US Lawmakers Urge SEC to Confront Prometheum’s Custody Plans for ETH

House Republicans wrote to the US SEC, seeking clarity on Prometheum’s status and whether Ethereum is considered a security.

United States House Financial Services Committee and House Agriculture Committee members have expressed notable concerns regarding the Securities and Exchange Commission’s (SEC) approach to managing Ethereum (ETH).

The focus of their apprehension centers on crypto firm Prometheum’s plans to offer institutional custody services for ETH, which has sparked several demands for clarity and action from regulatory authorities.

Regulatory Ambiguity

In a letter addressed to SEC Chair Gary Gensler dated March 26, prominent lawmakers, including House Financial Services Committee Chair Patrick McHenry and Vice Chair French Hill, urged the Commission to confront Prometheum’s intentions to provide custody services for ETH through its subsidiary, Prometheum Capital.

They warned that such actions could have serious and potentially irreversible implications for the digital asset markets. The lawmakers’ concerns revolve around the ambiguity surrounding the SEC’s stance on Special Purpose Broker-Dealers (SPBD) and their ability to custody non-security digital assets like ETH.

Despite previous assertions by the SEC and the Commodity Futures Trading Commission (CFTC) recognizing ETH as a non-security digital asset, questions linger regarding the regulatory classification and allowed activities within the existing framework.

#NEW : Republicans on the House Financial Services Committee and @HouseAgGOP sent a letter to @SECGov Chair Gensler urging his agency to clarify its position with respect to SPBD Prometheum’s custody of #ETH .

Read more 🔗 https://t.co/MGGB9NAvWi pic.twitter.com/1U8lqMw8Ao

— Financial Services GOP (@FinancialCmte) March 26, 2024

The letter highlights the lack of clarity in the SEC’s rule concerning SPBD custody of non-securities and the agency’s apparent inactivity in addressing potential non-compliance issues within this matter.

Lawmakers also expressed concern over the absence of comprehensive guidance or a defined regulatory framework for digital asset securities, increasing uncertainty within the digital asset space.

Lawmakers Demand Clarity on ETH

Furthermore, the lawmakers draw attention to Chairman Gensler’s reluctance to definitively classify ETH, which has only increased the confusion surrounding its regulatory treatment. Despite previous acknowledgments of ETH as a non-security digital asset, the SEC’s failure to provide unquestionable clarity has left market participants dealing with uncertainty.

The result of the SEC’s stance extends beyond regulatory ambiguity, potentially impacting the broader digital asset marketplace. Lawmakers warn that classifying ETH as a digital asset security could disrupt existing commodity futures markets and imperil essential risk management tools, ultimately stifling innovation and market growth.

The letter concludes with a call to action, urging the SEC to promptly address the concerns raised and provide much-needed clarity on the regulatory treatment of ETH. Failure to do so, lawmakers warn, risks undermining the integrity and competitiveness of U.S. digital asset markets, with far-reaching consequences for investors and market participants alike.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Syrah Prolongs Tesla Offtake Remedy Deadline While Vidalia Certification Progresses

The Timing Game: Crypto Winners Track Live News and the Macro Calendar

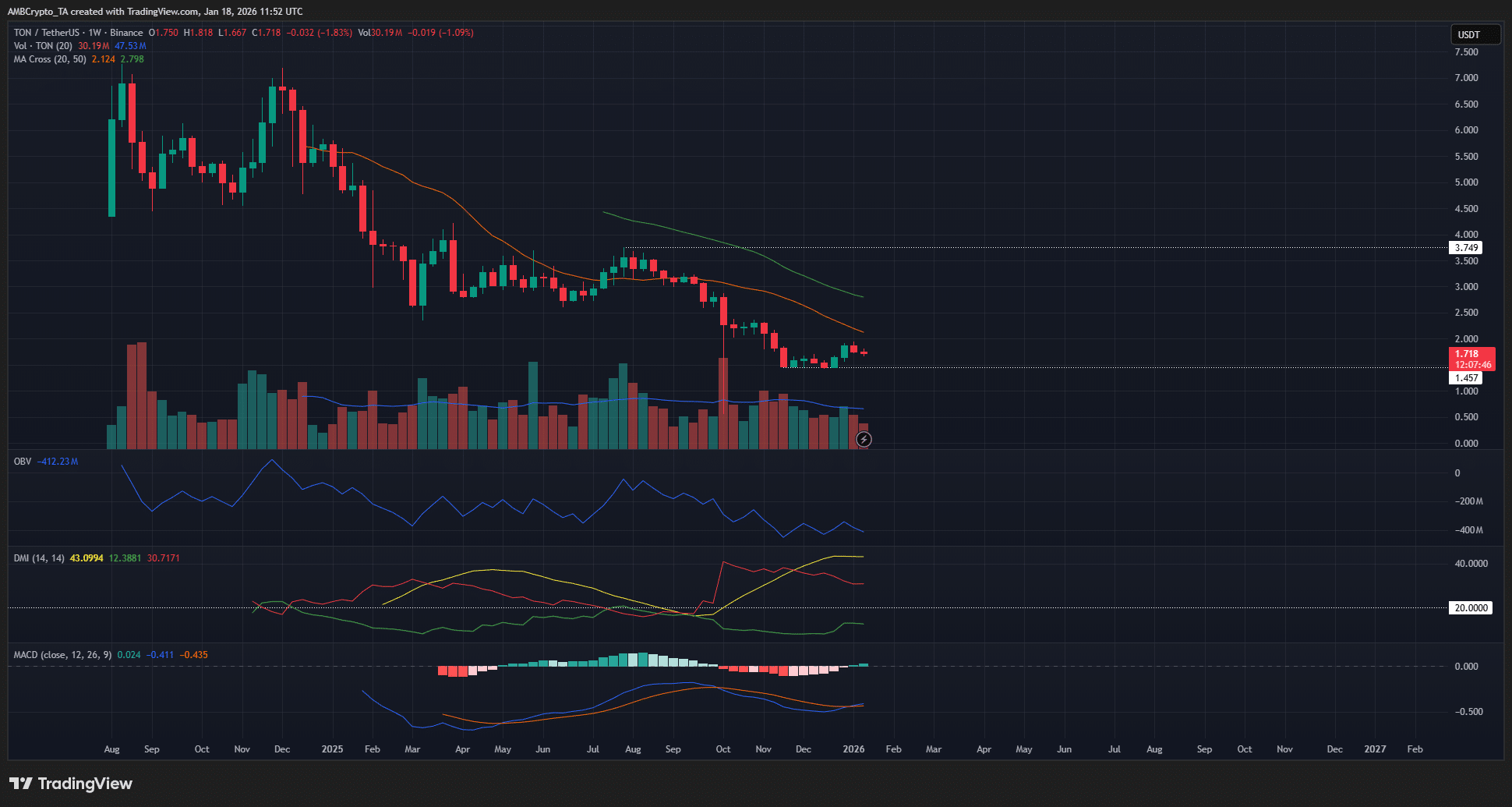

Toncoin: How profit-taking pressure can cap TON’s rally