European stock markets are all declining, traders are reassessing their bets on interest rate cuts

According to Jin10's report, European stock markets are all declining, with all sectors experiencing a downturn. After hawkish remarks from European Central Bank officials, traders are reassessing their bets on interest rate cuts. The STOXX Europe 600 index fell by about 0.8%, dragged down by an 85% decline in constituent stocks. Earlier, ECB Governing Council member Holzmann hinted that there may not necessarily be an interest rate cut this year. Currently, the smooth start of the European stock market in 2024 is being tested. Lindsay James, investment strategist at Quilter Investors, said that the European stock market may see a partial strong return from the fourth quarter and confidence in sustained rapid inflation decline and early signals of ECB interest rate cuts is being tested. Houthi militants continue to attack US commercial ships in the Red Sea, exacerbating geopolitical tensions in the Middle East region.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

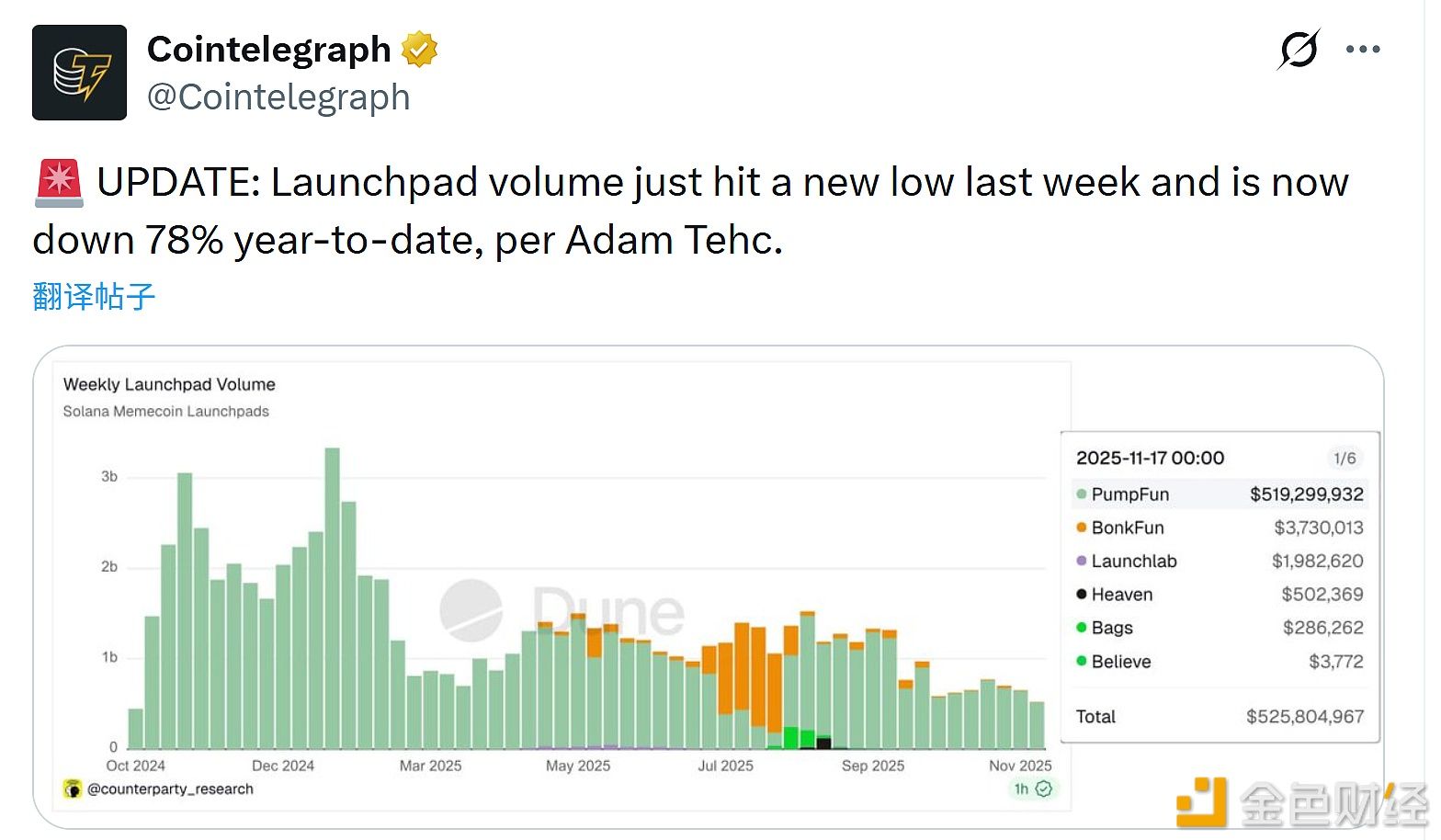

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93