Standard Chartered expects the Fed to cut interest rates in June, which will push the dollar down

Standard Chartered said the Fed may be more inclined to ease monetary policy in the second quarter if prices or economic activity cool sufficiently, which would push the dollar to "slightly weaken" from mid-year onwards. Analysts wrote in a report that our base case scenario is that the Fed will cut interest rates before or in conjunction with other central banks, which is negative for the dollar as improving risk appetite and liquidity conditions will lead to dollar selling. Optimism in risk assets is negative for the U.S. dollar, but if the spread between the Fed's rates and other central bank rates is maintained, then the U.S. dollar "could be moderately weak rather than collapsing."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

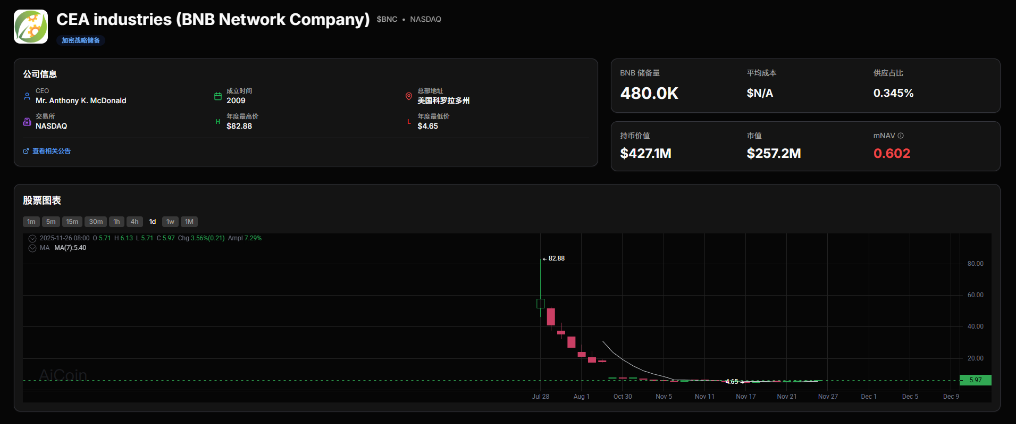

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage