Societe Generale: The expectation of a rate cut by the Federal Reserve in March may be overly reliant on history

Faced with the continuous warnings from the Federal Reserve, some strategists believe that traders betting on a rate cut in March may rely too much on history. According to data collected by institutions since 1980, on average, the Fed tends to ease monetary policy about six months after its last rate hike. As officials are expected to remain unchanged in January this year, extending the pause policy since July last year, the current pause period will be longer than before. Societe Generale Bank stated that this situation, coupled with continued inflation slowdown, may prompt traders to be overly aggressive in pricing for rate cuts. Subadra Rajappa, Head of US Rate Strategy at the bank, said that based on historical records, March seems like an appropriate time frame for a policy shift for many people. However, after Federal Reserve officials emphasized the risk of inflation rebounding, a rate cut in March seems premature. Societe Generale Bank believes that it will not be until May when the Federal Reserve cuts rates.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

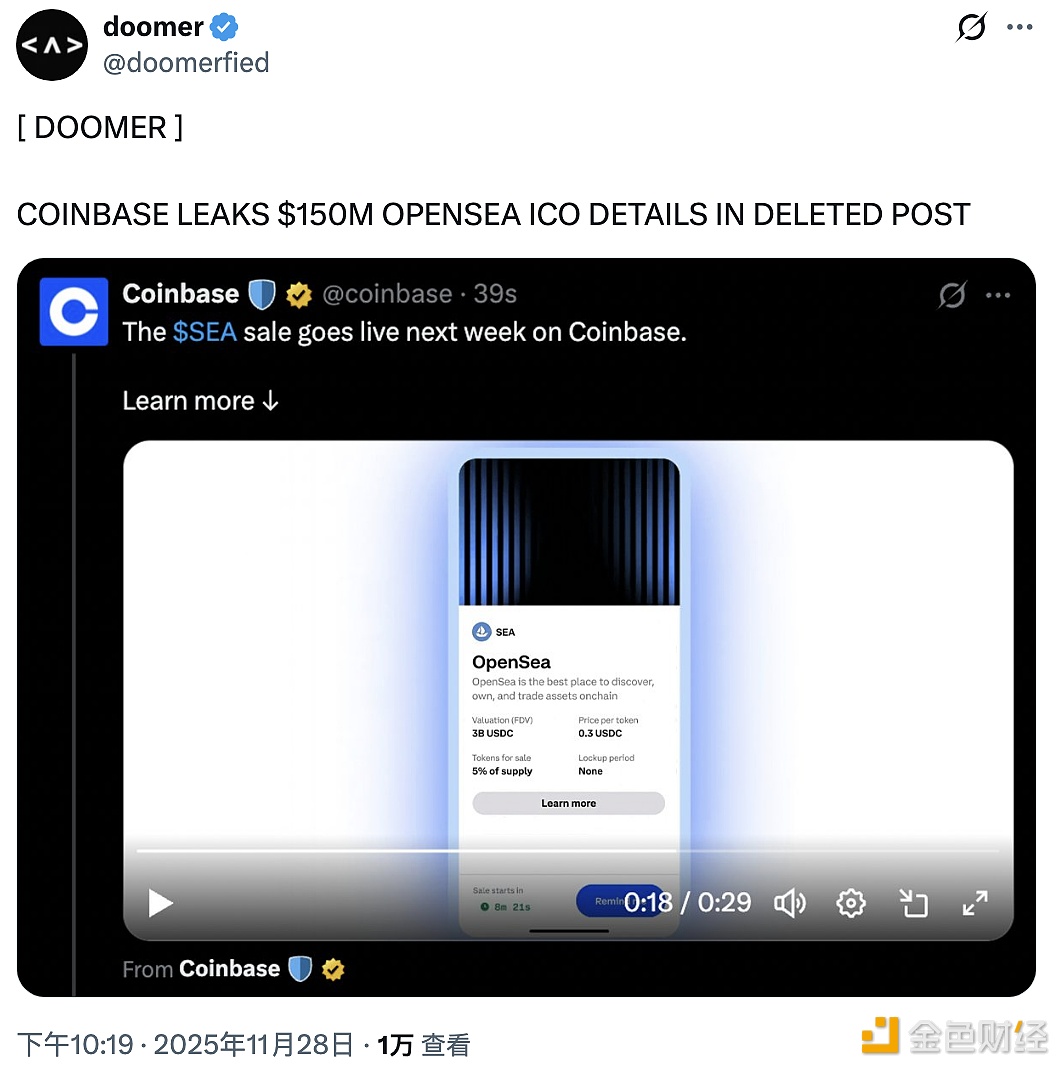

An exchange accidentally leaked details of OpenSea's $150 millions ICO

A certain exchange once posted "Opensea public sale next week," but later deleted it.

Data: Circle newly minted 500 millions USDC

Spot gold returns to $4,200