2026: The Year When RWAs Will Become the Standard for Global Payments

The boundary between traditional finance and blockchain is fading. In 2025, over 1% of the US money supply circulates as stablecoins, while RWAs attract billions of dollars in institutional investments. A transformation promising to redefine the global economy and crypto in 2026.

In Brief

- RWAs (real world assets tokenized) will revolutionize finance in 2026, becoming the standard for global payments.

- Financial institutions are massively adopting RWAs for their stable yields, liquidity, and transparency.

- Ethereum dominates the RWA and yield stablecoin market, with projects like USDY (Ondo) and sDAI (MakerDAO).

RWA: When Blockchain Charms Wall Street

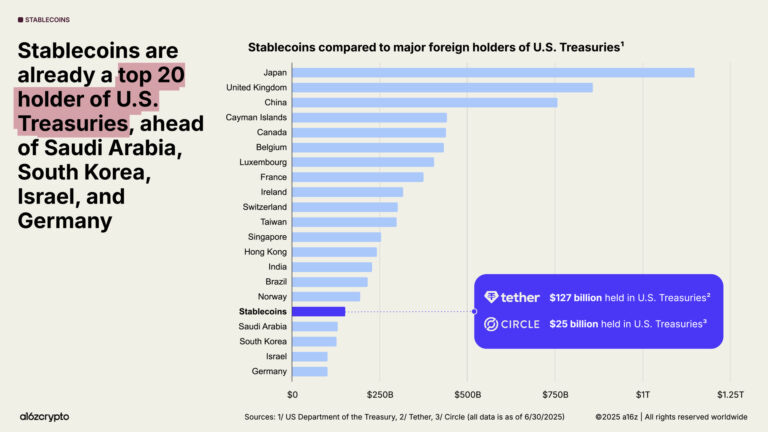

Tokenized government bonds, or “tokenized Treasuries”, are sovereign bonds (such as US Treasury bonds) converted into digital assets on a blockchain (RWA). This market is experiencing exponential growth, driven by institutional adoption. Indeed, stablecoins represent 1% of the US money supply and have become the 17th largest holder of Treasuries in the United States with over 150 billion dollars invested in 2025.

The position of stablecoins in the United States.

The position of stablecoins in the United States.

Giants like BlackRock, with its BUIDL fund, or Fidelity, via its OnChain project, are leading this transition. These institutions see it as a way to optimize their collateral management and reduce costs related to clearinghouses.

However, challenges remain, such as regulatory fragmentation between the US and Europe, or concentration of reserves with a few issuers. Despite this, projections remain ambitious, with the tokenized real world assets market estimated at 18.9 trillion dollars by 2033.

Next-Generation Stablecoins: The Programmable Money of Tomorrow

Stablecoins no longer just replicate the dollar. In 2025, assets like USDe or USDY, backed by tokenized government bonds, offer high annual yields. These programmable stablecoins attract institutions: 49% of financial companies already use them for cross-border payments or cash management. As Ignacio Aguirre, CMO of Bitget, highlights:

Yield-bearing stablecoins are emerging as “programmable digital dollars,” promoting wider blockchain adoption and financial innovation, while offering a low-risk, high-return alternative.

Their advantage? Reduce transaction costs by 50 to 80%, while offering permanent liquidity. Additionally, transaction volumes exceeded 19.4 billion dollars this year, illustrating their growing adoption. The regulatory framework, notably the GENIUS Act , played a key role in legitimizing these assets! Allowing players like Circle or JPMorgan to develop innovative solutions.

Ethereum: The Playground of Tokenized Assets

Ethereum dominates the tokenized asset ecosystem, with numerous tokenized government bonds and yield stablecoins issued on its blockchain. Projects like Ondo Finance, with its USDY stablecoin backed by government bonds, or MakerDAO, with its sDAI generating significant annual yield, illustrate this dynamic.

However, challenges persist, notably scalability. Layer 2 solutions, like Arbitrum or Optimism, reduce costs, but competition from blockchains like Solana is intensifying. Nevertheless, Ethereum remains the undisputed leader, with a projected 75% market share of RWAs by 2026.

RWAs and next-generation stablecoins are no longer niche concepts. Driven by institutional demand and clearer regulatory frameworks, these innovations are redefining the rules of finance. The question is no longer whether traditional assets will migrate to blockchain, but when your portfolio will include them. So, would you be ready to incorporate these assets into your crypto investment strategy ?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin’s Sharp Decline: What Sparks Anxiety During a Bullish Market?

- Bitcoin's 2025 bull market collapsed 30% to $83,824 amid Fed policy shifts and liquidity contractions, defying typical risk-on dynamics. - A 0.72 correlation to Nasdaq 100 and $19B leveraged liquidation event exposed Bitcoin's vulnerability to macro risks and institutional sentiment shifts. - AI-driven algorithms and algorithmic feedback loops amplified volatility, with Treasury yields and dollar strength triggering cascading sales. - Market psychology metrics (Fear & Greed Index, stablecoin outflows) an

Infrastructure Initiatives Fuel Real Estate Growth in Upstate New York: The Impact of Local Government Projects on Industrial Market Transformation

- Webster , NY leveraged a $9.8M FAST NY grant to transform a 300-acre Xerox brownfield into a high-tech industrial hub, slashing vacancy rates to 2%. - Infrastructure upgrades attracted food processing and semiconductor firms , with a $650M fairlife® dairy plant expected to create 250 jobs by 2025. - Strategic site readiness and pre-leased industrial space at the NEAT site reduced investor risk, driving 10.1% residential property value growth since 2023. - The model highlights underpenetrated markets' pot

ZEC Rises 4.81% After Major Investor Increases Long Position with 10x Leverage

- ZEC surged 4.81% in 24 hours to $330.5 amid a whale's 10x leveraged long position on HyperLiquid targeting $333.46. - The whale also holds 20x ETH and 5x DYDX longs but faces $2.7M total losses, highlighting risks of leveraged trading during crypto volatility. - Grayscale's ZEC ETF filing and Chainlink's ETF launch signal growing institutional interest in altcoins, potentially boosting ZEC liquidity and demand. - ZEC's 482.71% annual gain contrasts with 27.45% weekly drop, reflecting its cyclical nature

Amazon takes on rivals by introducing on-site Nvidia ‘AI Factories’