2025 Crypto Prediction Mega Review: What Nailed It and What Noped It?

Has a year passed already? Have those predictions from back then all come true?

Original Title: "2025 Crypto Prediction Review: 10 Institutions, Who Got It Right and Who Got It Wrong?”

Original Source: DeepTech TechFlow

As we approach the end of the year, it is foreseeable that the 2026 crypto predictions and outlooks of major institutions will be released over the next month.

However, before looking at the new predictions, it might be worth reviewing what these institutions said last year; after all, making predictions is easy, but accuracy is the real skill.

Recalling the end of 2024, with the market sentiment soaring and BTC just breaking $100,000, everyone's predictions were generally optimistic:

For example, BTC would surge to $200,000, stablecoin volume would double, AI agents would trigger on-chain activities, and crypto unicorns would rush to IPO... Now, a year has passed, have those predictions from back then all come true?

We have selected several typical institutions and individuals from last year's various prediction reports for a detailed review, to see whose prediction accuracy is higher.

1. VanEck: Accuracy 10%, Only Correct Prediction was Establishing a Bitcoin Strategic Reserve

At the end of 2024, VanEck made 10 predictions, with the only correct one being the establishment of a Bitcoin strategic reserve.

The other 9 were all off the mark, and most were not slight deviations but orders of magnitude errors. For example, predicting the peak of Q1 in crypto and Bitcoin reaching $180k, and hitting a new high by the end of the year; in reality, the timing and price targets were completely opposite.

Furthermore, their market size predictions were overly optimistic. They predicted tokenized securities to reach $500 billion, whereas it was around $300-350 billion in reality; DeFi TVL was predicted at $200 billion, while it was around $1200-1300 billion in reality; NFT transaction volume was forecasted at $300 billion, whereas actual estimates were $50-65 billion.

Overall, VanEck's judgment on policy direction was quite accurate, but they systematically overestimated the on-chain economic scale.

2. Bitwise: Accuracy 50%, General Direction Correct but Price Predictions Wrong

Bitwise made 10 predictions, with 5 hitting the mark, mainly focusing on regulatory and institutional adoption areas; however, their price and scale predictions also suffered from systematic overestimation.

· Policy and Institutional Adoption Hit the Mark. Coinbase and MicroStrategy entering the US stock indices became a reality; the Crypto IPO Era unfolded, with multiple crypto companies going public through IPOs; the number of countries holding BTC increased from 9 to nearly 30.

· Price Targets All Missed: Price predictions for BTC, ETH, and SOL were significantly higher than the actual performance of these tokens this year. Coinbase's stock price at $250 fell short of the $700 target by 65%. The estimated $500 billion in RWA tokenization also turned out to be an overestimation.

Overall, Bitwise demonstrated keen policy insight, accurately capturing the regulatory shift and institutional adoption momentum.

3. Coinbase: Accuracy Rate Close to 100%, Focusing on Direction Rather Than Price

Coinbase's forecasts are divided into two main categories: "Macro" and "Disruptive," mostly offering directional judgments rather than precise numbers, focusing on trend foresight.

Here are some core verifiable forecasts:

Additionally, some forecasts were directionally correct but challenging to quantify:

You can notice that this firm's forecasts clearly avoid specific price targets, concentrating on policy inflection points and industry trends. As a result, all core directional forecasts naturally hit the mark.

· Regulatory Shifts Fully Validated: Predictions regarding the "Most Crypto-Friendly Congress" bringing positive news and more asset ETF approvals; the actual situation indeed unfolded as predicted.

· Stablecoins and DeFi Overall Direction Correct: Predictions about stablecoins "experiencing explosive growth and expanding into commercial payments" came true this year, as evidenced by Mastercard's June announcement to support USDC/PYUSD/USDG, Coinbase integrating its payment platform with Shopify, and Stripe launching USDC subscription payments;

The prediction of a DeFi resurgence materialized, with DeFi TVL reaching $120 billion, nearing a three-year high since May 2022.

This "directional without pinpointing price" strategy, while lacking in sensationalism, retrospectively appears the most robust and less prone to being proven wrong.

