In the turbulent waves of the cryptocurrency market, every move by the whales tugs at the heartstrings of countless investors. The market was particularly volatile in October, with three highly watched crypto whales—the "100% Win Rate Whale," "Brother Machi," and the "10.11 Insider Whale"—each deploying drastically different strategies, creating legends of both fortune and tragedy. This article comprehensively reviews the trading trajectories, profit and loss situations, and market impacts of these three whales in October.

1. 100% Win Rate Whale: Myth Continues or Bubble Bursts?

Trading Trajectory and Profit/Loss Status

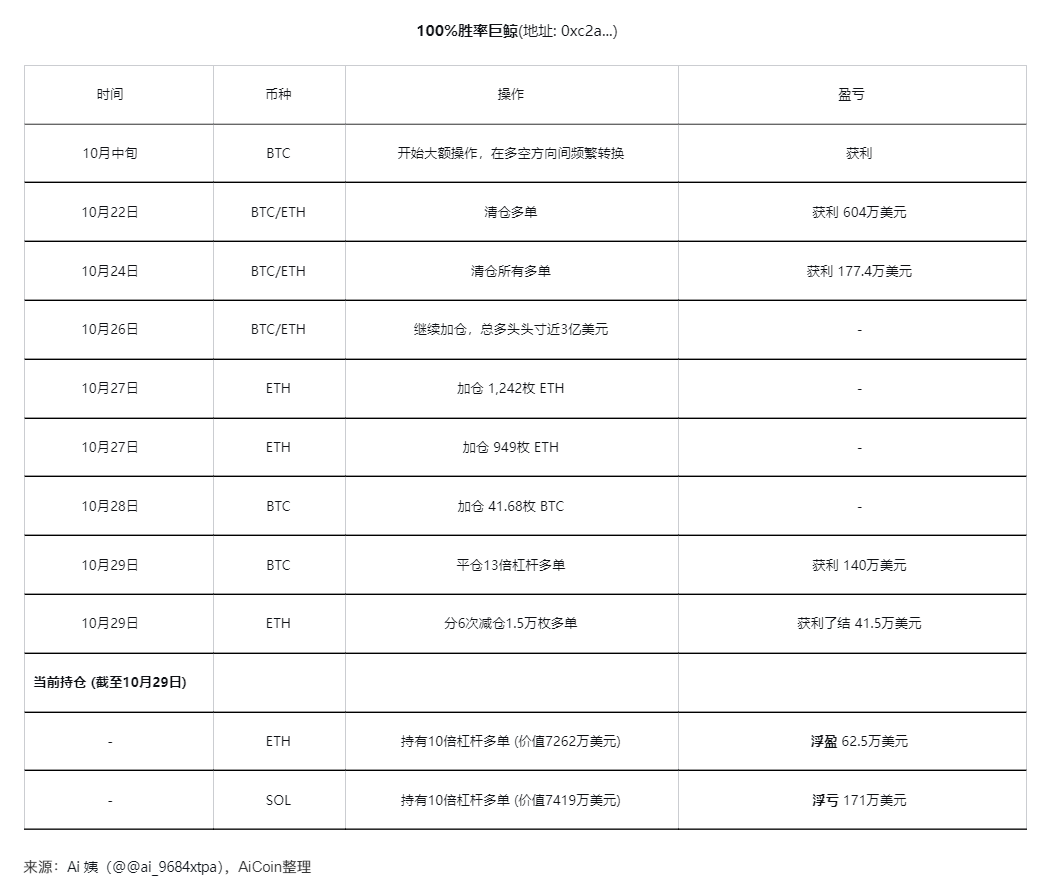

The whale labeled by the market as the "100% Win Rate Whale" (address 0xc2a...5f2) continued his precise operations in October, but inevitably faced the test of market volatility.

● In mid-October, this whale began large-scale operations, flexibly switching between long and short positions on BTC. On October 22, he closed all long positions, making a profit of $6.04 million; then on October 24, he again closed all long positions, profiting $1.774 million.

