After a 30% decline in Bitcoin, Grayscale: This is a non-cyclical pullback, new highs expected next year

Grayscale believes that the four-year cycle theory is no longer valid, and that bitcoin's price could reach a new all-time high next year.

Grayscale believes that the four-year cycle theory is no longer valid, and bitcoin price is expected to reach a new all-time high next year.

Written by: Grayscale

Translated by: Luffy, Foresight News

TL;TR

- Although bitcoin investors have achieved high returns, they have also experienced multiple significant corrections. The roughly 30% drop since early October is consistent with historical averages, marking the ninth significant pullback in this bull market.

- Grayscale Research believes that bitcoin will not fall into a deep and prolonged cyclical correction, and expects prices to reach new all-time highs next year. Tactically, some indicators point to a short-term bottom, but overall signals remain mixed. Potential positive catalysts before year-end include another Fed rate cut and progress on crypto-related legislation.

- In addition to mainstream cryptocurrencies, privacy-focused crypto assets have performed outstandingly; meanwhile, the first exchange-traded products (ETPs) for XRP and Dogecoin have begun trading.

Historically, investing in bitcoin has usually brought considerable returns, with annualized returns of 35%-75% over the past 3-5 years. However, bitcoin has also experienced multiple significant corrections: its price typically sees at least three drops of more than 10% each year. Like all other assets, bitcoin’s potential investment returns can be seen as compensation for its risk. Long-term HODLers have reaped substantial rewards, but they have also had to endure sometimes severe corrections along the way.

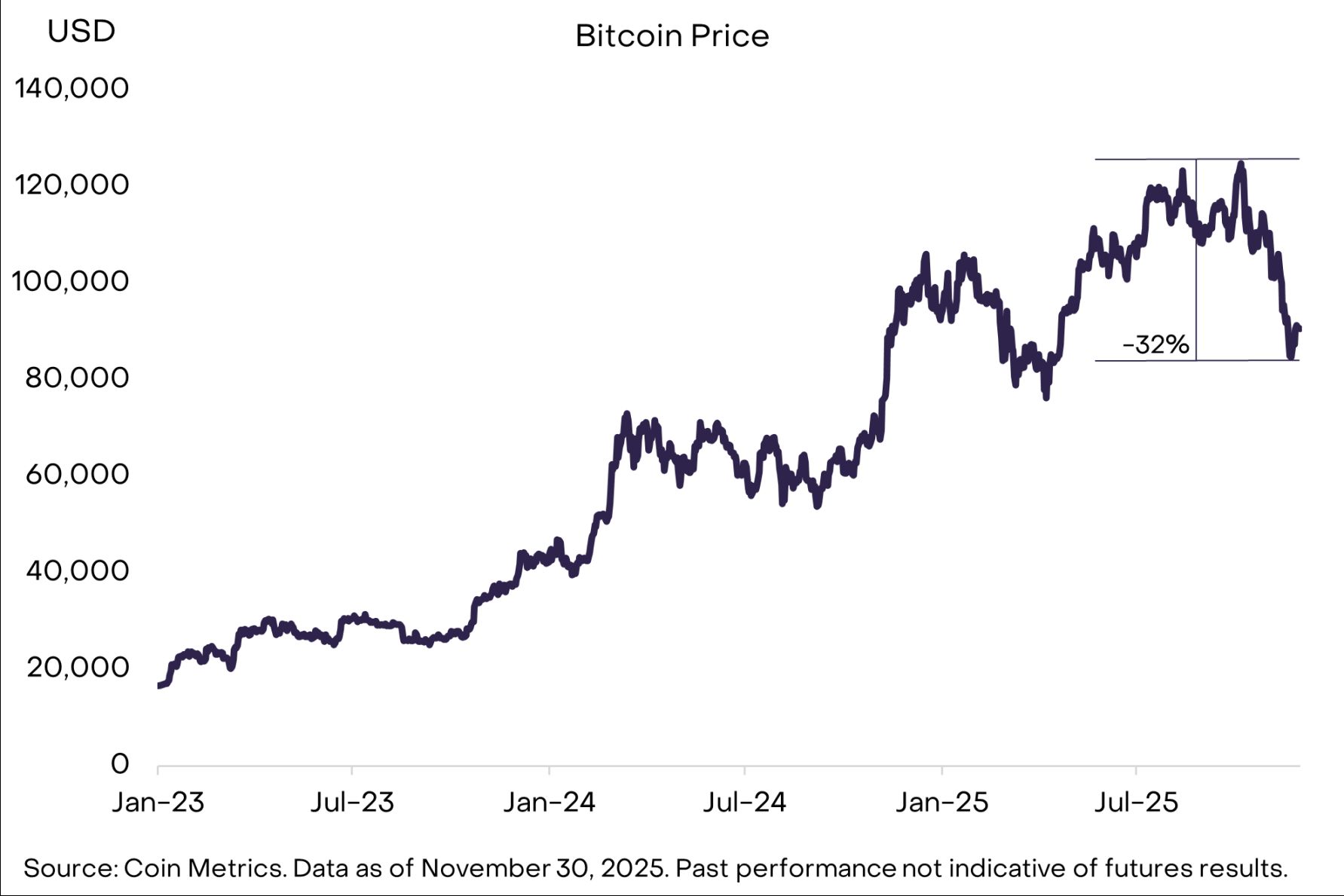

The bitcoin correction that began in early October continued through most of November, with a maximum drop of 32% (see Figure 1). So far, this pullback is close to the historical average. Since 2010, bitcoin has experienced about 50 instances of price drops exceeding 10%, with an average pullback of 30%. Since bitcoin bottomed in November 2022, there have been nine drops of more than 10%. Despite the volatility, this is not unusual in a bitcoin bull market.

Figure 1: This correction is consistent with historical averages

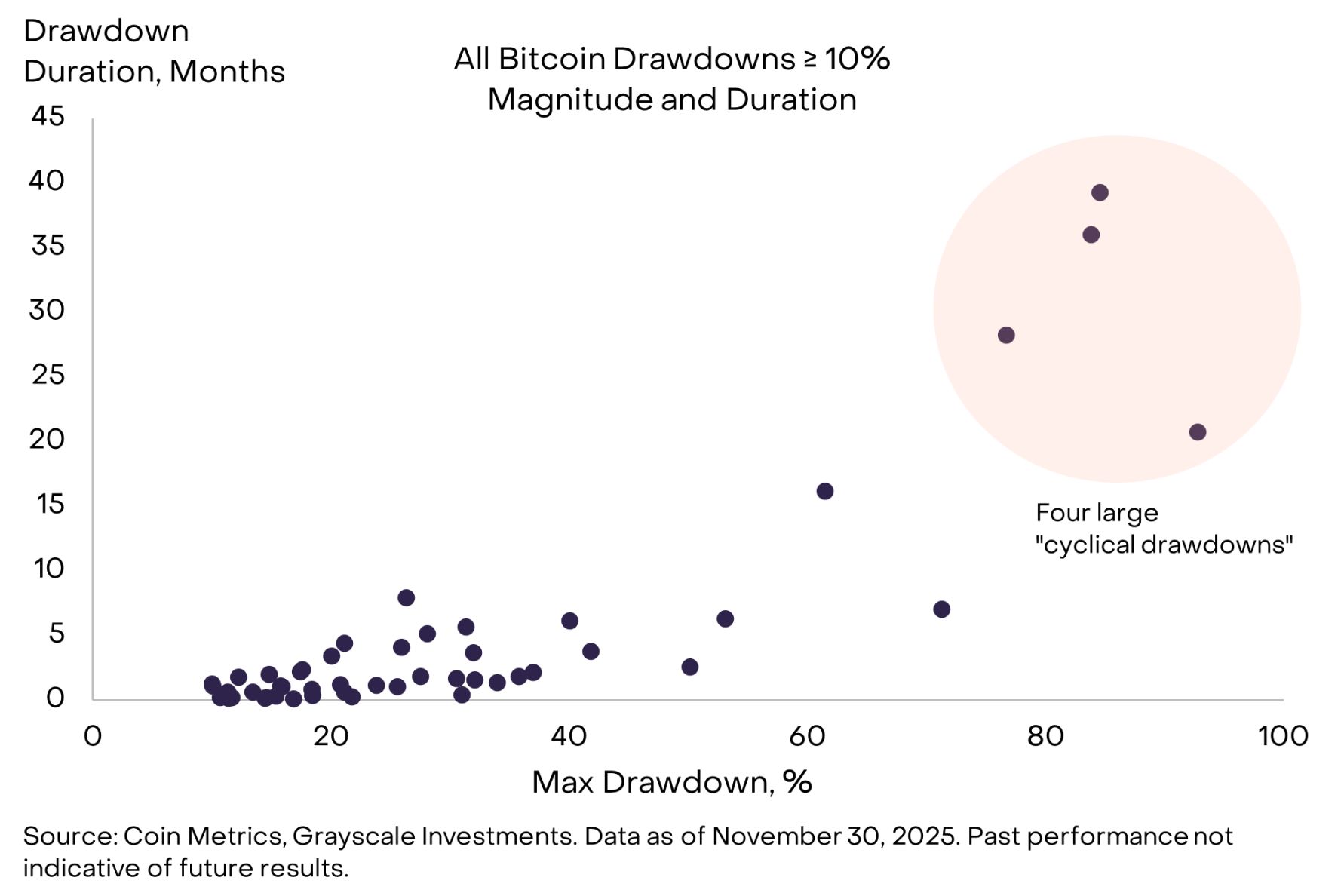

Bitcoin corrections can be measured by both magnitude and duration, and data shows they mainly fall into two categories (see Figure 2): one is "cyclical corrections," characterized by deep and prolonged price declines lasting 2-3 years, historically occurring about every four years; the other is "bull market corrections," with an average drop of 25% and lasting 2-3 months, typically occurring 3-5 times per year.

Figure 2: Bitcoin has experienced four major cyclical corrections

Downplaying the Four-Year Cycle Theory

Bitcoin supply follows a four-year halving cycle, and historically, major cyclical corrections in price have also occurred about every four years. Therefore, many market participants believe that bitcoin prices will also follow a four-year cycle—after three consecutive years of gains, prices will fall next year.

Although the outlook is uncertain, we believe the four-year cycle theory will be proven wrong, and bitcoin prices are likely to reach new all-time highs next year. The reasons are as follows: First, unlike previous cycles, this bull market has not seen the parabolic price surges that often signal overbought conditions (see Figure 3); second, the market structure for bitcoin has changed, with new capital mainly flowing in through exchange-traded products (ETPs) and digital asset treasuries (DATs), rather than retail investors; finally, as discussed below, the overall macro environment remains favorable for bitcoin.

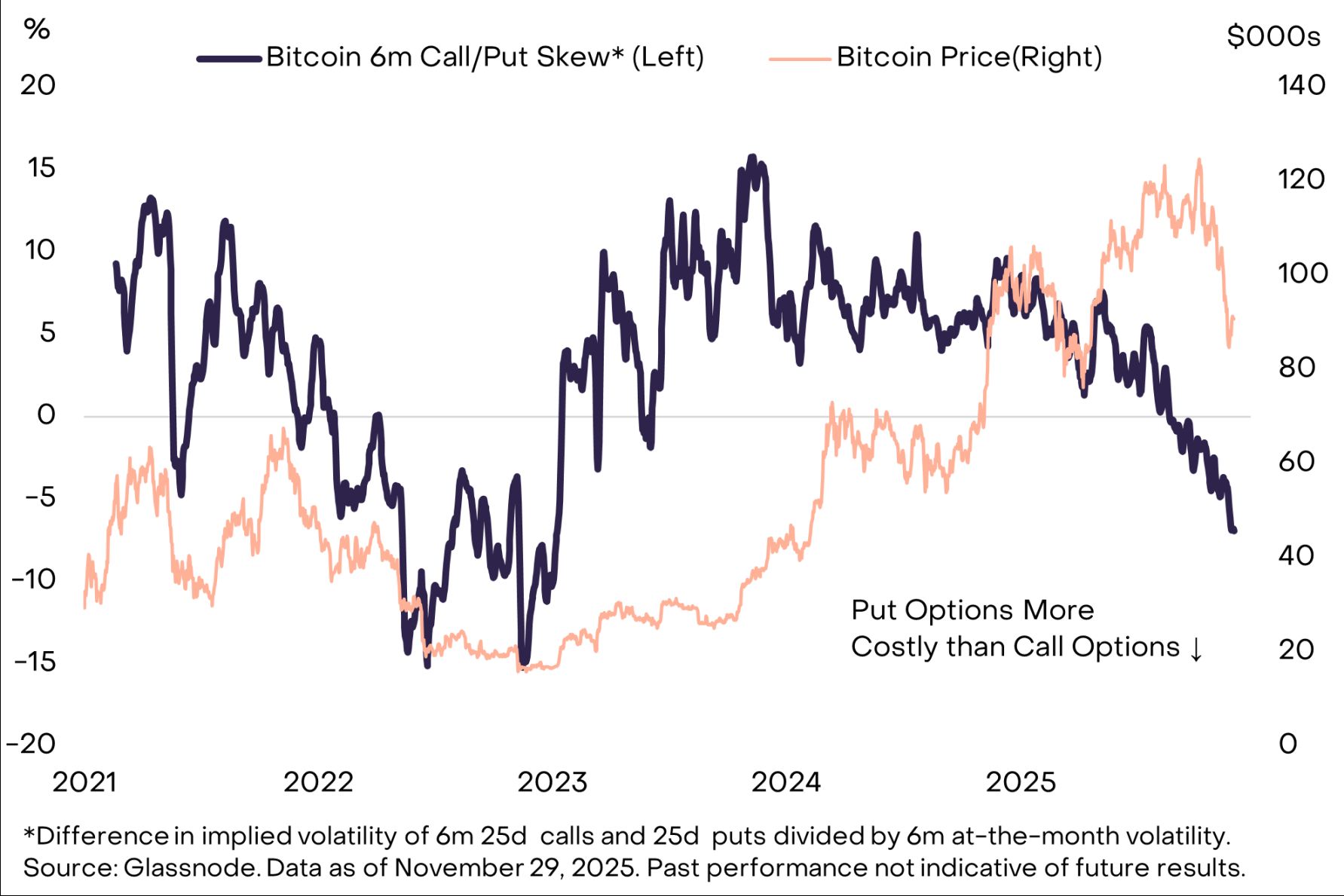

Figure 3: No parabolic price surge in this cycle

There are already some signs that bitcoin and other crypto assets may have bottomed out. For example, bitcoin put option skew is at extremely high levels (note: option skew measures the asymmetry of the implied volatility curve, reflecting differences in market expectations for future price movements), especially for 3-month and 6-month options, indicating that investors have widely hedged downside risk (see Figure 4); the largest digital asset treasuries are trading at prices below the value of their crypto assets on their balance sheets (i.e., their "modified net asset values" mNAVs are below 1.0), suggesting light speculative positioning (often a precursor to recovery).

