Bitcoin ( BTC ) tagged $59,000 into the May 2 Wall Street open as swing lows held as a BTC price floor.

Bitcoin price correction 'very common' if $56K lows hold — Peter Brandt

Bitcoin bulls see signs of the worst being over as a BTC price bounce gathers pace toward $60,000.

BTC price heads toward $60,000

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD acting closer to the key $60,000 zone.

After falling to $56,500 the day prior, Bitcoin received a boost from dovish economic guidance by the United States Federal Reserve.

As it left interest rates predictably unchanged, Fed Chair Jerome Powell reinforced plans to cut them at some point before the end of the year.

“We know that reducing policy restraint too soon or too much could result in a reversal of the progress we have seen on inflation,” he said during a subsequent press conference .

“At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment.”

Risk assets reacted well to the event, and BTC/USD continued to display relief after precipitous sell-side pressure earlier in the week.

“If Bitcoin can hold these lows and move higher the chart will qualify as a very common bull market continuation chart construction,” veteran trader Peter Brandt told followers on X (formerly Twitter).

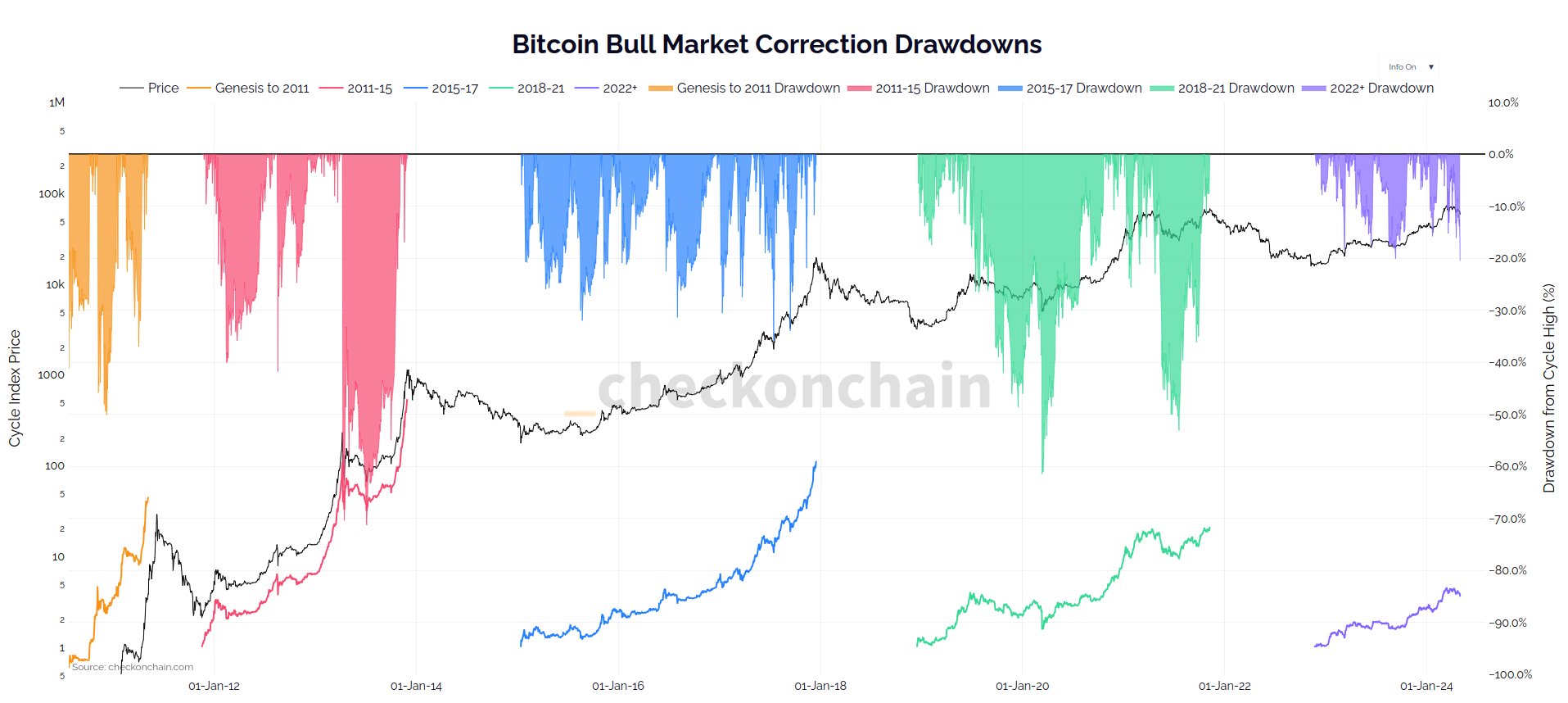

Earlier, Cointelegraph reported on the current BTC price pullback from new all-time highs being still mild compared to historical bull markets.

“Welcome to a more middle of the road Bitcoin bull market correction. P.S. it has been much worse literally every other bull cycle,” Checkmate, the lead on-chain analyst at Blockchain data firm Glassnode, confirmed alongside an explanatory chart.

Bitcoin RSI hits key buy level

Others meanwhile looked ahead with an eye to the BTC price bounce continuing.

Of particular interest on the day was Relative Strength Index (RSI) data, which on daily timeframes sought to bolster a fledgling bullish narrative.

Daily RSI was at its lowest levels since August 2023 — a time at which BTC/USD was also violating key support trendlines before it reclaimed them and headed to new highs.

“Buying Bitcoin when the Daily RSI has hit ~30 has been a pretty solid strategy so far this cycle,” popular trader Daan Crypto Trades wrote in part of an X post on the topic.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.