July 3rd Futures Market Dynamics

Bitget2024/07/03 05:44

By:Bitget

U.S. Bitcoin ETFs Record Largest Daily Inflows Since Early June

On Monday, U.S. spot

bitcoin ETFs saw net inflows of $129.45 million, the largest daily intake since June 7, marking the fifth consecutive day of positive flows. Fidelity’s FBTC led with $65 million, followed by Bitwise’s BITB with $41 million. Ark Invest and 21Shares’ ARKB reported $13 million, while funds from Invesco, Galaxy Digital, VanEck, and Franklin Templeton saw inflows around or under $5 million. Notably, BlackRock’s IBIT and Grayscale’s GBTC, the largest spot bitcoin ETFs by net asset value, recorded no flows. Monday’s trading volume for the 11 bitcoin funds totaled about $1.36 billion. Since January, these ETFs have accumulated $14.65 billion in net inflows.

Bitcoin’s price dipped 0.3% in the past 24 hours to $63,094, recovering from last week’s brief drop below $60,000 but still lower than its early June level of over $71,000. Analysts from QCP Capital and Coinbase noted that both bitcoin and ether typically perform better in July due to historically positive seasonality.

Source:

The Block

Futures Market Updates

BTC futures show an increase in total open interest by 0.24% to $32.88B, with a significant 24-hour volume increase of 24.20% to $45.37B. ETH futures, on the other hand, see a decrease in total open interest by 1.05% to $14.91B, though their 24-hour volume increased by 16.60% to $17.07B. BTC futures had higher long liquidations ($31.04M) compared to ETH ($29.57M), with similar short liquidation amounts for both. The long/short ratios are close, with BTC at 47.05%/52.95% and ETH at 46.29%/53.71%. Both

funding rates are positive, though BTC's is slightly higher at 0.0080% compared to ETH's 0.0061%.

Bitcoin Futures Updates

Total BTC Open Interest: $32.88B (+0.24%)

BTC Volume (24H):$45.37B (+24.20%)

BTC Liquidations (24H): $31.04M (Long)/$3.70M (Short)

Long/Short Ratio: 47.05%/52.95%

Funding Rate:0.0080%

Ether Futures Updates

Total ETH Open Interest: $14.91B (-1.05%)

ETH Volume (24H): $17.07B (+16.60%)

ETH Liquidations (24H): $29.57M (Long)/$3.29M (Short)

Long/Short Ratio: 46.29%/53.71%

Funding Rate: 0.0061%

Top 3 OI Surges

CHR: $13.36M (+70.53%)

OMNI1: $959.33K (+67.58%)

IOST: $10.92M (+66.57%)

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

Chaincatcher•2025/11/28 12:40

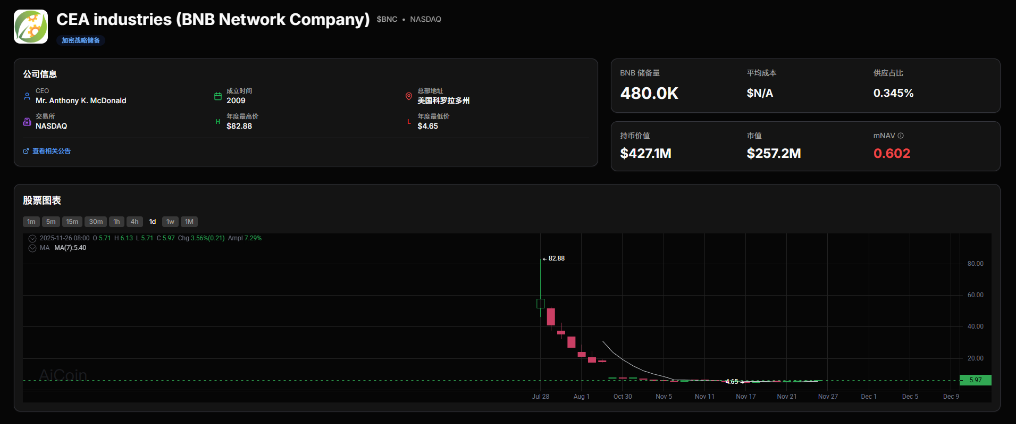

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

AICoin•2025/11/28 12:31

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

Bitpush•2025/11/28 12:30

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage

Bitpush•2025/11/28 12:30

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$91,490.56

+0.53%

Ethereum

ETH

$3,037.89

+1.33%

Tether USDt

USDT

$0.9999

-0.02%

XRP

XRP

$2.2

+1.09%

BNB

BNB

$890.22

+0.12%

Solana

SOL

$140.98

-0.16%

USDC

USDC

$0.9997

-0.03%

TRON

TRX

$0.2802

+0.87%

Dogecoin

DOGE

$0.1509

-1.08%

Cardano

ADA

$0.4245

-0.72%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now