Figure 4: High put option skew indicates downside risk is hedged

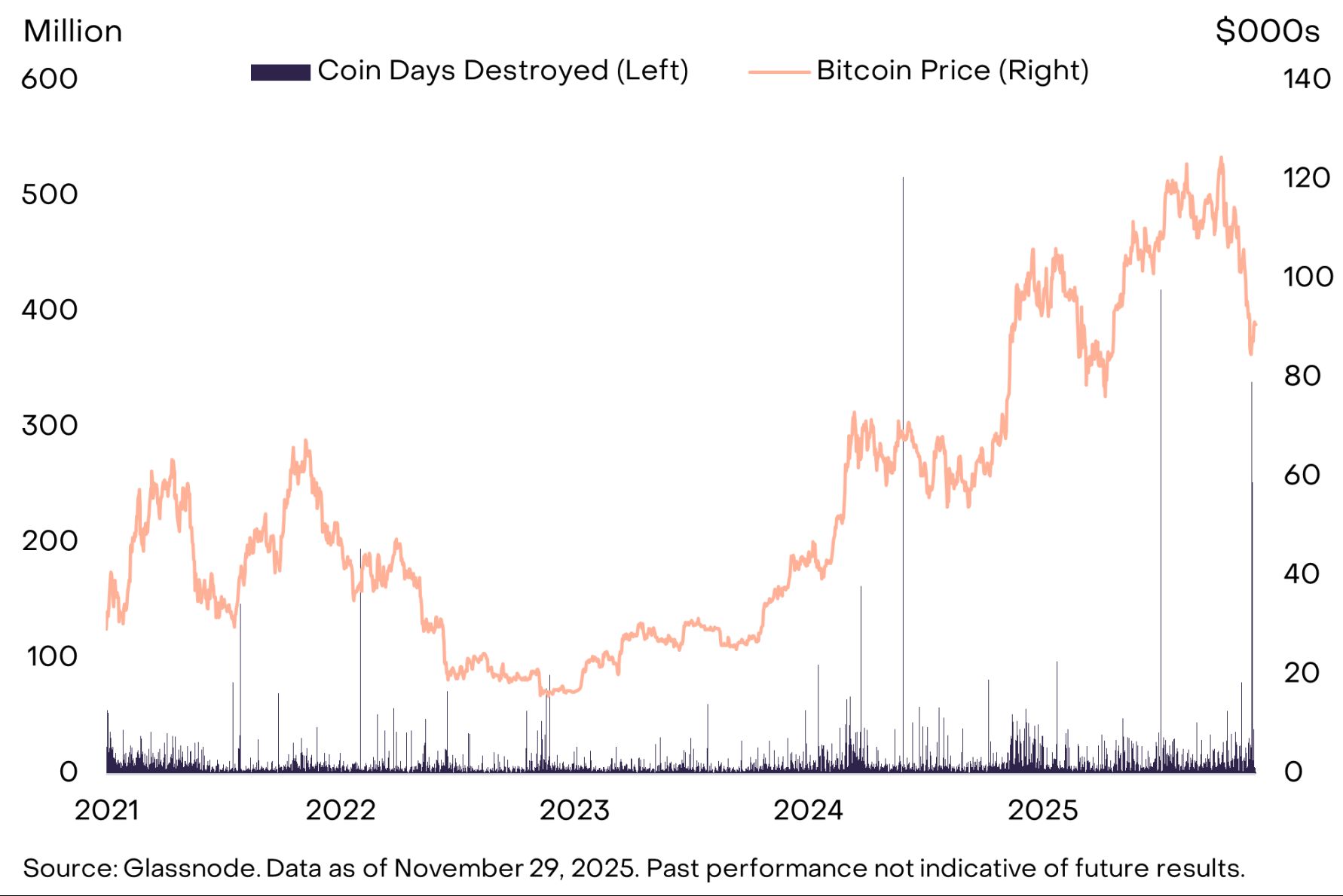

Meanwhile, several capital flow indicators show that demand remains weak: November futures open interest continued to decline, ETP flows only turned positive at the end of the month, and there may have been more early bitcoin holders selling. For the latter, on-chain data shows that at the end of November, "Coin Days Destroyed (CDD)" surged again (see Figure 5) (note: CDD is calculated as the number of bitcoins transacted multiplied by the number of days since they were last moved). Therefore, when a large number of long-dormant coins are moved at once, CDD rises. Similar to the CDD spike in July, the increase at the end of November may indicate that large, long-term holders are selling bitcoin. For the short-term outlook, only when these capital flow indicators (futures open interest, ETP net inflows, early holder selling) improve can investors be more confident that bitcoin has bottomed.

Figure 5: More long-dormant bitcoins are moving on-chain

Privacy Assets Stand Out

According to our Crypto Sectors index, bitcoin’s decline in November was moderate compared to other investable crypto assets. The best-performing market sector was the "currency crypto assets sector" (see Figure 6), which rose for the month excluding bitcoin. The gains were mainly driven by several privacy-focused cryptocurrencies: Zcash (+8%), Monero (+30%), and Decred (+40%). There has also been widespread attention to privacy technology in the Ethereum ecosystem: Vitalik Buterin announced a privacy framework at Devcon, and privacy-focused Ethereum Layer 2 network Aztec launched its Ignition Chain. As discussed in our previous monthly report, we believe that without privacy elements, blockchain technology cannot fully realize its potential.

