Gold Prices See Mild Negative Sentiment as Investors Watch Non-Farm Payrolls Release

Gold prices saw mild negative sentiment after retreating from fresh two-week highs during Friday's European trading session. Investors are now opting to stay off the sidelines and wait for the much-anticipated Non-Farm Payrolls release. Wednesday's release of the ADP private sector jobs report, which indicated that the U.S. labor market is cooling, cemented bets that the Federal Reserve will cut interest rates in September and weighed on U.S. Treasury yields. The benchmark 10-year U.S. Treasury yield hovered near its lowest level in two months, which in turn was seen weakening the U.S. dollar and acting as a driver for gold. However, some follow-through buying is likely to push gold up to the next relevant barrier near $2,425 and towards the $2,450 area, the all-time high touched in May.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

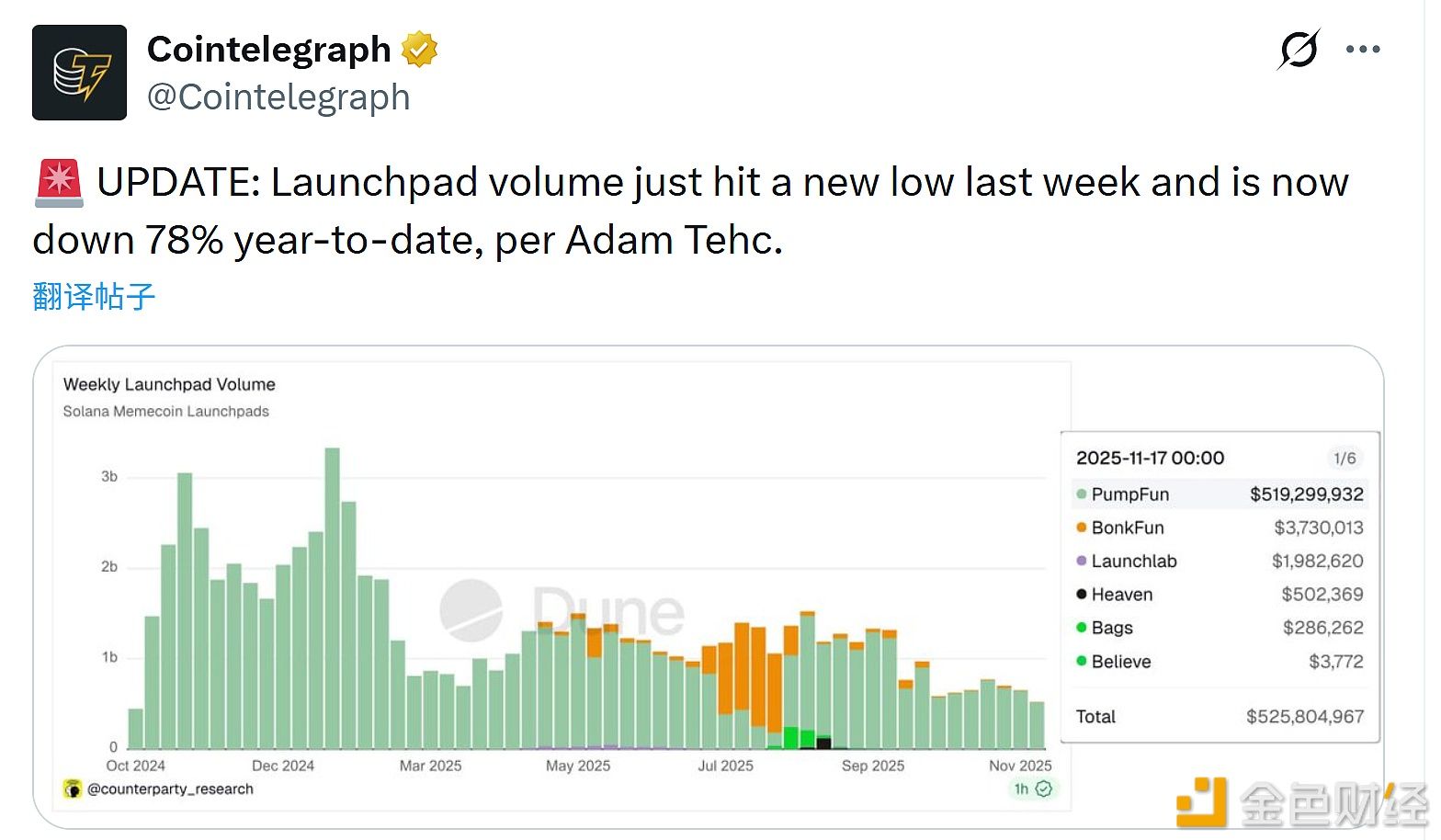

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93

Tether suspends Bitcoin mining operations in Uruguay due to rising energy costs