4. Galaxy Research: Accuracy Rate 26%, Data-Related Predictions Almost All Wrong

Galaxy's various researchers made a total of 23 predictions, making it the most quantitative and comprehensive list among all institutions.

In hindsight, the policy prediction team performed excellently (100% hit rate), while price and market size predictions were almost all incorrect. In particular, the prediction of DOGE breaking $1 can now be seen as overly optimistic.

Furthermore, Galaxy's predictions on ecosystem development were fairly accurate. For example, predicting that most mining companies would transition to AI and high-performance computing was indeed a prominent trend amid this year's AI boom.

When predictions are numerous and detailed, even professional research institutions will not always get everything right; the market does not always unfold as expected.

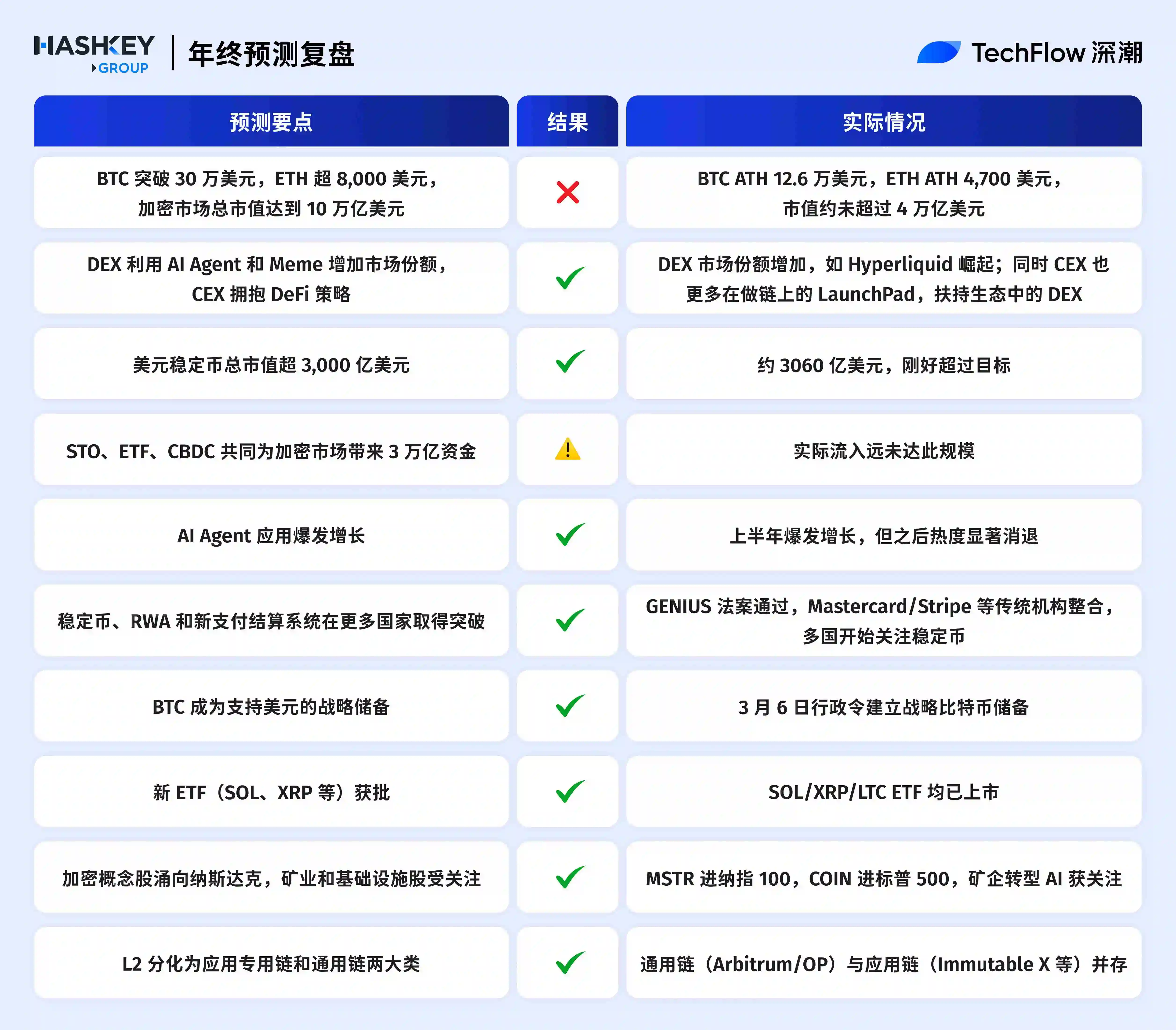

5. Hashkey: Accuracy Rate 70%, Price Predictions Too Optimistic

Overall, HashKey's predictions were precise regarding regulatory progress (ETFs, stablecoin legislation) and ecosystem structural changes (DEX emergence, L2 differentiation), but they were overly optimistic about price cycles.

Interestingly, these predictions also reflected the sentiment of the crypto community at the time.

After HashKey Group released its top 10 market forecasts for 2025, nearly 50,000 community users participated in a vote based on the sixteen popular predictions summarized by HashKey researchers, analysts, and traders;

The results showed that 50% of voters favored the prediction of "Bitcoin breaking $300,000, Ethereum surpassing $8,000, and the total crypto market cap reaching $10 trillion."

Ironically, the prediction with the highest voting probability is now looking the least likely to materialize by the end of this year.

