The last week of 2025 has officially kicked off.

Looking back, it’s been a tough year for the crypto market. The TOTAL market cap is still down 7% from its $3.15 trillion peak, with 2025 clearly closing on a cautious note as the market heads into the “New Year.”

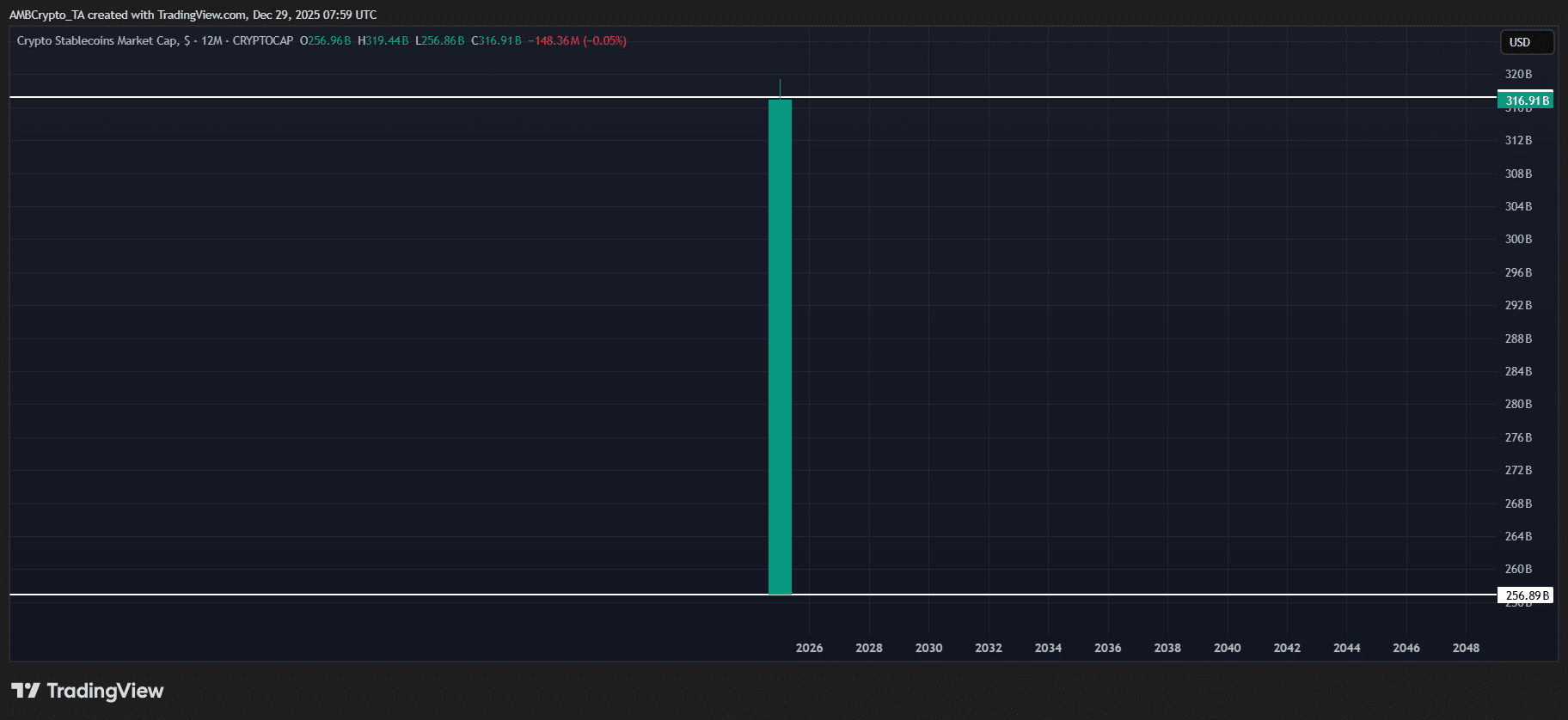

One notable exception, however, has been stablecoins. From a technical standpoint, the stablecoin market cap (STABLE.C) is up 25% YTD, adding $60 billion over the year to reach a total market cap of $315 billion.

In short, the market has seen a clear divergence in flows.

As 2025 wraps up, stablecoins have once again acted as the market’s “safe haven”, absorbing capital while the rest of crypto dealt with elevated volatility, something the market has been exposed to for most of the year.

But volatility isn’t going away just yet. The market is heading into another macro-heavy week, one that could test key levels across risk assets. In that context, are stablecoin flows the key signals investors should be watching?

Stablecoin stagnation signals liquidity hesitation

Liquidity remains one of the main drivers of the crypto market.

Lately, the U.S. has seen a steady stream of liquidity support from the Federal Reserve, via repo operations, Treasury sell-offs, and interest rate cuts. Yet, price action across risk assets has stayed muted.

