Solana News Update: SEC's Crypto ETF Disagreement: Bitcoin Sees $1.6B Outflow, Solana Attracts $26M

- SEC's regulatory decisions drive divergent crypto ETF flows: Bitcoin ETFs lost $1.6B while Solana ETFs gained $26.2M in November 2025. - Traditional firms like Qualigen (now AIxCrypto) and Coincheck pivot to blockchain, signaling growing institutional adoption of decentralized technologies. - South Korea's Dunamu saw 300% Q3 profit growth linked to U.S. crypto regulatory progress, while Harvard invested $442M in Bitcoin ETFs. - SEC's focus on utility-driven crypto projects may accelerate ETF approvals fo

The U.S. Securities and Exchange Commission (SEC) has become a central force in directing the regulatory framework for crypto exchange-traded funds (ETFs), as recent shifts in the market reveal both hurdles and prospects for the industry. In November 2025,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Blockchain Enables Investors to Acquire Stakes in Trump’s Maldives Resort

- Trump Organization partners with Saudi's Dar Global to tokenize a $4T-aiming Maldives resort via blockchain, enabling early-stage digital share purchases. - Project features 80 luxury villas near Malé, blending real estate innovation with Saudi Vision 2030's digital transformation goals and blockchain-driven financial systems. - Saudi's blockchain expansion includes CBDC frameworks, Islamic finance experiments, and 4,000+ registered blockchain firms, positioning it as a regional tech leader. - Initiative

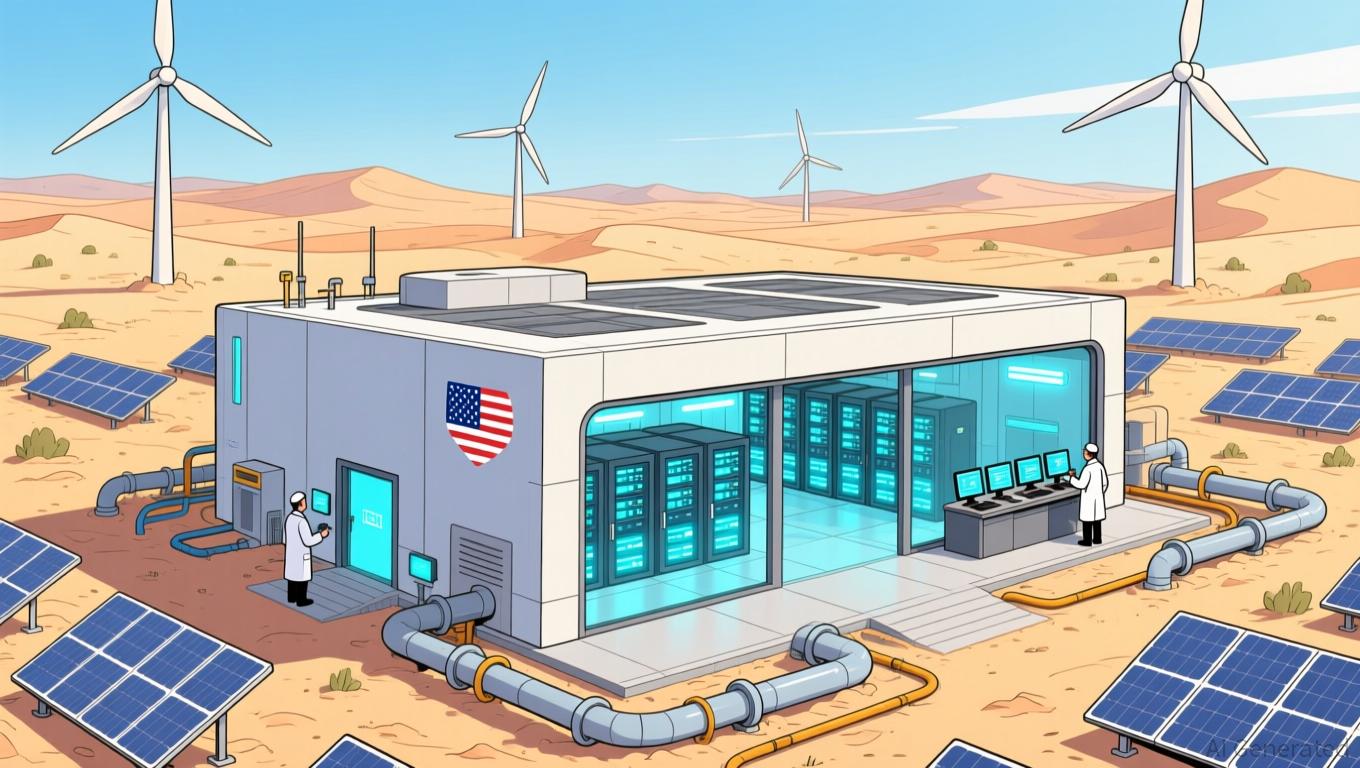

U.S. Technology Leaders Pursue Saudi AI Partnerships as Policy Discussions Continue at Home

- Nvidia's Nov. 19 earnings report, projected to show 56.4% revenue growth to $54.9B, will gauge the AI sector's health amid valuation concerns and market volatility. - Nasdaq-100 futures rose 0.6% as investors anticipate results that could either boost AI-driven stocks or trigger a sell-off, compounded by delayed data and Fed policy uncertainty. - Repeated mentions of Saudi Arabia's Humain AI partnership highlight Nvidia's strategic alignment with sovereign AI initiatives, reflecting global competition fo

Bitcoin Updates: Bitcoin ETFs See $2.6B Outflow While Harvard and Saylor Increase Investments

- Bitcoin ETFs lost $2.6B in November as institutional outflows accelerated amid macroeconomic uncertainty and price declines below $100,000. - Harvard and MicroStrategy bucked the trend by increasing Bitcoin holdings, while derivatives liquidations and risk limits worsened the selloff. - Regulatory frameworks like the GENIUS Act and crypto-collateralized loans emerged to stabilize markets during the 25% drawdown from October highs. - Analysts compare the pullback to historical volatility patterns, noting

PENGU Price Forecast Soars Following Enigmatic Smart Contract Update

- PENGU's 12.8% price surge in late November 2025 defies broader bearish trends despite Bitcoin's 4.3% rally and altcoin rebound. - Smart contract upgrades and opaque governance raise risks, while $2B token movements from team wallets signal potential dumping concerns. - Regulatory pressures (GENIUS Act, MiCA) and DeFi vulnerabilities (e.g., $128M Balancer exploit) amplify volatility amid fragmented on-chain activity. - Technical indicators (OBV, MACD) and whale-driven speculation highlight short-term mome