Date: Mon, Dec 15, 2025 | 06:20 PM GMT

The cryptocurrency market continues to face heavy selling pressure as both Bitcoin (BTC) and Ethereum (ETH) dropped more than 4.50% over the past 24 hours. This sharp correction sparked heightened volatility across the market, triggering over $618 million in liquidations , with long positions absorbing the bulk of the damage.

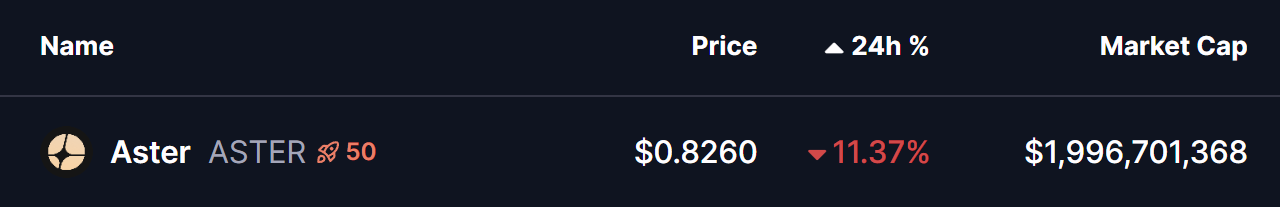

Altcoins have not been spared from the selloff, and Aster (ASTER) is no exception. The token has slipped more than 10% during the downturn. However, beneath the surface, ASTER’s price structure is beginning to reveal a potentially bullish setup that could hint at a recovery attempt if key levels continue to hold.

Source: Coinmarketcap

Source: Coinmarketcap

Double Bottom Pattern in Focus

On the daily chart, ASTER appears to be forming a classic double-bottom structure, a pattern that often signals seller exhaustion and a possible trend reversal. The token has remained under pressure since mid-November, following a failed breakout above the $1.4073 neckline resistance. That rejection led to a sharp decline of nearly 42%, dragging price back toward the critical $0.80–$0.81 support zone.

Notably, this area has already acted as a strong demand region in the past. The chart now shows price revisiting this same zone, where buyers are once again stepping in. If this level continues to hold, the current pullback may represent the second bottom of the emerging double-bottom formation — a key ingredient needed for a bullish reversal.

ASTER Daily Chart/Coinsprobe (Source: Tradingview)

ASTER Daily Chart/Coinsprobe (Source: Tradingview)

What’s Next for ASTER?

The importance of the $0.80–$0.81 support cannot be overstated. Sustained defense of this zone keeps the bullish structure intact and allows momentum to gradually rebuild. The first major upside test sits at the 50-day moving average near $1.0663, which has acted as dynamic resistance throughout the recent downtrend.

A successful reclaim of this moving average would be an early confirmation that buyers are regaining control. In that scenario, ASTER could attempt a broader recovery toward the neckline resistance at $1.4073. A decisive breakout above this level would complete the double-bottom pattern and significantly strengthen the bullish outlook.

On the downside, a daily close below the $0.80 support would invalidate the setup, exposing ASTER to deeper downside risk and delaying any meaningful recovery attempt.

For now, repeated reactions from the same demand zone suggest that selling pressure is weakening. While confirmation is still needed, the chart structure indicates that ASTER may be approaching a critical turning point, with the next few sessions likely to define its short-term direction.