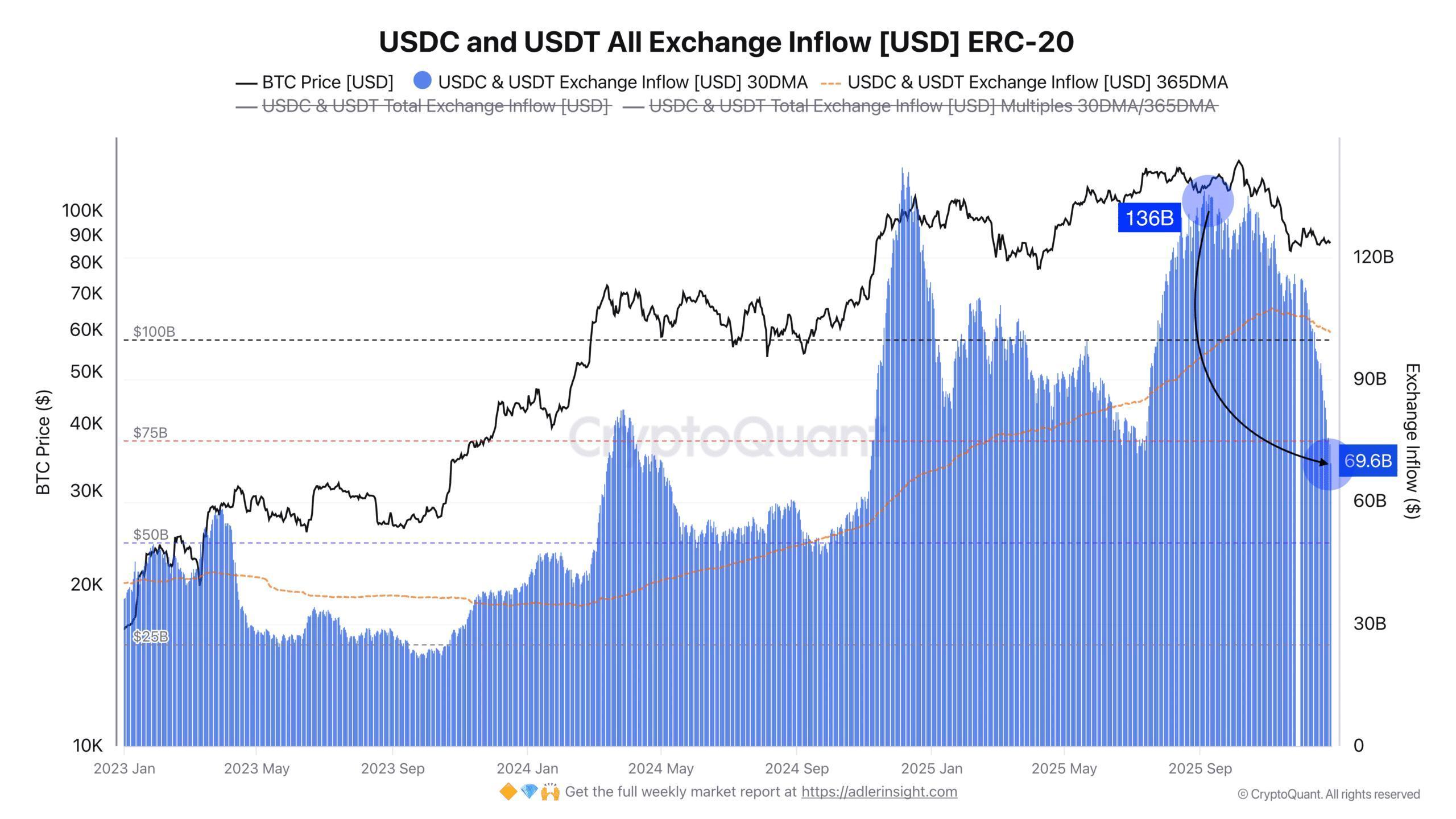

Notably, the chart below shows why. Even though liquidity is coming in, it’s not being deployed. Stablecoin inflows to exchanges have dropped sharply since September, falling from around $136 billion to roughly $70 billion.

Put simply, stablecoin flows into exchanges are down roughly 50%.

From a technical angle, that’s a signal of caution. When inflows fall like this, it means capital is staying on the sidelines instead of moving into Bitcoin [BTC] or other high-beta alts, marking a bearish hint for risk assets.

Given this context, the “New Year” rally looks a bit too optimistic at the moment, especially with a macro-heavy week ahead. Consequently, that makes stablecoin flows one of the key metrics to watch right now.

Final Thoughts

- While the total crypto market cap is down 7% YTD, stablecoins are up 25%, highlighting a clear divergence in market flows.

- Stablecoin inflows to exchanges have dropped 50% since September. This signals that capital is staying out of risk assets.