BlackRock's BUIDL fund backs Mountain Protocol's wUSDM stablecoin

Key Takeaways

- BlackRock's BUIDL fund enhances wUSDM's security and yield, facilitating its use in DeFi platforms.

- The integration of wUSDM into Manta Network promotes enhanced capital efficiency and rewards for users.

Manta Network announced today that Mountain Protocol’s stablecoin, wUSDM, is now backed by BlackRock’s BUIDL fund and facilitated through Securitize, BlackRock’s transfer agent and tokenization platform. The latest development makes Manta Network among the first to leverage BUIDL by supporting its backed assets through wUSDM.

“Manta Network is proud to be one of the early adopters of the BUIDL Fund by supporting its backed assets through the on-chain yield-bearing stablecoin,” stated Manta Network.

Mountain Protocol’s wrapped USDM (wUSDM) is a vault token that represents deposits of the USDM stablecoin on the Ethereum blockchain. wUSDM makes USDM more accessible in decentralized finance (DeFi) applications.

According to Manta Network, the new backing is set to bolster the security and yield potential of wUSDM. The team expects that holders will benefit from BlackRock’s custodianship.

Introduced during the New Paradigm event on Manta Pacific, wUSDM allowed users to stake USDC to receive wUSDM, with over $132 million minted throughout the campaign, according to Manta Network.

The team said the latest development signifies Manta’s commitment to expanding the use cases, security, and utility of Real-World Assets (RWAs). The enhanced features of wUSDM, backed by BlackRock’s BUIDL, offer substantial benefits for users, including participation in Manta CeDeFi—a new product offering institutional-grade yield and security.

Launched in March this year, BUIDL is BlackRock’s first tokenized fund on Ethereum. Within three months of its debut, the fund overtook Franklin Templeton’s Franklin OnChain US Government Money Fund (FOBXX) to become the world’s largest equity tokenized fund .

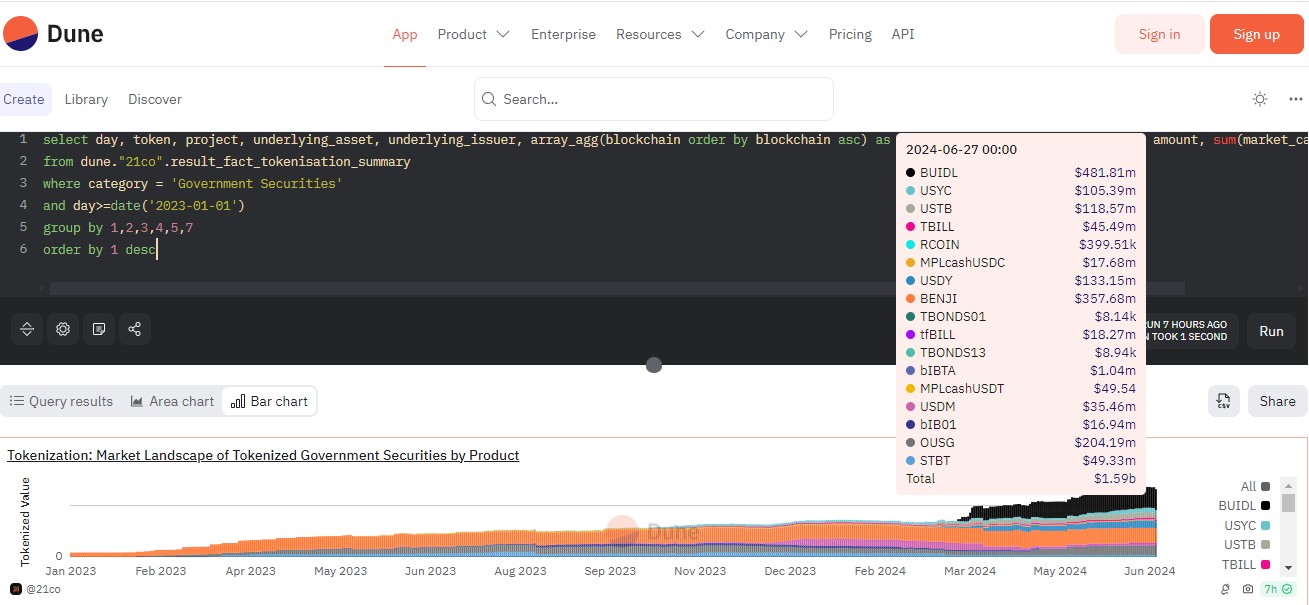

As of June 27, BUIDL crossed $481 million in assets under management (AUM) while Franklin’s FOBXX, represented by BENJI, reached $357 million in AUM, according to data from Dune Analytics.

Source: Dune Analytics

Source: Dune Analytics

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens