- Solana: Developers and whales accumulate during 30% pullback as ETF speculation and DeFi inflows grow.

- Sei: Native USDC launch drives TVL growth and attracts institutional liquidity during market weakness.

- Hedera: Enterprise partnerships and standards compatibility draw quiet whale accumulation after recent correction.

Crypto whales usually move when fear dominates price action. Recent market pullbacks created that environment across several major altcoins. On-chain data now shows steady accumulation during declines near thirty percent. Solana, Sei Network, and Hedera stand out during this phase. Each network shows improving fundamentals while prices remain suppressed.

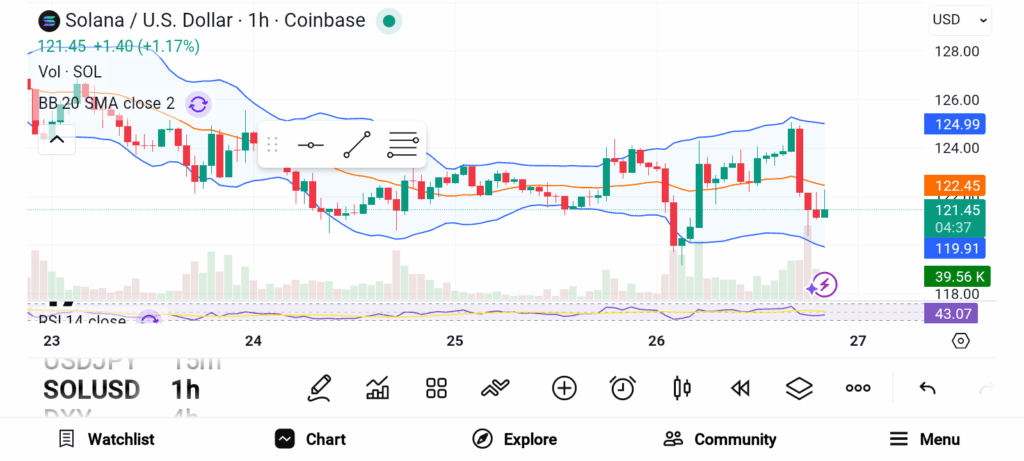

Solana (SOL)

Source: Trading View

Source: Trading View Solana continues drawing strong interest from institutions and long-term builders. Discussion around a possible United States spot ETF keeps gaining traction across financial circles. Developer participation recently reached the highest level since late 2022, signaling renewed confidence in the network. Improved stability and consistently low transaction fees support that growth. These factors strengthen Solana’s position among Layer 1 platforms facing intense competition.

Capital flows into Solana-based DeFi protocols also show positive momentum. Liquidity growth suggests renewed trust following earlier network challenges. During the recent correction, SOL dropped more than thirty percent from local highs. On-chain data shows large wallet addresses adding during that decline. Accumulation remained steady rather than reactive.

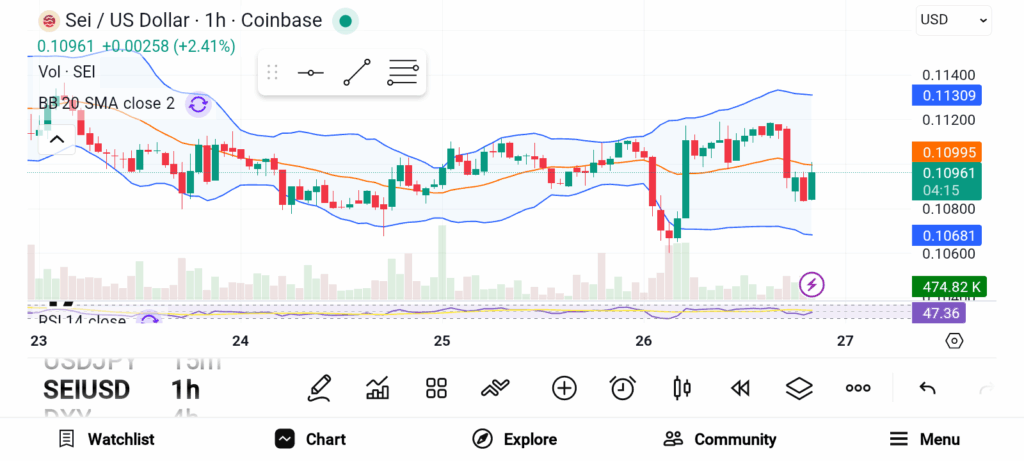

Sei Network (SEI)

Source: Trading View

Source: Trading View Sei Network gained fresh attention after launching native USDC integration. This upgrade allows faster and cheaper stablecoin settlement across the network. The design supports high-frequency trading and efficient liquidity movement, which aligns with the original network vision. Following the upgrade, total value locked surged one hundred eighty eight percent quarter over quarter. That growth reflects rising developer interest and increasing capital deployment.

Institutional participation also played a role in that expansion. New DeFi primitives continue launching as liquidity deepens. Stablecoins now serve as core infrastructure for real-time financial settlement. Sei benefits from that shift due to specialized architecture focused on speed and execution. Accumulation increased during broader market weakness, suggesting long-term positioning rather than speculative trading. The network now sits well positioned for continued adoption if stablecoin usage expands further.

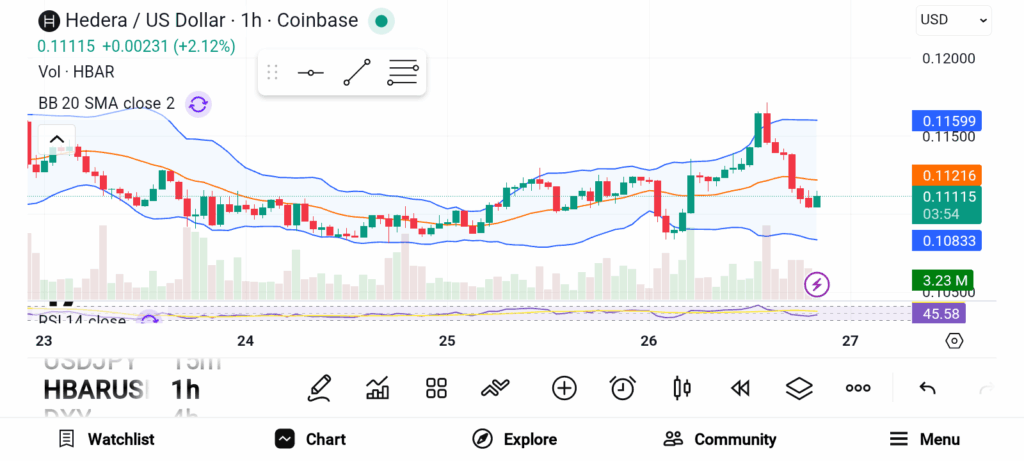

Hedera (HBAR)

Source: Trading View

Source: Trading View Hedera follows a different path compared to most Layer 1 networks. The focus remains enterprise adoption and real-world integration. Recent partnerships in artificial intelligence and asset tokenization added fresh utility to the ecosystem. Compatibility with ISO 2002 standards increases appeal for future financial infrastructure.

That compliance matters for institutions exploring blockchain-based settlement systems. Speculative interest also links HBAR to broader ETF narratives within the market. During the recent pullback, large holders accumulated while prices moved lower. Enterprise-driven networks often experience slower price discovery compared to retail-focused platforms.

Whales often accumulate during deep pullbacks rather than chasing strength. Solana shows rising developer activity and renewed DeFi inflows. Sei benefits from native stablecoin settlement and rapid liquidity growth. Hedera attracts enterprise-focused capital tied to real-world use cases. These signals suggest preparation during weakness rather than panic selling.