Date: Sat, Dec 13, 2025 | 05:58 PM GMT

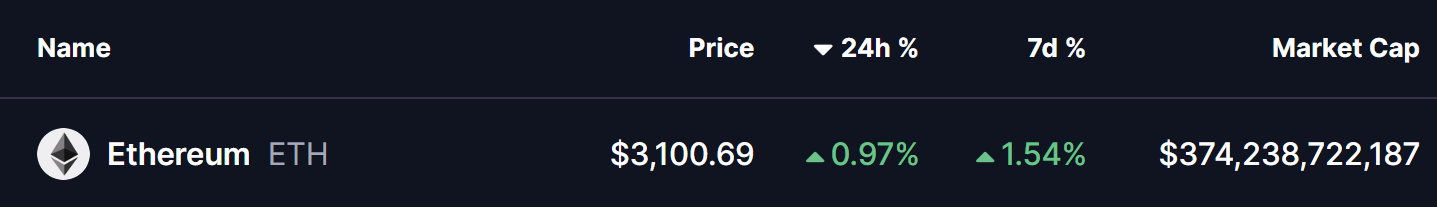

The broader altcoin market has remained volatile over the past few weeks, with sharp swings keeping traders on edge. Amid this uncertainty, Ethereum ($ETH) is flashing a technically important signal. While price action may appear hesitant on the surface, the latest chart structure suggests ETH is currently retesting a key bullish breakout zone — a move that often determines whether a trend reversal can sustain itself or fade away.

This retest phase places ETH at a decisive crossroads, where buyer strength will play a crucial role in shaping the next directional move.

Source: Coinmarketcap

Source: Coinmarketcap Retesting the Descending Channel Breakout

On the 4-hour chart, Ethereum had been trapped inside a well-defined descending channel since its early December peak near $4,758. The structure was characterized by consistent lower highs and lower lows, reflecting strong bearish control that eventually pushed ETH down toward the $2,559 region.

That bearish structure finally broke on December 9, when ETH decisively moved above the upper boundary of the descending channel near the $3,120 level. The breakout triggered a sharp relief rally, carrying price toward the $3,447 zone, which acted as near-term resistance.

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview)

Ethereum (ETH) 4H Chart/Coinsprobe (Source: Tradingview) Following that rally, ETH entered a healthy pullback phase. Price has now returned to retest the former channel resistance near $3,100— a zone that has flipped into support. This breakout-and-retest behavior is often seen in trend reversals and serves as a key validation point for bullish continuation.

What’s Next for ETH?

As long as Ethereum holds above the reclaimed channel boundary, the bullish structure remains intact. A successful bounce from this support zone would signal that buyers are defending the breakout, increasing the probability of a renewed push toward the $3,447 resistance area. A clean move above that level would further strengthen bullish conviction and confirm momentum is shifting back in favor of buyers.

If upside continuation unfolds, the measured move projection from the descending channel points toward a potential target near $4,220. This would represent a recovery of roughly 36 percent from current levels and mark a meaningful trend reversal on the medium-term timeframe.

On the downside, failure to hold the breakout support would weaken the bullish thesis. A sustained move back below the reclaimed trendline could invalidate the breakout structure, reopening the door for a return to the prior downtrend and extending consolidation or downside pressure.

For now, Ethereum remains in a technically sensitive zone, where the outcome of this retest is likely to define its next major move.