Bitget Deepens Liquidity with DWF Labs Partnership

Victoria, Seychelles, 24 June, 2025 — Bitget, the leading cryptocurrency exchange, and Web3 company, has entered into a strategic liquidity partnership with DWF Labs, a global digital asset market maker and investment firm. As part of this collaboration, DWF Labs will provide institutional-grade liquidity support for USD1, a fiat-backed stablecoin backed by World Liberty Financial (WLFI), across both spot and derivatives markets.

This partnership enhances the stability and tradability of USD1 by ensuring tighter bid-ask spreads, deeper market depth, and consistent two-sided liquidity across trading pairs. By optimizing cross-pair routing and liquidity provisioning for USD1, DWF Labs is playing a key role in expanding stablecoin usage within the Bitget ecosystem and enabling a smoother trading experience for users.

“Stablecoins power trading at Bitget, it’s vital we work with partners that bring support to stronger liquidity on the platform,” said Gracy Chen, CEO of Bitget. “Partnering with DWF Labs helps us ensure our users get consistent, two-way liquidity across market conditions, making institutional trading smoother, cost-efficient and fast.”

By supporting USD1 liquidity across a variety of market conditions, DWF Labs enables Bitget to maintain capital efficiency and a risk-managed trading environment, essential features as Bitget continues to meet shifting regulatory and transparency expectations. This partnership also signals a deeper alignment between Bitget and DWF Labs to support the long-term credibility and growth of stable, tradable digital assets.

“At DWF Labs, we support the development of stable, transparent markets—especially as exchanges scale their infrastructure and regulatory alignment,” said Andrei Grachev, Managing Partner of DWF Labs. “Our work with Bitget around USD1 is part of that commitment. By providing consistent liquidity and stablecoin depth, we help ensure that on-platform assets like USD1 function reliably across trading environments.”

Bitget has consistently broadened its offerings to better serve professional and high-frequency traders, including introducing a Unified Trading Account, crypto lending for spot pairs, and most recently, unlocking Bitget PRO for institutional-grade traders. This collaboration represents a significant milestone in Bitget’s stablecoin strategy, reinforcing its focus on reliability, security, and institutional readiness in a rapidly evolving crypto landscape.

About Bitget

Established in 2018, Bitget is the world's leading cryptocurrency exchange and Web3 company. Serving over 120 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices. Formerly known as BitKeep, Bitget Wallet is a leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built into a single platform.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World's Top Football League, LALIGA, in EASTERN, SEA and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

For media inquiries, please contact: media@bitget.com

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

About DWF Labs

DWF Labs is the new generation Web3 investor and market maker, one of the world's largest high-frequency cryptocurrency trading entities, which trades spot and derivatives markets on over 60 top exchanges. Learn more: www.dwf-labs.com

2025-06-24

2025-06-24- Press releaseBitget Drops New Video With World Cup Winner Julián Álvarez, Turning Trading Into a One-Stop UEX MegastoreVictoria, Seychelles, January 14, 2026—Bitget, the world’s largest Universal Exchange (UEX), has released a new global video featuring World Cup winner Julián Álvarez, using football culture to explain a simple idea: if you want to trade the world, you should not have to shop around. The video brings Bitget’s Universal Exchange vision to life through a familiar setting for football fans. Set inside a stylized football megastore, Álvarez browses match-day essentials that double as investment cues

2026-01-14

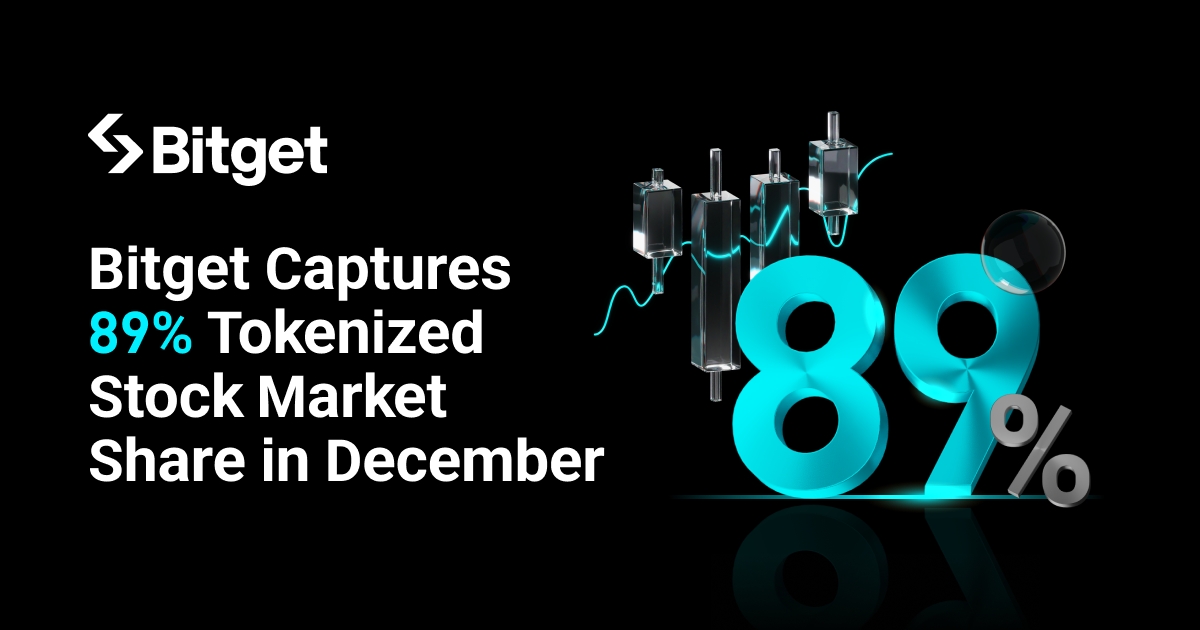

- Press releaseBitget Captures 89% Tokenized Stock Market Share in December, Extends 0 Fee Trading Through April 2026 Victoria, Seychelles, January 14, 2026 — Bitget, the world’s largest Universal Exchange (UEX), announced a significant expansion of its leadership in tokenized equities, capturing approximately 89% of total market share on Ondo in the month of December 2025 — further up from 73% in the first week of December. The increase reflects accelerating demand for on-chain access to global equities and positions Bitget as the dominant venue for tokenized stock trading as participation broadens across re

2026-01-14

- Press releaseBitget Transparency Report 2025: One Exchange. Every Market. 2025 Through the Lens of UEXTLDR; Bitget recorded $8.17 trillion in annual derivatives trading volume, positioning it among the top four centralized exchanges globally. Institutional trading volume share surged from 39.4% in January to 82% by December 2025. Cumulative trading volume for tokenized stock futures surpassed $15 billion with daily TradFi trading exceeding $2 billion. Bitget Wallet Card spending experienced a massive 28× year-on-year increase across more than 50 markets. Bitget Onchain generated over

2026-01-13