Figure 6: Non-bitcoin currency assets performed strongly in November

The worst-performing market sector was the "artificial intelligence (AI) crypto assets sector," which fell 25% for the month. Despite weak prices, the sector saw several significant fundamental positive developments.

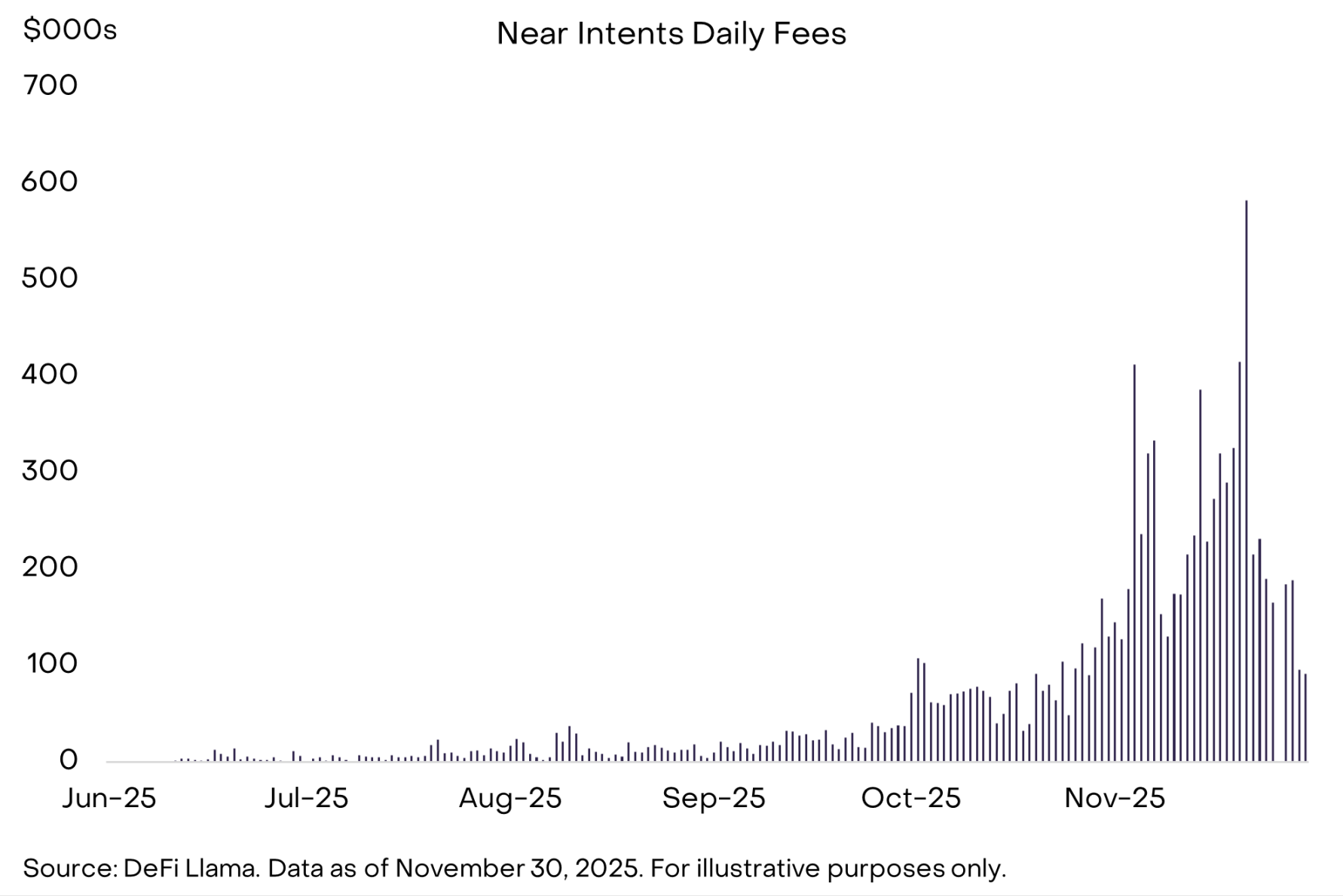

Specifically, as the second-largest asset by market cap in the AI crypto assets sector, Near’s Near Intents product has seen continued adoption (see Figure 7). Near Intents connects users’ desired outcomes with a "network of solution providers," who compete to execute the optimal cross-chain implementation, eliminating cross-chain complexity. This feature has improved the utility of Zcash—users can privately spend ZEC, while recipients can receive assets like Ethereum or USDC on other chains. Although still in the early stages, we believe this integration could play an important role in driving privacy-protected payments across the crypto ecosystem.

Figure 7: Near’s Intents product finds market fit

Additionally, developers’ attention has shifted to the x402 protocol. This is a new open payment protocol developed by Coinbase that enables AI agents to drive stablecoin payments directly over the internet. The payment standard requires no account creation, manual approval steps, or custodial payment processor fees, enabling frictionless, autonomous microtransactions executed by AI agents, with blockchain as the settlement layer. Recently, x402 adoption has accelerated, with daily transaction volume rising from less than 50,000 in mid-October to over 2 million by the end of November.

Finally, thanks to new universal listing standards approved by the US Securities and Exchange Commission (SEC) in September, the crypto ETP market continues to expand. Last month, issuers launched ETP products for XRP and Dogecoin, and more single-token crypto ETPs are expected to be listed by year-end. According to Bloomberg, there are now 124 crypto-related ETPs listed in the US, with total assets under management of $145 billions.

Rate Cuts and Bipartisan Legislation

In many ways, 2025 is shaping up to be a milestone year for the crypto asset industry. Most importantly, regulatory clarity has driven a wave of institutional investment, which could form the foundation for sustained industry growth in the coming years. However, valuations have not kept pace with long-term fundamental improvements: our market cap-weighted Crypto Sectors index is down 8% year-to-date. Although the crypto market has been volatile in 2025, fundamentals and valuations will eventually align, and we remain optimistic about the outlook for the end of the year and 2026.