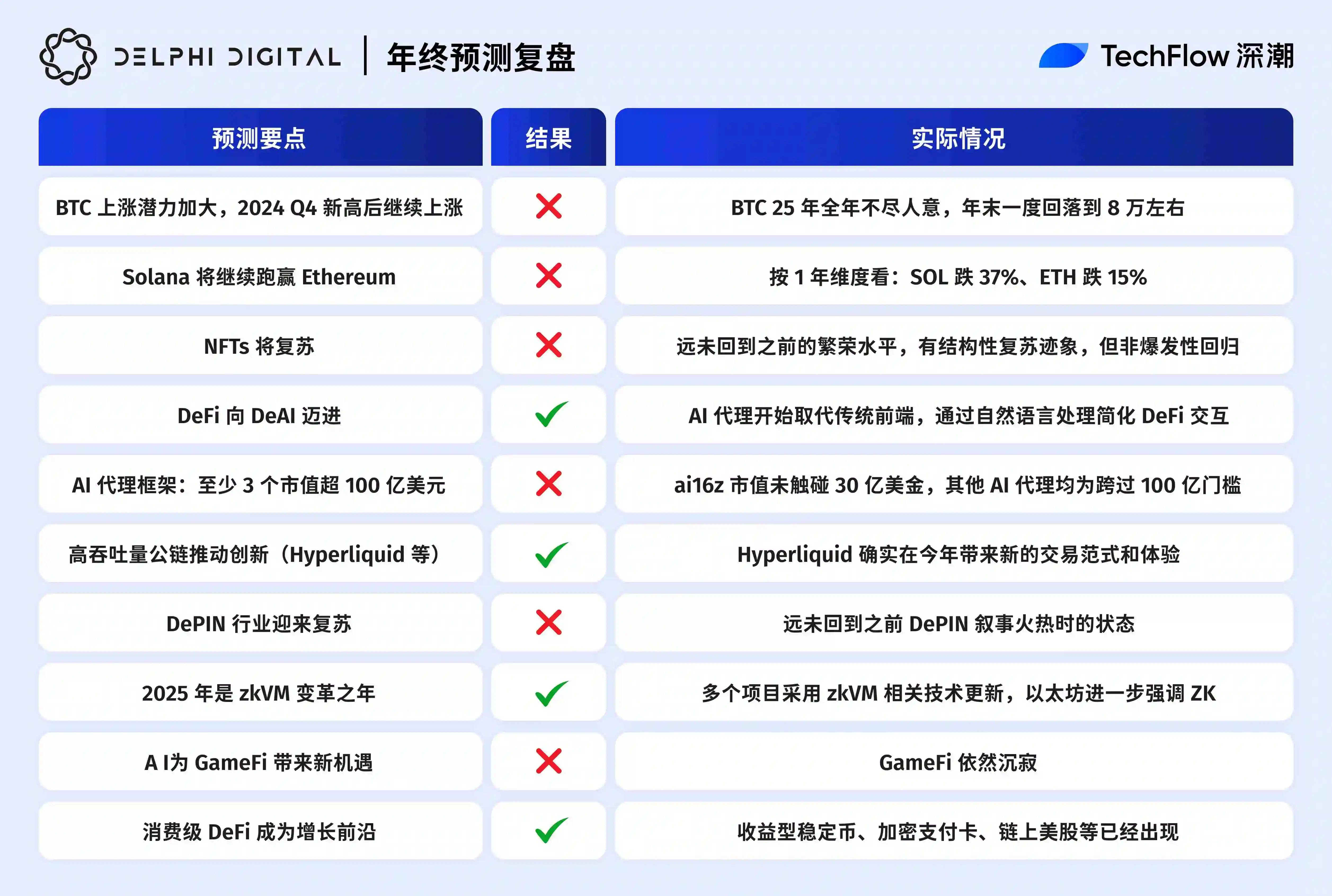

6. Delphi Digital: Accuracy Rate 40%, Consumer-Level DeFi Predictions Stand Out

Delphi Digital's predictions were more accurate concerning technical infrastructure and consumer-level applications; with the prediction on consumer-level applications stated as:

"2025 will be a critical development milestone for consumer-level DeFi, as more and more crypto users will fully embrace on-chain financial services."

This year, we have also seen various U-cards and tokenization of US stocks. In addition, traditional financial applications such as Robinhood are gradually embracing the blockchain.

7. Messari: Accuracy 55%, No Specific Price Points Involved

Although Messari is a data analysis platform, its predictions tend to lean towards the "trend direction" rather than "specific numbers," and in hindsight, its judgment on major trends has been relatively accurate.

8. Framework Ventures: Accuracy 25%, Providing More Confidence to Invested Projects

Next, we have selected some of the more representative personal prediction viewpoints from last year to see how the results turned out.

First is the prediction from Vance Spencer, co-founder of Framework Ventures. We have extracted the part related to crypto:

Evidently, Vance has shown high prediction expectations for projects in which he has invested, such as Glow, Daylight, and Berachain, representing the energy and public chain sectors, respectively.

In addition, some quantitative targets are overly aggressive, such as an average daily inflow of $1 billion into an ETH ETF.

