U.S. Technology Leaders Pursue Saudi AI Partnerships as Policy Discussions Continue at Home

- Nvidia's Nov. 19 earnings report, projected to show 56.4% revenue growth to $54.9B, will gauge the AI sector's health amid valuation concerns and market volatility. - Nasdaq-100 futures rose 0.6% as investors anticipate results that could either boost AI-driven stocks or trigger a sell-off, compounded by delayed data and Fed policy uncertainty. - Repeated mentions of Saudi Arabia's Humain AI partnership highlight Nvidia's strategic alignment with sovereign AI initiatives, reflecting global competition fo

Nvidia Corp. (NVDA) is preparing to announce a crucial earnings report on Nov. 19, drawing intense attention from both investors and analysts as the AI chip giant navigates a turbulent market environment. The upcoming report,

There is a sense of anticipation in the U.S. stock market, with futures ticking upward ahead of the earnings release. Nasdaq-100 futures

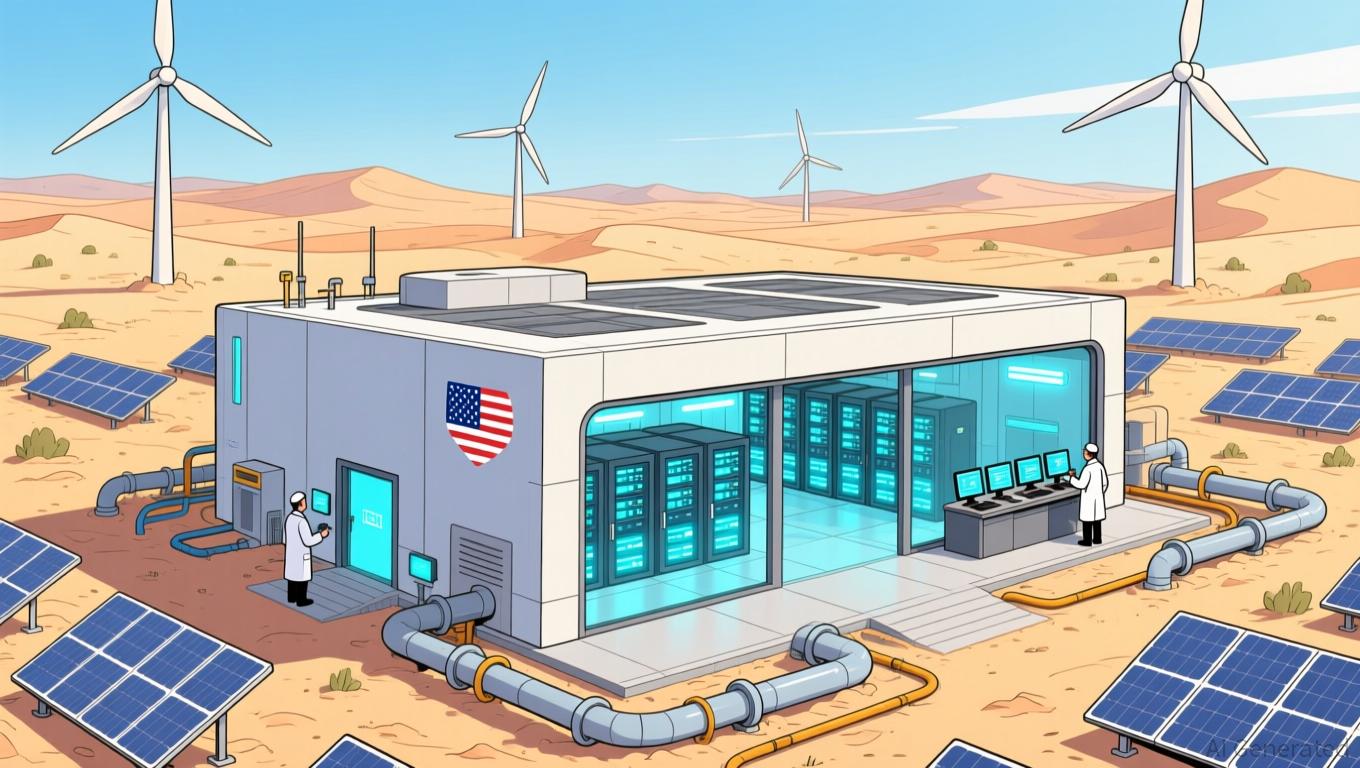

The geopolitical implications are significant. As the U.S. works to regulate the distribution of advanced AI technologies, Saudi Arabia’s Humain, backed by the country’s sovereign wealth fund, is emerging as a major contender in the global AI landscape.

As Nvidia’s earnings approach, the dynamic between business strategy, regulatory developments, and international AI rivalry is set to influence the sector’s direction. Strong results may bolster faith in the AI surge, while disappointing numbers could prompt a move toward more defensive industries. For now, attention is firmly fixed on the San Jose, California-based firm, whose ability to steer through these complex challenges will be a true test of its leadership in a rapidly evolving tech world.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Yen’s Decline: Japan’s Stimulus and BOJ Face Off Grows as Fed Pauses

- Japanese yen hit 10-month low vs. dollar at 157.36 amid Fed policy uncertainty and ¥25 trillion stimulus plan. - BOJ's rate-hike hesitation and weak Q3 Japanese data accelerated yen's decline despite record bond yields. - Fed's divided stance reduced December cut odds to 43%, pushing dollar index to 99.545 as hawkish signals emerged. - Japanese officials warn of "one-sided" yen depreciation but intervention unlikely below ¥156 level. - Analysts predict dollar/yen consolidation near 157.36, with yen under

Bitcoin News Update: How Bitcoin is Transforming Banking—Institutions Tap into the Power of a Versatile Asset

- Anchorage Digital and Mezo partner to offer institutional-grade Bitcoin solutions, enabling yield generation and liquidity via veBTC and MUSD stablecoin. - HTX DAO's 42.2% Q1-Q3 2025 token burns (36.22T $HTX) reinforce Bitcoin's scarcity, aligning deflationary strategy with user governance to boost value retention. - Coinbase expands Bitcoin accessibility in Brazil through fee-free DEX trading, leveraging Uniswap/Aerodrome integration to align with "everything app" vision. - Despite $97,000 Bitcoin price

Three Reasons Why Bitcoin Will Lead a Major Crypto Bull Rally In The Coming Weeks

Bitcoin Updates: Bitcoin ETFs See Outflows as Solana Picks Up Speed

- Bitcoin ETFs saw $75.4M net inflow led by BNY Mellon's IBIT , contrasting Ethereum ETFs' $37.4M outflow. - Abu Dhabi's ADIC tripled BlackRock IBIT holdings to $520M amid Bitcoin's 6-month price drop below $100K. - Solana ETFs gained $48.5M in 16-day streak, while BlackRock's IBIT faced record $523M outflow on Nov 19. - Analysts cite "mini bear market" from fading ETF inflows and weak macro signals, but note Solana staking and policy clarity as potential rebounds.