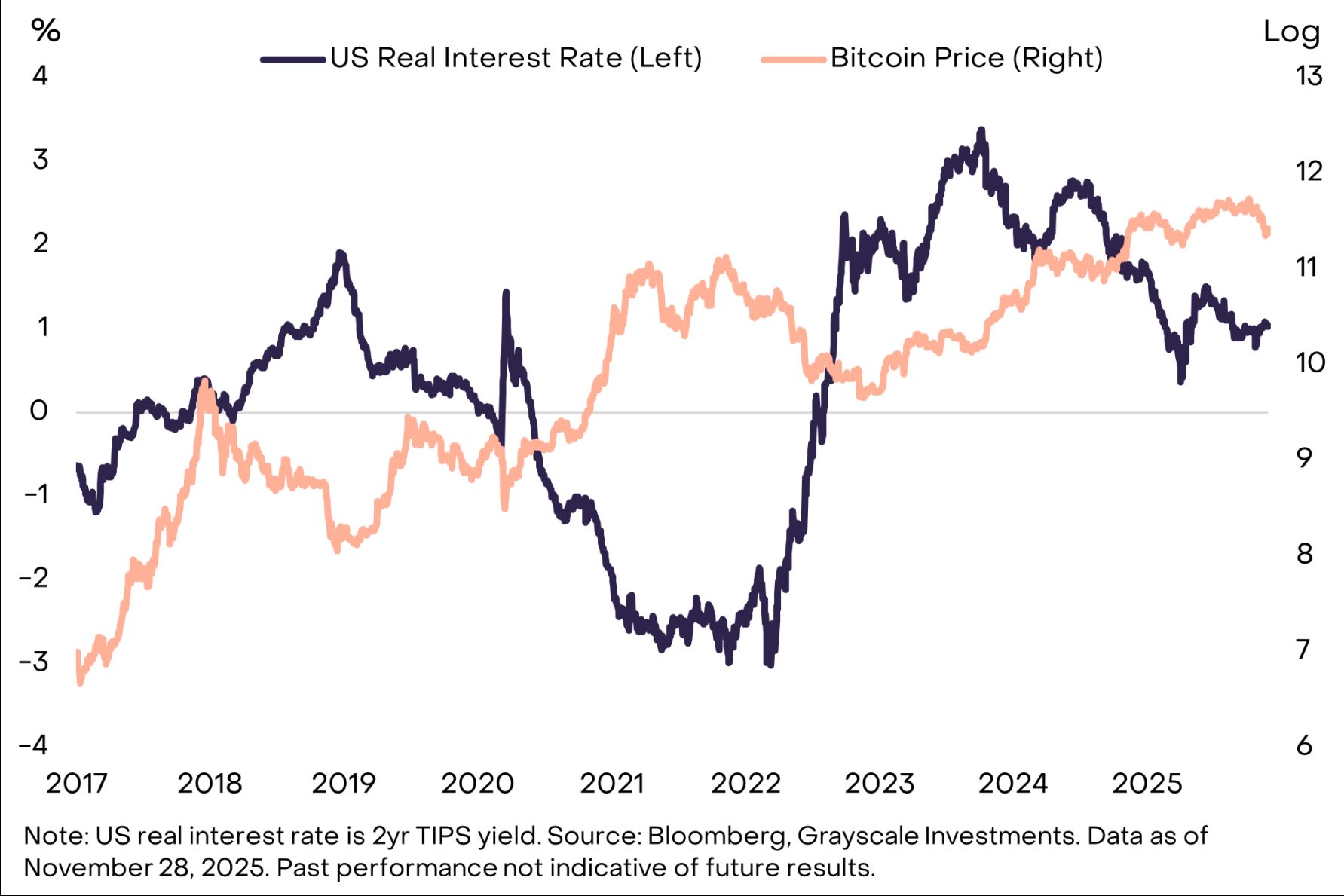

In the short term, the key variable may be whether the Fed cuts rates at its December 10 meeting and its guidance for next year’s policy rates. Recent media reports indicate that National Economic Council Director Kevin Hassett is a leading candidate to succeed Fed Chair Powell. Hassett may support lowering policy rates: in a September interview with CNBC, he said the Fed’s 25-basis-point rate cut was a "good first step" toward "substantial rate cuts." All else being equal, a decline in real interest rates typically has a negative impact on the value of the US dollar and benefits assets that compete with the dollar, including physical gold and some cryptocurrencies (see Figure 8).

Figure 8: Fed rate cuts may support bitcoin prices

Another potential catalyst may be the continued bipartisan efforts on crypto market structure legislation. The Senate Agriculture Committee (which oversees the Commodity Futures Trading Commission) released a bipartisan draft bill in November. If cryptocurrencies can maintain bipartisan consensus and not become a partisan issue in the midterm elections, the market structure bill could make further progress next year, potentially driving more institutional investment into the industry and ultimately pushing up valuations. While we are optimistic about the short-term market outlook, truly substantial returns may come from long-term holding.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Volatility Weekly Review (November 17 - December 1)

Key metrics (from 4:00 PM HKT on November 17 to 4:00 PM HKT on December 1): BTC/USD: -9.6% (...

When all GameFi tokens have dropped out of the TOP 100, can COC reignite the narrative with a Bitcoin economic model?

On November 27, $COC mining will be launched. The opportunity to mine the first block won't wait for anyone.

Ethereum's Next Decade: From "Verifiable Computer" to "Internet Property Rights"

Fede, the founder of LambdaClass, provides an in-depth explanation of anti-fragility, the 1 Gigagas scaling goal, and the vision for Lean Ethereum.

The reason behind the global risk asset "Tuesday rebound": a "major change" at asset management giant Vanguard Group

This conservative giant, which had previously firmly resisted crypto assets, has finally compromised and officially opened bitcoin ETF trading access to its 8 million clients.