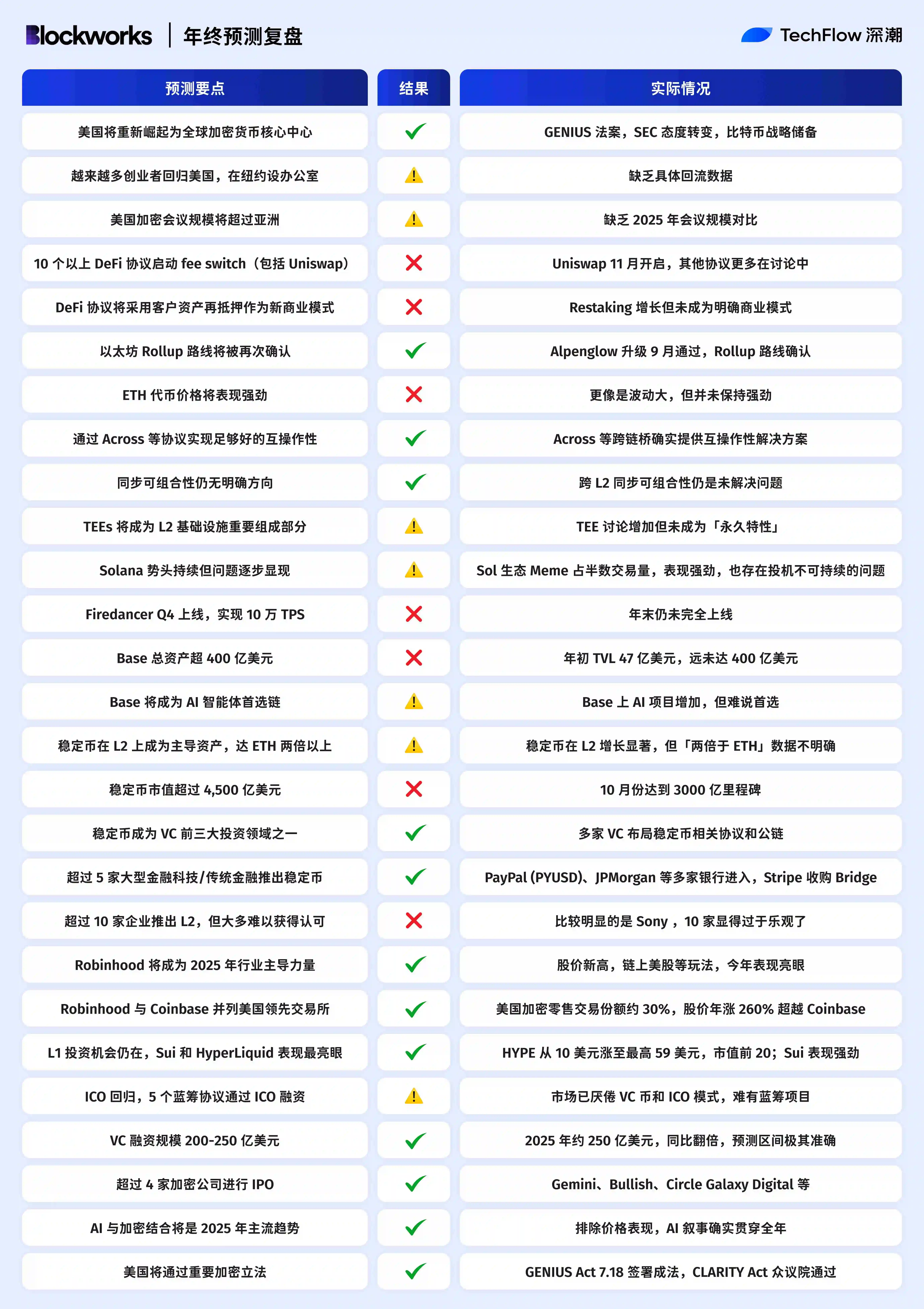

9. Blockworks Co-founder: Accuracy 48%, Most Number of Predictions

Blockworks co-founder Mippo (Twitter: @MikeIppolito_) is the individual with the highest number of predictions among our review of institutions and individuals, and although the accuracy of his predictions is good, he got nearly half of them right.

A highlight is that his prediction about the rise of Robinhood was completely correct, and he also seized the investment opportunity in L1, such as Hyperliquid and SUI, both of whose tokens have had remarkable performances this year.

10. Alliance DAO Wang Qiao & Imran: Accuracy 50%, Overly Optimistic about BTC Price

Alliance DAO's two founders, Wang Qiao and Imran, have also made predictions about the development of the next 25 years during a podcast chat.

We have compiled their views related to crypto as follows:

It can be seen that the two founders' expectations for BTC were overly optimistic. Even the lowest predicted value of 150K is still a long way from this year's highest BTC price.

However, their market prediction was very accurate, as they foresaw this key trend a year in advance.

Summary

After reviewing last year's predictions, several patterns are quite evident:

1. The quantity of predictions is generally inversely proportional to their accuracy. The more predictions made, the more of them tend to be wrong.

2. Attempts to predict specific price points and numbers mostly ended up being off the mark.

3. Predictions related to regulations were highly reliable. Nearly all institutions and individuals accurately predicted the improvement in the regulatory environment and the U.S.'s crypto-friendly stance.

Finally, the author believes that the value of these annual institutional forecasts lies not in "telling you what to buy" but in "telling you what the industry is thinking." These predictions can be viewed as industry sentiment indicators. If used as investment guides, the results may be quite dire.

Furthermore, it's good practice to remain skeptical of any prediction with specific numbers, regardless of whether it comes from a Key Opinion Leader (KOL), institution, or industry tycoon.

This is not to suggest that we should criticize these industry elites but rather to highlight that even incorrect predictions hold value.

They tell you what the market once believed, but no one can predict the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From Sahara to Tradoor: A Review of Recent “Fancy Drop” Tactics Among Altcoins

The End of Ethereum’s Island: How EIL Reconstructs Fragmented L2s into a “Supercomputer”?

XRP's price beginning to show promise above $2.15: Here’s why