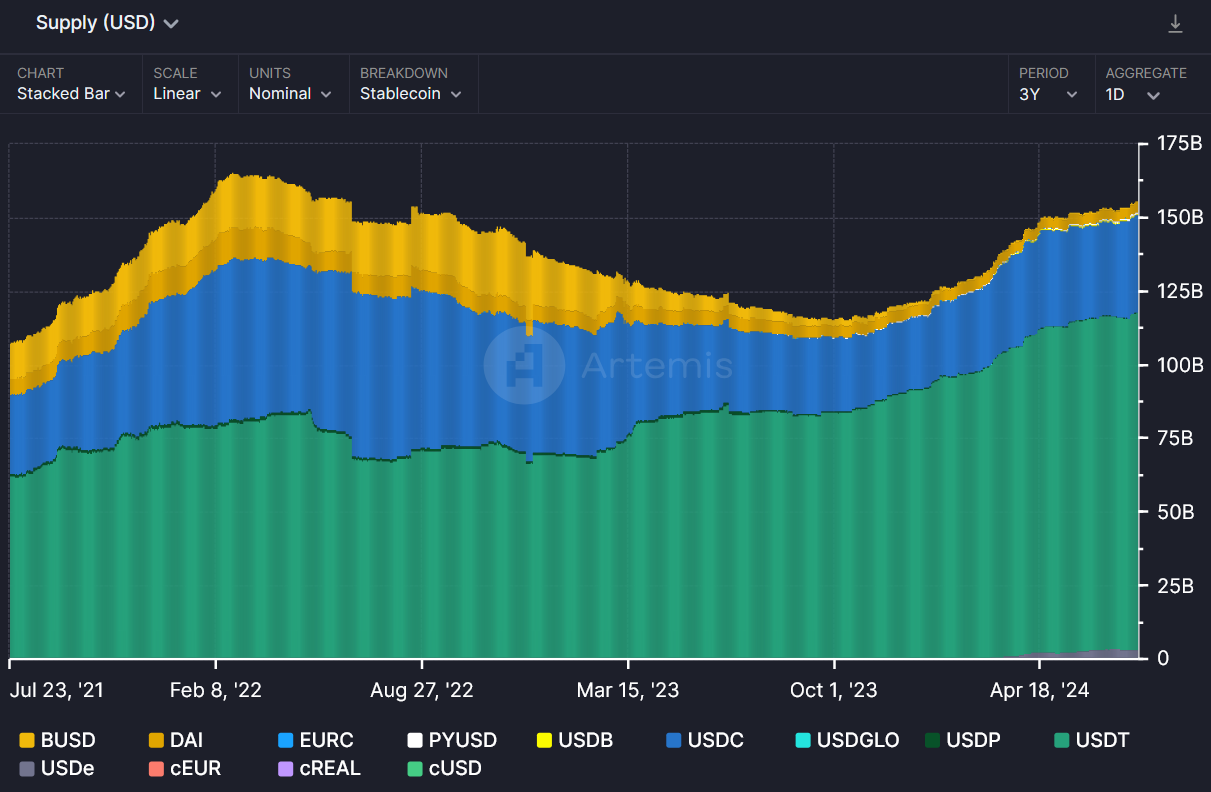

Meanwhile, the aggregate stablecoin market cap is also breaking out of a three-month long stagnancy to $156 billion, suggesting a growth in users coming onchain, based on Artemis data. Stablecoin growth is largely considered by investors as a crucial metric in assessing the health of DeFi activity, which has been laggard in recent months despite the overall market return since the start of the year.

How about altcoin markets? The “TOTAL3” market cap, a proxy index to track the altcoin market by excluding BTC and ETH, is slightly down 2% in the last day to $626 billion, according to TradingView.

In light of the landmark launch of ETH ETFs, there are movements around “ETH Beta” tokens too — so called for the perceived correlation in price action with ETH’s price itself.

For the top 300 tokens by market cap, the largest “ETH Beta” movements belong to decentralized naming protocol Ethereum Name Service ( ENS ), with a 12% jump in the last 24 hours, per CoinGecko. Within the crowded layer-2 landscape, Arbitrum (ARB) has risen 3%, while Metis (METIS) is up 1.5%.

Bucking the ETH Beta theory, however, is DOGE. Ethereum’s largest memecoin saw a 7% slump in the last 24 hours, correlating with an overall drop of 7.5% in meme category tokens in the past day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.