RootData Dubai "Integration, Growth, and the New Crypto Cycle" Forum Highlights: Industry Leaders Discuss the New Crypto Cycle

This forum not only brought together cutting-edge insights across multiple dimensions such as investment, infrastructure, data services, and asset issuance, but also clearly conveyed a consensus: transparency, compliant innovation, and user-centric trust building will be the core pillars guiding the crypto industry through cycles and achieving sustainable growth.

On December 2nd, Dubai time, the themed forum "Integration, Growth, and the New Crypto Cycle," jointly organized by RootData, ChainCatcher, and Klickl, and co-sponsored by UXLINK, USDD, 0G, Olaxbt, Oops Panda, Tron, Sunpump, Tencent Cloud, and others, concluded successfully.

At the event, top global industry builders, investment institutions, and opinion leaders such as Cypher Capital co-founder Bill Qian, Babylon Labs co-founder Fisher Yu, Klickl Group founder Michael Zhao, Klickl International CEO Dermot Mayes, Solayer CEO Jeff, 0G Asia-Pacific head JT Song, Olaxbt founder Jason Chan, USDD Communications Director Yvonne Chia, Oops Panda COO Emma, and RootData Chief Product Manager Ye Wang, gathered to discuss the future landscape of the new crypto cycle.

In addition, RootData officially launched the industry's first multidimensional real-time exchange ranking at the event, using "information transparency" as the core evaluation dimension and establishing disclosure standards across seven dimensions, including token unlocks, project events, and team information. This system aims to turn transparency into a quantifiable competitiveness indicator, promoting exchanges to improve information disclosure within a compliance framework. RootData stated it will work with exchanges to improve project information disclosure mechanisms, helping investors make rational decisions and effectively extend the investment lifecycle of crypto retail investors.

I. Highlights Review

Opening Insights: The Next Generation Monetary Operating System

The forum began with a presentation from Klickl. Klickl Group founder Michael Zhao and Klickl International CEO Dermot Mayes delivered keynote speeches, systematically elaborating Klickl's in-depth judgment on the evolution direction of the future global financial system, and proposed their overall vision of an "Operating System for Future Money," providing a framework for the next stage of digital financial infrastructure development.

Michael Zhao pointed out that the core contradiction of today's global financial system has evolved from a local efficiency issue to a structural imbalance. He emphasized: "The future upgrade of finance is no longer about local optimization or single-point innovation, but about moving towards unified, regulatory-compliant, and programmable integrated infrastructure. Only in this way can traditional finance and Web3 truly integrate."

Klickl International CEO Dermot Mayes further pointed out, based on Middle Eastern business practices, that the core competitiveness of digital finance is shifting from technological advantages to the maturity of regulatory systems. "Regulation-Native" will become the basic standard for future financial infrastructure—the architecture needs to be natively compatible with the regulatory logic of different jurisdictions, rather than being supplemented after the fact.

Through the Cycle: Three Core Investment Principles

Subsequently, Cypher Capital co-founder and managing partner Bill Qian delivered a keynote speech titled "What Always Matters, Regardless of the Cycle." He systematically elaborated on three core investment principles that he believes apply in all types of market environments:

Focus on the Leaders: Investment returns follow a power-law distribution rather than a normal distribution. He cited data showing that 72 companies contribute 50% of the total value of 28,114 listed companies; in the crypto market, 63% of historical total market value is contributed by leading assets. Therefore, investors should strive to identify and hold potential "top winners" for the long term.

Embrace Rotation: The market's "Alpha" (excess returns) rotates among different sectors and does not stay permanently in any particular track. Investors need to maintain portfolio diversification and an open mindset to capture emerging opportunities in different cycles.

Utilize Volatility: Volatility is the inevitable price and entry opportunity for achieving long-term high returns. Even Warren Buffett has experienced more than five drawdowns of over 30% in his lifetime. For long-term investors, market downturns should not be seen as risks but as strategic opportunities to increase holdings of quality assets at better prices.

Unlocking Potential: The Key to Breaking Through Bitcoin DeFi

Babylon Labs co-founder Fisher Yu delivered a keynote titled "The Future of Bitcoin DeFi," providing an in-depth analysis of current bottlenecks and solutions. He pointed out that the DeFi market craves Bitcoin liquidity, but less than 1% of Bitcoin participates via cross-chain bridges, mainly because users must trust centralized custodians. He emphasized that the key to breaking through is enabling trustless participation of native Bitcoin.

To this end, Babylon has proposed a "Trustless Bitcoin Vault" solution based on technologies such as BitVM. This solution allows Bitcoin holders to use native BTC as collateral and directly access mainstream DeFi protocols on chains such as Ethereum, including Aave and Morpho, for lending and other operations, without transferring asset custody and without introducing trust risk, thereby unlocking the financial utility of Bitcoin.

Fisher Yu envisions that such infrastructure will give rise to a series of innovative products such as Bitcoin-collateralized lending, derivatives trading, and stablecoins, aiming to activate hundreds of billions of dollars worth of Bitcoin into DeFi and build a truly "crypto economy powered by Bitcoin."

