The Bitcoin Volatility Index dropped to 44.87 yesterday, with a daily decline of 1.3%

The BitVol index, launched by financial index company T3 Index in partnership with Bitcoin options trading platform LedgerX, fell to 44.87 yesterday, a daily drop of 1.3%. Note: The BitVol index measures the expected implied volatility over the next 30 days derived from tradable Bitcoin option prices. Implied volatility refers to the volatility implied by actual option prices. It is calculated using the B-S option pricing formula, substituting all parameters except for volatility σ into the formula to derive this volatility. The actual price of an option is formed through competition among many options traders; therefore, implied volatility represents market participants' views and expectations about future market conditions and is considered as closest to real-time volatility at that time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

20,000 ETH transferred out from a certain exchange, worth $61.21 million

The probability of "OpenSea launching a token this year" rises to 52% on Polymarket

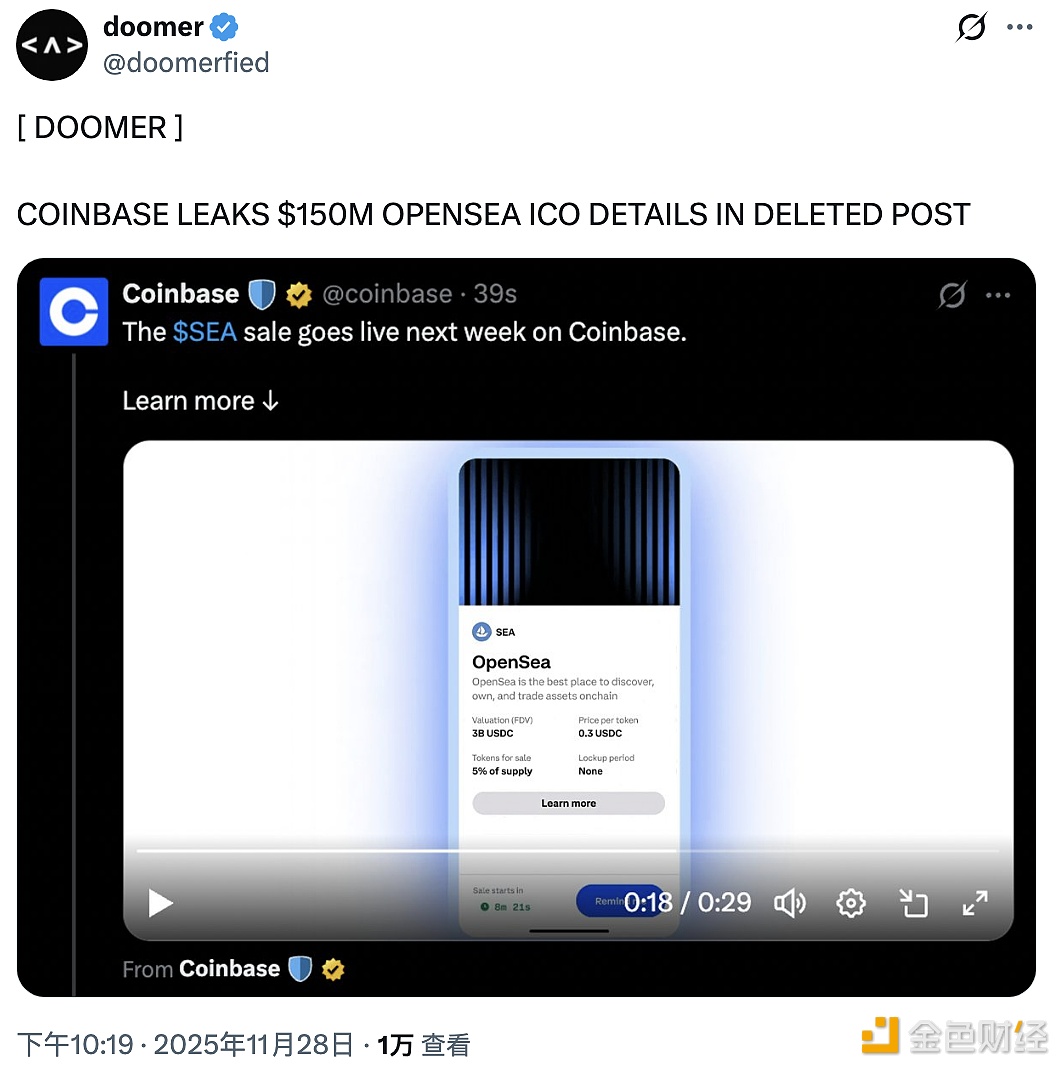

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.