Ethereum Price Prediction: ETH Breaks Above $3,200 as Bullish Momentum Accelerates

Crypto Market Rally Lifts Ethereum Higher

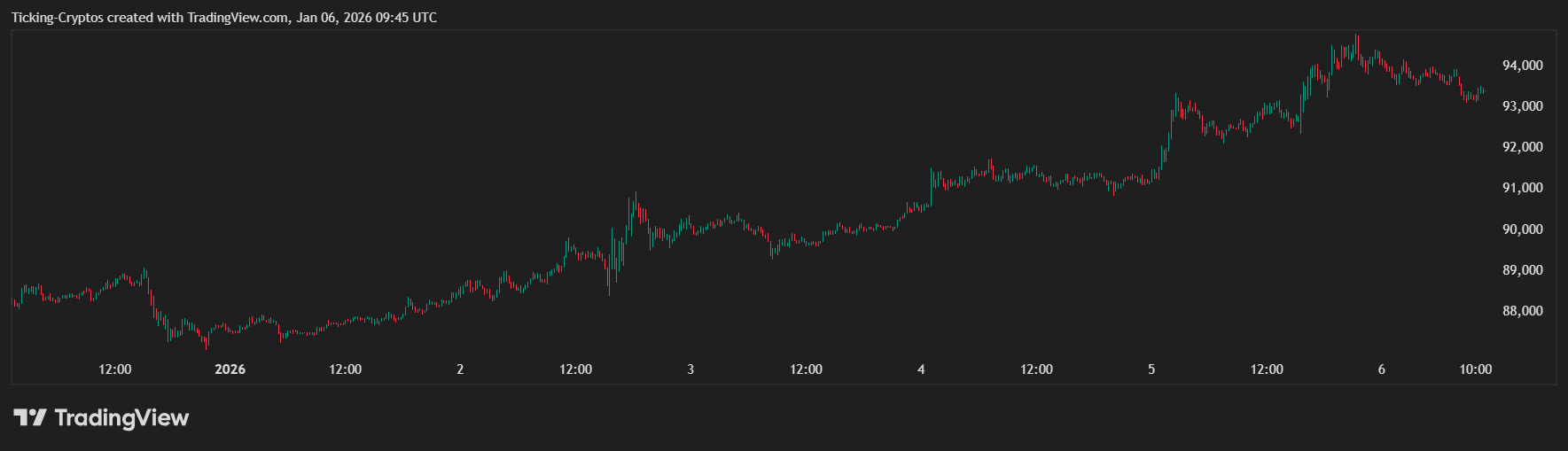

The crypto market is starting 2026 on a strong note. $Bitcoin’s move above $90,000 has reignited bullish sentiment across the board, bringing fresh capital back into altcoins. As market confidence improves, Ethereum is once again taking a leadership role among large-cap cryptocurrencies.

Bitcoin Price USD over the past week - TradingView

Historically, $Ethereum tends to follow Bitcoin’s major breakouts with a slight delay — and that pattern appears to be playing out again. After weeks of consolidation, ETH is now showing renewed strength.

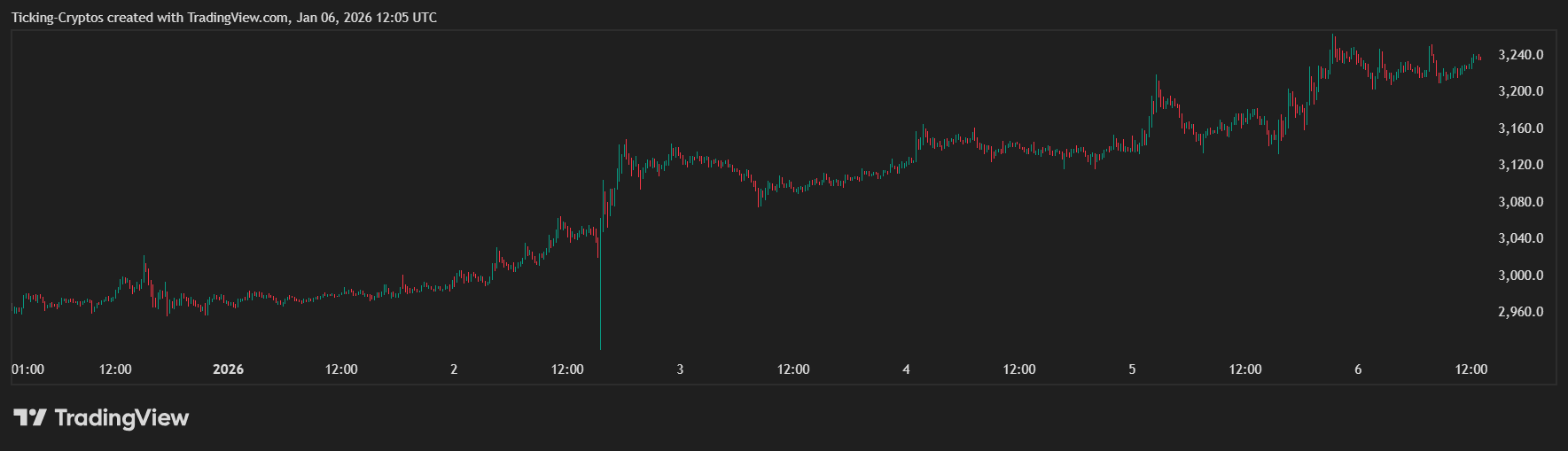

What Happened: Ethereum Reclaims the $3,200 Level

Ethereum spent the final weeks of 2025 trading in a broad range, repeatedly testing the $3,200 zone without a clear breakout. Each attempt was met with selling pressure, turning this level into a well-defined resistance.