Roundtable Discussion: Exploring Future Industry Trends

In the roundtable session themed "Crypto: Next Big Things," moderated by RootData Chief Product Manager Ye Wang, Solayer CEO Jeff, 0G Asia-Pacific head JT Song, Olaxbt founder Jason Chan, and Oops Panda COO Emma participated together. The guests engaged in a forward-looking and in-depth dialogue from multiple perspectives, including Layer2 scaling, modular blockchains, emerging asset forms, and community development, discussing key tracks and innovation opportunities that may emerge in the next cycle.

Stablecoin Evolution: Exploring the Integration of Yield and Stability

USDD Communications Director Yvonne Chia delivered a speech on the topic "Is Yield-Bearing Stablecoin Truly Possible," systematically explaining the implementation path of yield-bearing stablecoins.

The speech pointed out that traditional stablecoins have long faced the contradiction of "yield and stability cannot be achieved simultaneously." USDD makes it possible for stablecoins to be both stable and yield-bearing through four pillars: building stable sources of yield, expanding application scenarios, flexible infrastructure, and full-chain transparency. Among them, sUSDD supports a dual-layer yield mechanism of "holding yield + liquidity provision" and will integrate lending and other diverse scenarios in the future, continuously expanding the yield boundary.

At the infrastructure level, USDD has completed a protocol upgrade from 1.0 to 2.0, enabling users to mint autonomously via CDP and introducing a Peg Stability Module (PSM) to enhance anti-volatility capability. At the same time, through full on-chain financial transparency, third-party audits, and real-time data dashboards, a verifiable trust system for users is established.

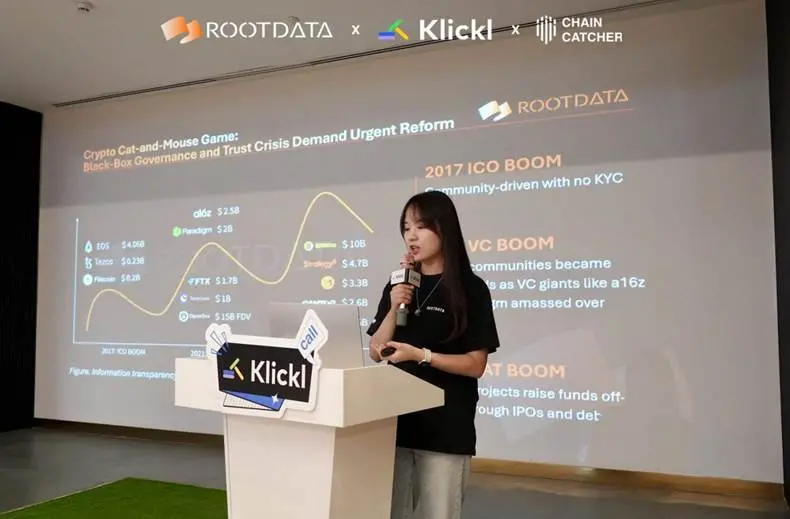

RootData Initiative: Reshaping the Foundation of Trust with Transparency

After the roundtable discussion, RootData Chief Product Manager Ye Wang released the "2025 Cryptocurrency Industry Transparency Insight Report" and announced the official launch of RootData's industry-first multidimensional real-time exchange ranking. The report pointed out that the cryptocurrency industry is facing a systemic trust crisis triggered by the "information black box," and establishing a quantifiable and verifiable transparency system is key to the industry's move toward standardization and maturity.

Ye Wang analyzed that the industry's transparency issue has evolved from the information asymmetry of the ICO era to the current new contradiction of off-chain financing and on-chain data disconnection. Especially at the token economy level, the "slow bleed" style of continuous unlocks and opaque sell-offs suppresses asset value and market confidence.

To this end, RootData's new ranking uses "information transparency" as the core evaluation dimension, establishing disclosure standards across seven dimensions, including token unlocks, project events, and team information. The aim is to break the inertia of "volume-only" ratings, turn transparency into a quantifiable competitiveness indicator, promote exchanges to improve information disclosure within a compliance framework, and ultimately help investors make rational decisions and effectively extend their investment lifecycle.

II. Free Exchange: Collision of Ideas, Lively Atmosphere

The final session of the event was a free exchange. Guests and the audience continued to engage in lively discussions in a relaxed atmosphere, having more direct and in-depth exchanges and collisions of ideas on industry pain points, innovative solutions, and future trends touched upon in the speeches. The on-site interaction was frequent and the atmosphere was enthusiastic, bringing a vibrant conclusion to this content-rich forum.

This forum not only brought together cutting-edge thinking across multiple dimensions such as investment, infrastructure, data services, and asset issuance, but also clearly conveyed a consensus: transparency, compliant innovation, and user-centric trust building will be the core cornerstones for leading the crypto industry through cycles and achieving sustainable growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.

The reason behind the global risk asset "Tuesday rebound": a "major change" at asset management giant Vanguard Group

This conservative giant, which had previously firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to its 8 million clients.