Dutch economist: Eurozone inflation slows down, expectations of interest rate cuts are not significant

According to a report by Jin10, Dutch economist Bert Colijn stated that although the eurozone economy continues to be weak, the pace of inflation in the eurozone still appears too slow, so it cannot be expected to lower interest rates quickly. Eurozone PMI data shows that economic activity in the eurozone continued to contract in January, although at a slower pace, with heavyweight economies France and Germany dragging down the overall economy. Colijn pointed out that the eurozone continues to be plagued by declining demand for goods and services, and inflation remains a concern, including disruptions from wage costs and tensions in the Red Sea region. For the European Central Bank (ECB), these concerns are likely to prevent any interest rate cuts before June.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

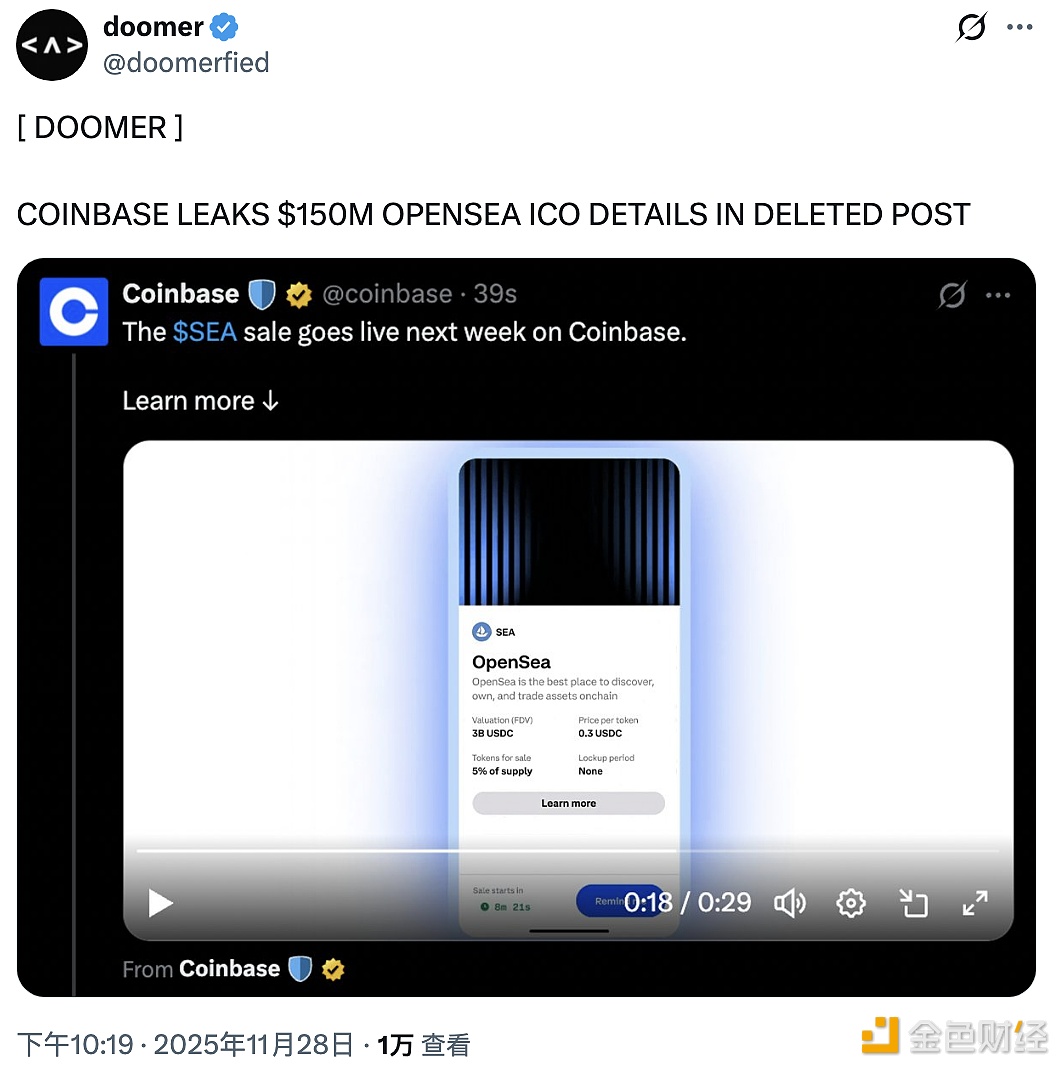

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.

Data: Circle newly minted 500 millions USDC

Spot gold returns to $4,200