The Rise of CFTC-Regulated Clean Energy Markets: Opening a New Chapter for Institutional Investors

- CFTC's 2025 approval of REsurety's CleanTrade as a SEF marks a landmark shift in clean energy markets by introducing standardized, transparent trading for VPPAs and RECs. - The platform attracted $16B in notional value within two months, enabling rapid institutional-grade transactions that previously took months to negotiate. - By addressing liquidity gaps and enabling precise risk modeling, CleanTrade is accelerating capital flows into decarbonization while bridging ESG investment gaps for institutional

Transforming Clean Energy Markets: The Rise of CleanTrade

The journey toward a sustainable energy future has often been slowed by a major obstacle: the absence of transparent and liquid markets for green assets. Institutional investors interested in funding renewable energy initiatives have long encountered a fragmented system, characterized by unclear pricing, intricate deal structures, and a lack of accessible secondary markets. However, this landscape is rapidly changing. In September 2025, the Commodity Futures Trading Commission (CFTC) granted approval for REsurety's CleanTrade platform to operate as a Swap Execution Facility (SEF), marking a pivotal moment that could reshape the flow of capital into the clean energy sector.

CleanTrade has emerged as the first regulated exchange for Virtual Power Purchase Agreements (VPPAs), physical PPAs, and project-specific Renewable Energy Certificates (RECs). This platform introduces much-needed standardization and openness to clean energy trading. As a SEF, CleanTrade offers a centralized, regulated environment where participants can transact with greater assurance. This is more than a regulatory formality—it represents a fundamental shift in how green assets are traded.

Within just two months of receiving CFTC approval, CleanTrade attracted $16 billion in notional trading volume, highlighting the strong demand for a transparent, institutional-grade marketplace for clean energy assets.

Unlocking Liquidity for Green Investments

Traditionally, VPPAs and RECs were exchanged through private negotiations, often resulting in unclear pricing and high transaction costs. CleanTrade’s SEF status addresses these challenges by providing real-time pricing and standardized contracts, making the market more efficient and accessible.

Advanced analytics tools, such as CleanSight, are integrated into the platform, enabling users to accurately assess factors like energy output, congestion risks, and carbon impact. This reduces uncertainty and allows institutional investors to manage risks with the same sophistication found in conventional commodity markets.

The impact is significant. For instance, a major transaction between Cargill and Mercuria in January 2025, executed on CleanTrade, showcased the platform’s ability to facilitate large, complex deals in a matter of days rather than months. By streamlining the trading process, CleanTrade is unlocking capital that was previously held back by market complexity.

Empowering Institutional Investors and Advancing ESG Goals

Interest in sustainable assets among institutional investors is at an all-time high. Recent analysis indicates that 84% of these investors are actively looking to expand their green portfolios. Until now, inadequate market infrastructure has limited their participation. CleanTrade’s regulated framework bridges this gap, offering a transparent and reliable marketplace for trading clean energy assets.

By bringing together a wide range of buyers and sellers, CleanTrade enhances price discovery—a crucial element for institutional investment strategies. Corporate buyers aiming to meet sustainability targets can now connect with more suppliers, while developers gain access to stable, long-term revenue streams without the need for opaque, one-on-one agreements. This virtuous cycle of increasing liquidity and participation is deepening the market and driving further growth.

Redefining the Green Transition

The CFTC’s endorsement of CleanTrade signals a new era for clean energy, positioning it as a mainstream asset class. The platform’s robust infrastructure enables institutional investors to participate at scale, accelerating the shift from experimental projects to widespread adoption.

As one industry expert observed, “CleanTrade is to clean energy what the Bloomberg Terminal is to finance—a platform that democratizes access and brings clarity to the market.”

For investors, the message is unmistakable: the transition to clean energy is no longer a speculative venture but a financially sound opportunity. With CleanTrade’s infrastructure, barriers such as illiquidity, lack of transparency, and risk management are being systematically removed. This advancement benefits not just REsurety, but the entire ecosystem supporting renewable energy.

Conclusion

The establishment of CFTC-regulated clean energy markets marks a turning point in the global effort to combat climate change. By transforming VPPAs and RECs into liquid, tradable assets, CleanTrade empowers institutional investors to align their portfolios with the urgent need for decarbonization. As the platform continues to expand, its influence will extend across sectors, from energy generation to financial services. Early adopters stand to gain from a market that is both environmentally essential and economically attractive.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Husky Inu pre-launch hits $0.00023840 as crypto market sell-off deepens

Revealing: UK Crypto Ownership Plummets to 8% – What’s Behind the Sharp Decline?

Top 10 Legal Cloud Mining Tools for Android and iOS (2025)

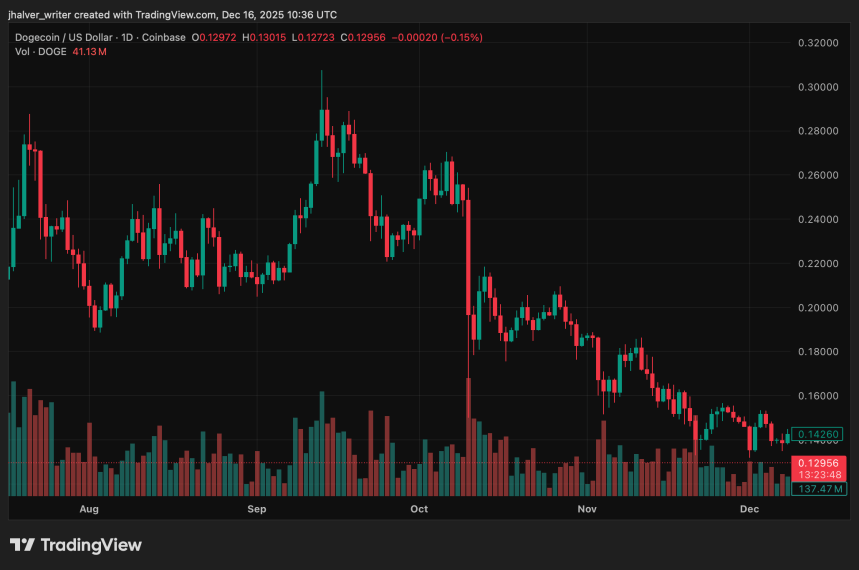

Dogecoin’s Selloff Tests Long-Held Beliefs as Traders Debate Capitulation or Reset