The US SEC discusses tokenization regulation issues, with significant differences between traditional finance and the crypto industry on the topic of decentralization.

Jinse Finance reported that the U.S. Securities and Exchange Commission (SEC) Investor Advisory Committee held a meeting on Thursday, where executives from companies such as Citadel Securities, an unnamed exchange, and Galaxy discussed regulatory issues related to asset tokenization. The meeting revealed a clear divide between traditional finance and the crypto industry regarding decentralization. In a letter submitted on Wednesday, Citadel Securities suggested that the SEC implement stricter rules for tokenized securities, requiring full identification of intermediaries involved in transactions, including decentralized trading protocols. This proposal immediately sparked strong opposition from the crypto industry. Scott Bauguess, Vice President of Regulatory Policy at the unnamed exchange, stated at the meeting that decentralized exchanges (DEXs) should not be subject to the same regulatory obligations as brokers, as this would introduce risks that do not exist in the current environment. SEC Chairman Paul Atkins emphasized that, in order to promote U.S. innovation, investment, and employment, a compliant pathway must be provided for market participants to leverage the unique capabilities of new technologies. Meanwhile, outgoing Democratic Commissioner Caroline Crenshaw expressed concerns about the risks that tokenized products such as "wrapped securities" might pose to investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

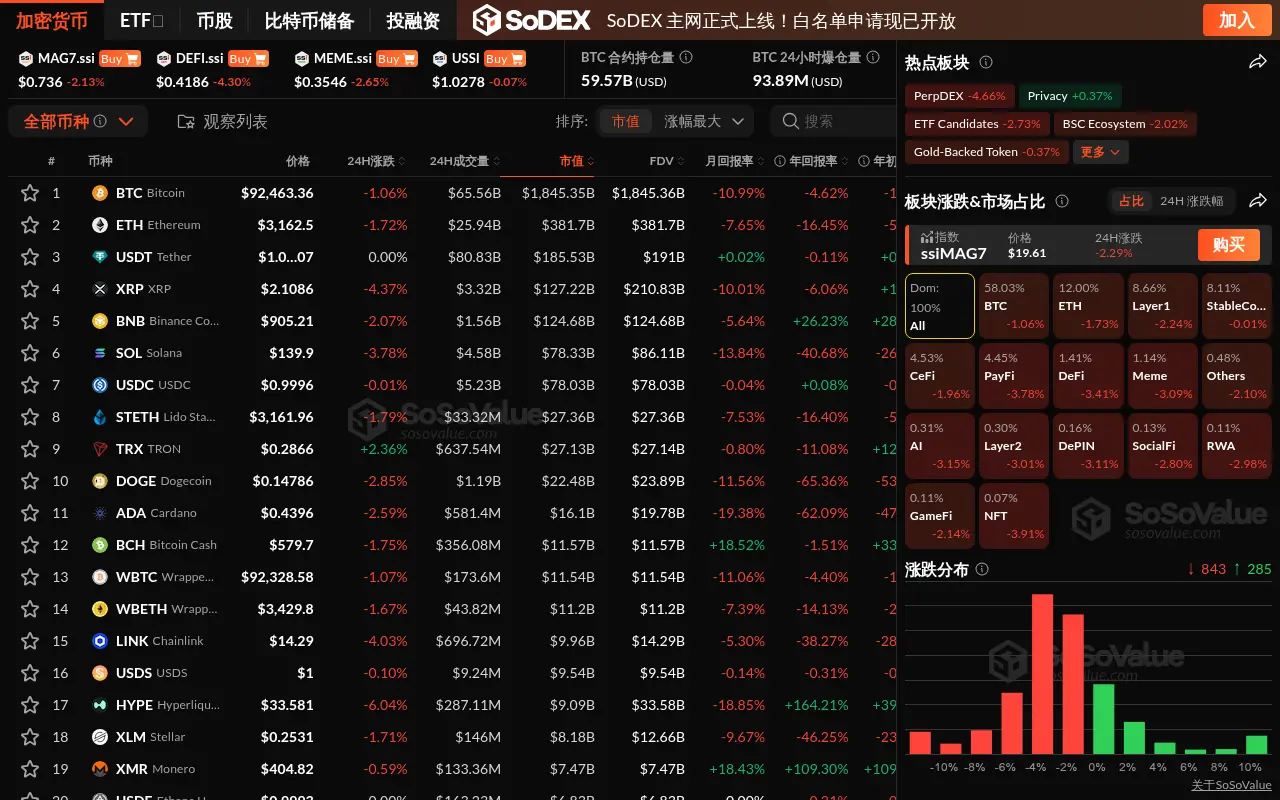

Data: The entire crypto market pulls back, PayFi sector drops nearly 4%

User data from Argentine crypto platform Lemon Cash leaked due to a hack on a third-party service provider