Google Trends Shows Crypto Interest Fading in 2025

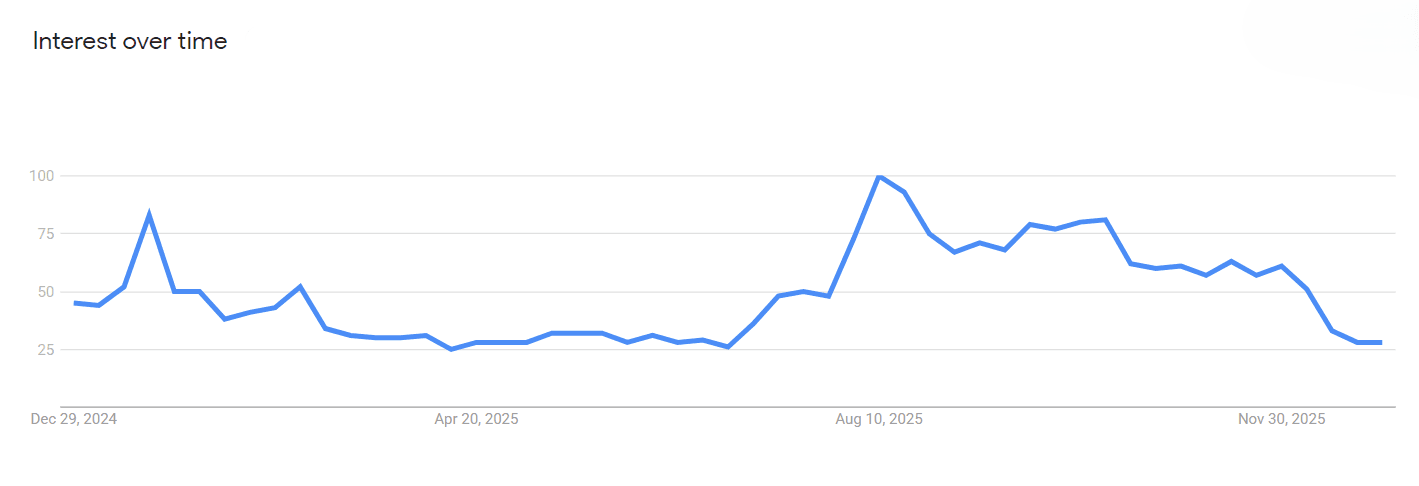

Public interest in crypto is quietly fading. Google search volume for the keyword “crypto” has dropped to some of its lowest levels of the past 12 months, according to Google Trends data. At the same time, Bitcoin has already lived through a full year of volatility, rallies, and corrections.

This disconnect between price action and public attention is not new — but it’s often meaningful.

Google Trends Shows Crypto Interest at Yearly Lows

Looking at the chart over the past 12 months, interest in the term “crypto” peaked during moments of strong market momentum earlier in the year. Since then, search volume has steadily declined, recently returning to levels last seen during quieter market phases.

Crypto searches in 2025

Key observations from the data:

- Search interest peaked during high-volatility periods

- Interest dropped even while Bitcoin continued trading at elevated levels

- Current readings are near yearly lows despite BTC remaining historically expensive

This suggests fewer retail participants are actively searching, researching, or entering the market right now.

