- Bitcoin: Reliable digital store of value with strong institutional interest and predictable issuance.

- Arbitrum: Ethereum scaling solution offering low fees, high throughput, and growing DeFi adoption.

- Binance Coin: Powers BNB Chain, supports staking, governance, and expanding smart-contract ecosystem.

The cryptocurrency market keeps evolving, offering investors a mix of established players and innovative newcomers. Picking the right coins for 2026 requires looking at adoption, liquidity, and technical upgrades. Some assets attract attention because of broad usage and strong developer support. Others show promise thanks to utility within growing ecosystems. This post highlights three cryptocurrencies worth considering next year and explains why they may deliver long-term potential for both retail and institutional investors.

Bitcoin (BTC)

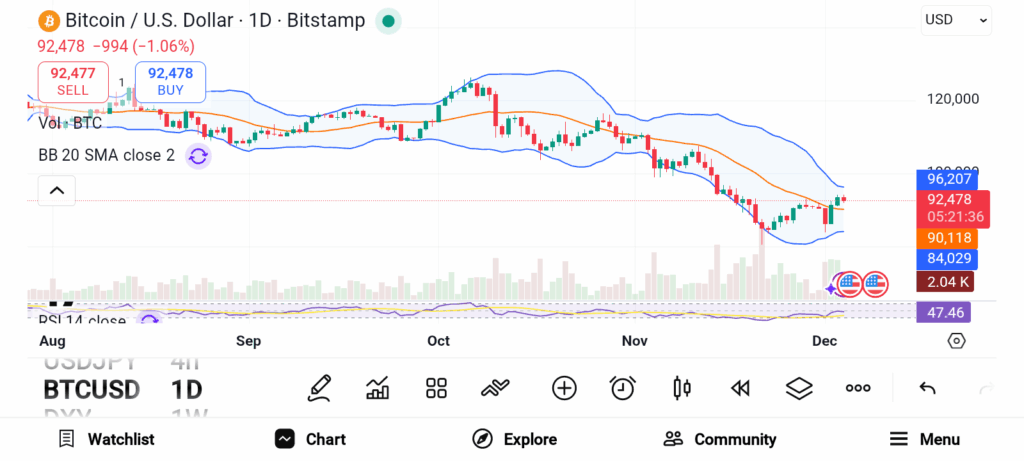

Source: TradingView

Source: TradingView Bitcoin remains the market leader with unmatched recognition and liquidity. Investors view it as a reliable digital store of value, offering protection against inflation. Limited supply and predictable issuance reinforce long-term demand. In 2026, institutional inflows may become a bigger driver, especially as regulated products gain traction.

Large asset managers and corporate treasury strategies can influence market expectations significantly. Short-term price swings often respond to interest rate decisions or shifts in global risk sentiment. Despite this, Bitcoin’s core strength lies in stability, widespread acceptance, and structural reliability.

Arbitrum (ARB)

Source: TradingView

Source: TradingView Arbitrum continues to stand out as a leading Ethereum scaling solution. Developers favor it for high throughput, predictable performance, and compatibility with existing Ethereum infrastructure. The network supports a wide range of DeFi applications, from lending platforms to complex trading strategies, while keeping transaction costs low.

In 2026, Arbitrum plans to improve efficiency, expand rollup-based execution, and enhance governance. These changes aim to support larger applications and more sophisticated automated contracts. Growing adoption within the DeFi ecosystem and consistent network performance position Arbitrum as a promising candidate for investors seeking exposure to Ethereum-related growth.

Binance Coin (BNB)

Source: TradingView

Source: TradingView BNB powers the BNB Chain ecosystem and plays a central role in transaction fees, staking, and governance. Strong liquidity from the exchange and an active smart-contract ecosystem ensures steady demand. In 2026, the network plans upgrades focused on higher throughput, faster confirmations, and native privacy features for transactions and smart contracts.

Expanding rollups and sidechains will allow the network to support larger user bases and more complex workloads. Ecosystem growth continues to attract developers creating scalable applications in both DeFi and consumer-facing projects. BNB’s utility and network expansion make it a noteworthy option for investors seeking both stability and growth potential.

Bitcoin, Arbitrum, and Binance Coin stand out as cryptocurrencies to watch in 2026. Each offers unique advantages, from Bitcoin’s reliability to Arbitrum’s developer appeal and BNB’s utility. Investors should evaluate adoption, ecosystem growth, and technical upgrades when considering them. Careful monitoring and strategic investment could reveal significant long-term opportunities in these assets.