Greeks.live: All major risk assets fell sharply after the US CPI data was released

Greeks.live on X platform: The US CPI data for March exceeded expectations at 3.5%. Strong U.S. economic data made a rate cut a long shot, and all major risk assets fell sharply after the data was released, but then, a sharp rebound led by silver.

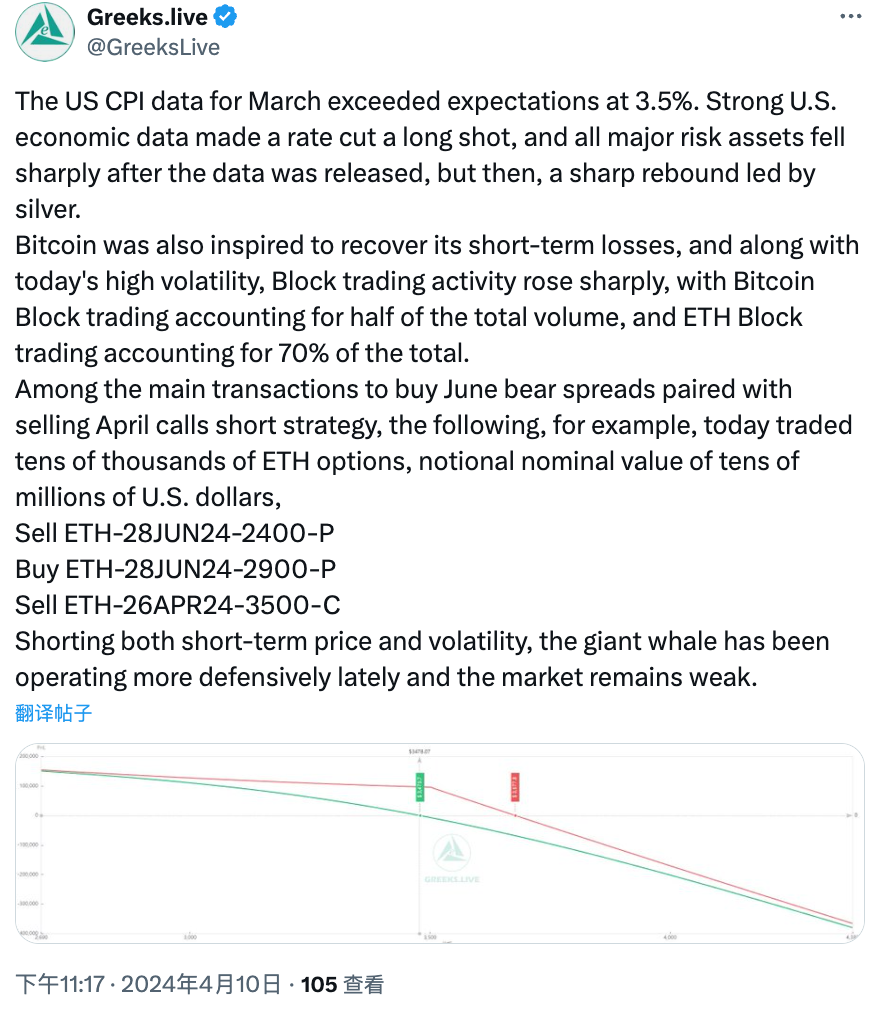

Bitcoin was also inspired to recover its short-term losses, and along with today's high volatility, Block trading activity rose sharply, with Bitcoin Block trading accounting for half of the total volume, and ETH Block trading accounting for 70% of the total. Among the main transactions to buy June bear spreads paired with selling April calls short strategy, the following, for example, today traded tens of thousands of ETH options, notional nominal value of tens of millions of U.S. dollars,

Sell ETH-28JUN24-2400-P

Buy ETH-28JUN24-2900-P

Sell ETH-26APR24-3500-C

Shorting both short-term price and volatility, the giant whale has been operating more defensively lately and the market remains weak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

An AAVE whale has bought over 40,000 AAVE on dips again in the past 5 days

Chainlink Reserve adds 89,079 LINK tokens, bringing total holdings to 973,752 LINK

A certain whale has bought another $7.1 million worth of AAVE in the past 5 days