In early January, that changed.

ETH managed to push decisively above $3,200, turning a former resistance area into support. This move signals that buyers are regaining control and that demand is stepping in at higher prices.

Technical Analysis: Key Levels on the Chart

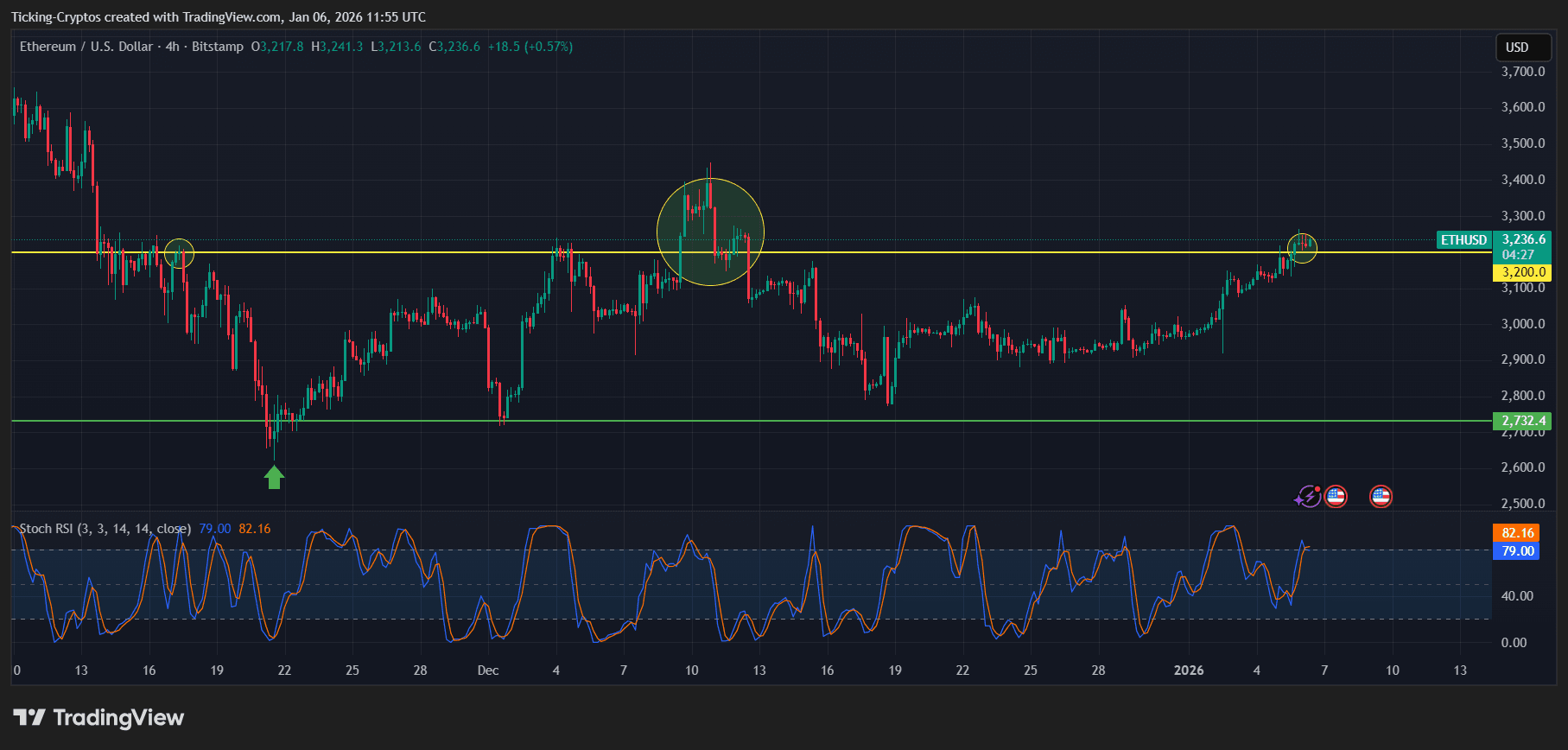

From a technical perspective, Ethereum’s structure has improved significantly.

ETH/USD 4H - TradingView

Key Support Levels

- $3,200 – former resistance, now the most important short-term support

- $3,000 – strong psychological and structural support

- $2,730 – major downside support if the market pulls back

Holding above $3,200 keeps Ethereum firmly in a bullish setup.

Key Resistance Levels

- $3,400 – local resistance from previous highs

- $3,600 – major breakout zone

- $3,800–$4,000 – psychological targets if momentum accelerates

The Stochastic RSI on the 4-hour timeframe is elevated, suggesting short-term cooling or consolidation may occur before the next leg higher — a normal behavior after a breakout.

Traders are positioning themselves fr either scenario.

Ethereum Price Prediction: What Comes Next?

If the broader market remains supportive, Ethereum could follow one of these paths:

- Bullish scenario: A sustained hold above $3,200 could open the door to $3,400, followed by a push toward $3,600.

- Consolidation scenario: ETH may trade sideways between $3,100 and $3,300, building strength for the next move.

- Bearish invalidation: A clear break back below $3,000 would weaken the bullish structure and delay higher targets.