CryptoQuant: BTC Shows Potential Signs of a Localized Bottom After 15% Correction

CryptoQuant posted that Bitcoin has experienced a correction of about 15% over the past three weeks, falling from the $70,000 range to the $60,000 range. With Bitcoin's relatively large pullback yesterday, signs of a possible localized bottom have emerged: Futures markets: Open positions have fallen by about $3 billion over the past three weeks, mainly due to long liquidations. Financing rates on permanent contracts have fallen to near zero, suggesting a more balanced relationship between buyers and sellers, resulting in a healthier, less overly optimistic price structure. SHORT TERM HOLDERS: Prices have exceeded the realized price of $62.6k for Short Term Holders (STH). The average profitability of short-term holders is now slightly negative, which has historically been a point of support for localized corrections in uptrends. A key factor influencing price action in recent months has been U.S. macroeconomic data, as there is uncertainty about the future of U.S. monetary policy, which can affect investors' risk appetite. On Thursday, we have GDP and Initial Jobless Claims data, and on Friday, inflation data (PCE), which are expected to sway market sentiment in the near term. However, the current structure suggests that a localized bottom may be in the offing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

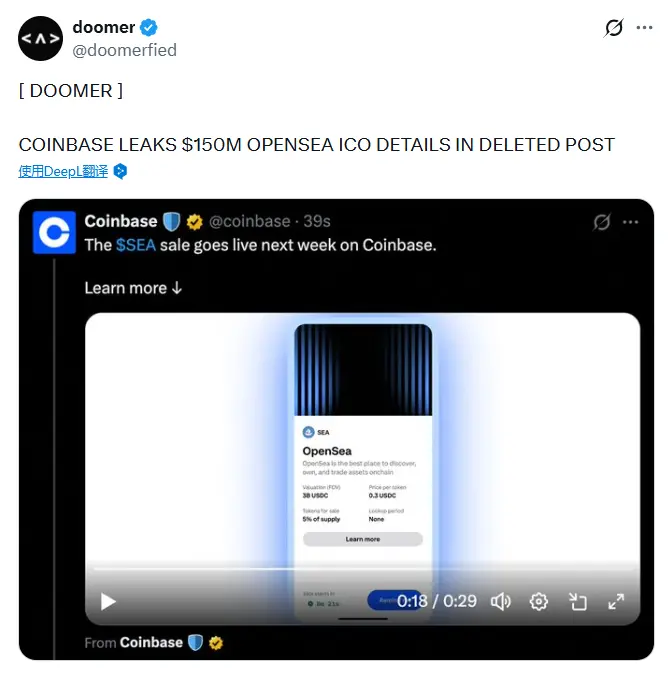

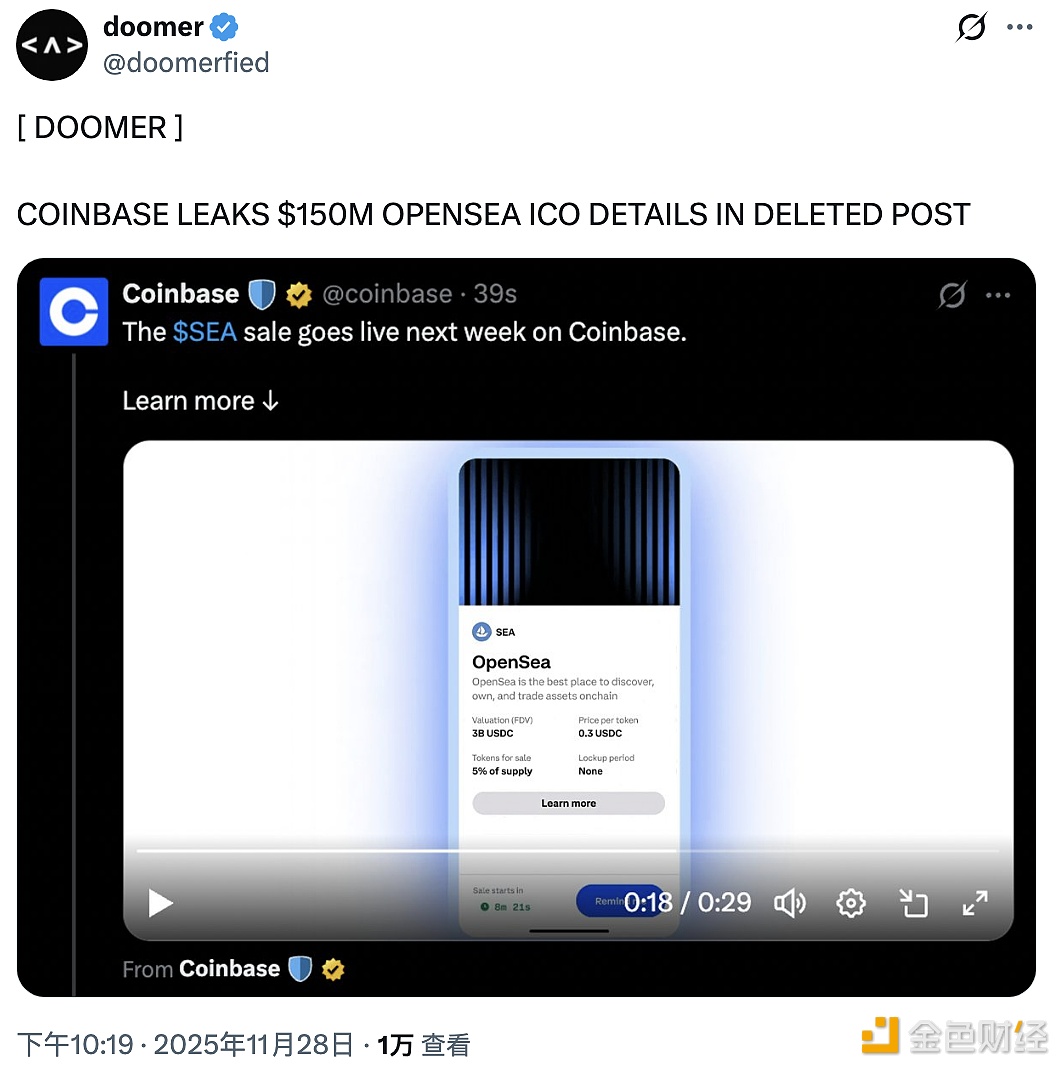

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.