Regional Interest Remains Uneven

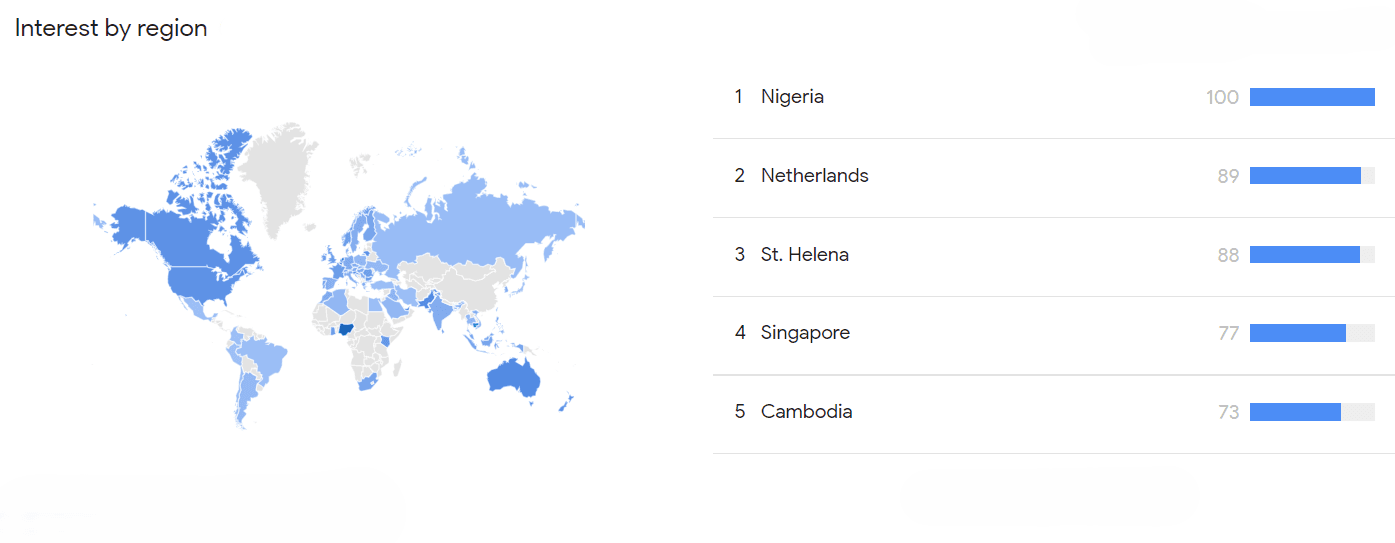

The regional breakdown adds another layer to the picture.

Countries like Nigeria, the Netherlands, Singapore, and parts of Southeast Asia continue to show relatively strong interest compared to the global average. However, large developed markets show noticeably softer engagement.

Crypto interest by region

This points to a shift:

- $Crypto interest is becoming more utility-driven in certain regions

- Speculative retail attention in Western markets appears muted

- Adoption continues, but hype cycles are cooling

Bitcoin Price 2025: Volatility Without the Hype

The Bitcoin year-to-date price chart tells a very different story from Google search trends.

Over 2025, Bitcoin:

- Experienced strong rallies and deep pullbacks

- Reached new local highs before correcting

- Remained well above prior cycle averages

Bitcoin price in USD in 2025

Despite these moves, public search interest failed to recover in a meaningful way after mid-year. In other words, price moved, attention didn’t.

This divergence often appears in later stages of market cycles, where:

- Early buyers are already positioned

- Retail interest is fatigued

- Volatility is driven more by institutions and derivatives

Why Low Search Interest Can Matter

Historically, low Google search volume has often coincided with:

- Market consolidation phases

- Reduced retail participation

- Accumulation periods rather than distribution

When everyone is searching for “crypto,” markets tend to be overheated. When almost no one is searching, markets are often building quietly.

This doesn’t guarantee immediate upside — but it does suggest the market is less emotional and less crowded than during hype-driven peaks.

Sentiment vs Price: A Familiar Pattern

Bitcoin has repeatedly shown that:

- Price can rise before attention returns

- Attention usually follows performance, not the other way around

- Major trends often start when interest is still low

The current setup fits that historical pattern. Bitcoin remains volatile, but the absence of widespread hype changes the market’s risk profile.

Does Falling Search Interest Signal an Imminent Crash?

Historically, no. Major $Bitcoin crashes have typically occurred during periods of rising enthusiasm, heavy media coverage, and elevated retail participation. Falling Google search interest more often reflects fatigue and disengagement, not fear.

In quiet markets, there are fewer emotional participants and less forced selling pressure. While low interest does not guarantee upside, it tends to reduce crash risk unless price itself breaks key long-term support levels.