Spot Bitcoin ETFs Hold 90% of the Market, Leaving Futures ETFs in the Dust

Spot bitcoin ETFs currently hold nearly 90% of the daily volume market share, while bitcoin futures ETFs hold around 10%. This underscores investors' preference for investing directly in bitcoin through ETFs rather than products based on bitcoin futures contracts. Trading volume in spot bitcoin ETFs has been strong since their launch on January 11, totaling $113 billion to date. BlackRock's IBIT, Grayscale's GBTC, and Fidelity's FBTC funds have been major contributors to this volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

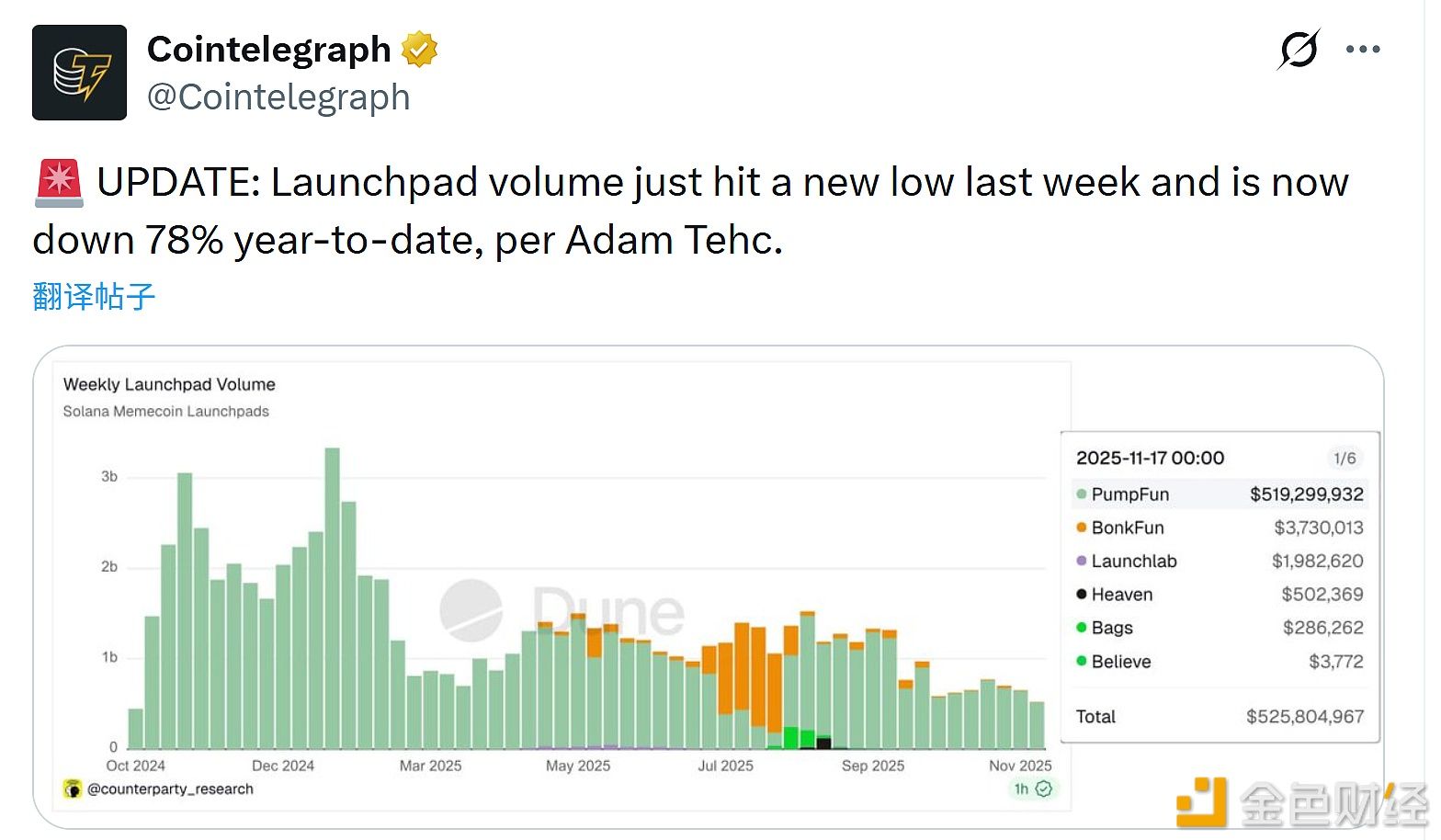

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93

Tether suspends Bitcoin mining operations in Uruguay due to rising energy costs