90%+ Probability An Ethereum ETF Approval Today, Sell The News?

Institutional Crypto Research Written by Experts

👇1-12) The SEC should approve US-listed ETH ETFs today. Hours before the Bitcoin ETF approval, SEC Gensler tweeted that crypto investors should consider all potential risks before making any investment. Today, a tweet could come around 9 a.m. ET. and would provide more clarity on whether approval would be imminent.

👇2-12) As the SEC had previously provided warning signals ahead of ETF listings tied to crypto futures, it was also evident in January 2024 that Bitcoin ETFs would be approved.

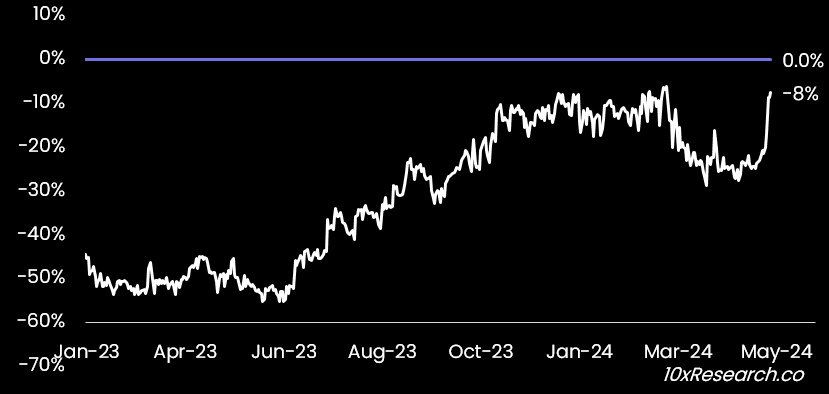

👇3-12) Today, the market will be waiting for similar ‘warnings.’ However, approval seems only a formality, with the Grayscale Ethereum Trust having narrowed the discount to just -8% from -30% a week ago. An 8% discount implies at least a 90% probability that an ETF would be approved. With $11bn of AUM, this Trust is meaningful in size and will likely see some outflows from investors who are happy to lock in their gains finally. The critical question remains when those ETFs would start trading if approved.

Grayscale’s $11bn Ethereum Trust is nearly trading at par with it’s NAV

👇4-12) Ether is up +400% from when Grayscale launched this ETH Trust. Potential ETH ETF Inflows should also be less than we have seen with the Bitcoin ETFs. Nevertheless, Ether prices could rise further, and crypto benefits from a dovish Fed and regain political support from both US political parties.

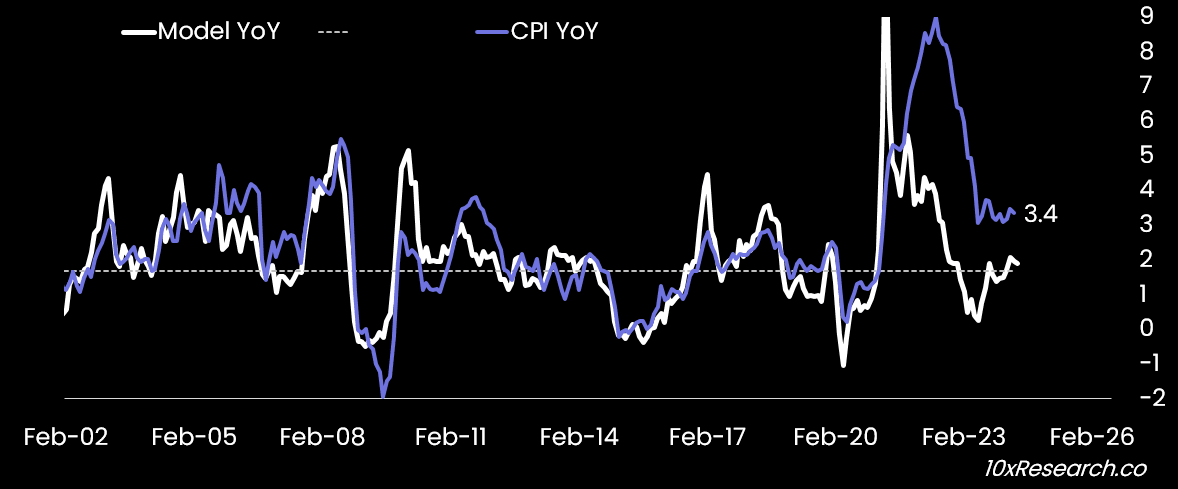

👇5-12) The Fed and the Biden administration changed policy during the last two weeks. Combined with the expectations that inflation would eventually decline, this is setting up the market for bullishness.

👇6-12) The derivatives markets are pricing in a +/-4.8% move as a response to the SEC’s decision, and by the end of next week, Ether prices could move up or down by 10% - again, according to the derivatives markets. Yes, some volatility is expected.

👇7-12) It is important to remember that crypto promotors have changed over the years, and with them, the narrative about Bitcoin's value proposition has changed. The most influential crypto ‘promotor’ nowadays might be Blackrock’s Larry Fink. As he correctly points out, Bitcoin is not a currency but an asset class that holds and stores value.

👇8-12) Blackrock believes that most investing will be done through ETFs, as ETFs have also changed how fixed-income markets operate. This allows active and passive investors to express their views using the same instrument. We should, therefore, expect that those Bitcoin (and Ethereum) ETFs will hold many more billions of crypto exposure.

👇9-12) An asset that most people hold, like an ETF, will be challenging to decline significantly unless during risk-off events. The nature and reaction function of the two leading crypto assets, along with their holders, are changing.

👇9-12) In the long term, this could mean that Ethereum prices could rise further, especially if the focus moves away from transactional crypto value proposition (dependent on revenue, transactions, TVL, etc.) to an asset that simply ‘stores value.’ This is what happened to Bitcoin in 2017.

👇10-12) But ETFs are only the first step in Blackrock’s vision of the future. Step two is the tokenization of every asset. This is also how they look at Bitcoin. Even an Ethereum ETF would be a stepping stone toward tokenization as investors become familiar with the technology.

👇11-12) Crypto is here to stay, but it is evolving; this becomes clear with the political changes we have seen during the last two weeks and the resumption of ETF inflows when the inflation data rose less than expected. Imagine what happens to Bitcoin when inflation declines below 3.0%—which will eventually occur.

US CPI vs. 10x Research Inflation Model - Post-COVID gap, sustainable?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.