● From October 26 to 28, the whale continued to increase positions, with total long positions once approaching $300 million. On October 28, he added 41.68 BTC to his position, bringing the total position value to $237 million.

● On October 29, this whale made a key strategic adjustment, closing his 13x leveraged BTC long position for a profit of $1.4 million. At the same time, he reduced his 15,000 ETH long position in six transactions, realizing about $415,000 in profit.

Current Positions and Risk Exposure

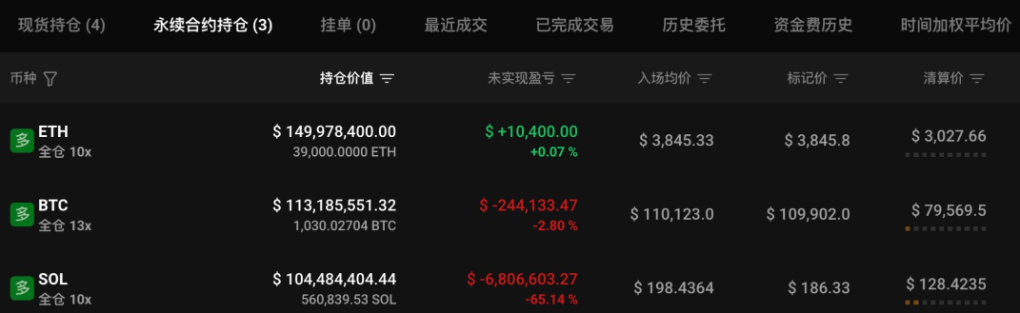

As of October 29, this whale's positions were as follows:

● ETH long position (10x leverage): value $72.62 million, unrealized profit $10,000

● SOL long position (10x leverage): value $74.19 million, unrealized loss $6.81 million

It is worth noting that although the BTC long position has been closed, the whale shows a different attitude toward altcoin positions. The ETH long position, though retraced from its peak, remains profitable; the SOL long position, despite an unrealized loss of $6.81 million, is still being held. This "selective holding" reflects a differentiated investment logic for different types of digital assets.

Chain Reactions and Market Impact

The whale's position adjustments triggered chain reactions in the market. On one hand, a large number of copy-trading retail investors found themselves in trouble. On-chain analyst @ai_9684xtpa monitored that a trader copying this whale closed out within less than 24 hours, incurring a cumulative loss of $1.061 million. On the other hand, a "counterparty" address targeting the whale's trades achieved an unrealized profit of up to $2.68 million in the same period by precisely shorting in the opposite direction.

2. Brother Machi: Painful Lessons from High Leverage Strategies

Massive Losses

Well-known crypto investor "Brother Machi" (Jeffrey Huang) suffered a major setback in October, with his high-leverage long positions taking a significant hit.

● In the early hours of October 10, Brother Machi closed all XPL, PUMP, and ASTER long positions, with cumulative losses reaching $21.53 million. Hours later, he reopened a 5x XPL long position on Hyperliquid, starting with 500,000 tokens (about $375,000), then increasing to 2.5 million tokens ($1.83 million), and also reopened a 3x ASTER long position (500,000 tokens, about $795,000).

● On the morning of October 11, his ETH long position was liquidated, losing about $12.16 million in just two hours, bringing his total monthly loss to $29.92 million, mainly concentrated in XPL and ETH long positions. After closing out, he immediately increased his positions again, opening a 25x ETH long (2,000 tokens, worth $7.63 million) and a 10x HYPE long (60,000 tokens, worth $2.33 million), with both positions totaling $9.968 million, both in an unrealized loss state.

Significant Shrinkage of Account Assets

● According to on-chain analyst Ai Yi (@ai_9684ptpa), as of October 15, Brother Machi's account had a 30-day cumulative loss of $53.62 million (as of September 19, his account was still up $44 million).

● On October 16, Brother Machi was liquidated in succession, reducing his position by 1,590 ETH in 11 hours, losing $246,000, with only 585 ETH ($2.33 million) left. His account balance dropped to $32,800, with cumulative losses turning from a peak profit of $43.64 million to a net loss of $13 million.

Strategy Adjustment and Recent Performance

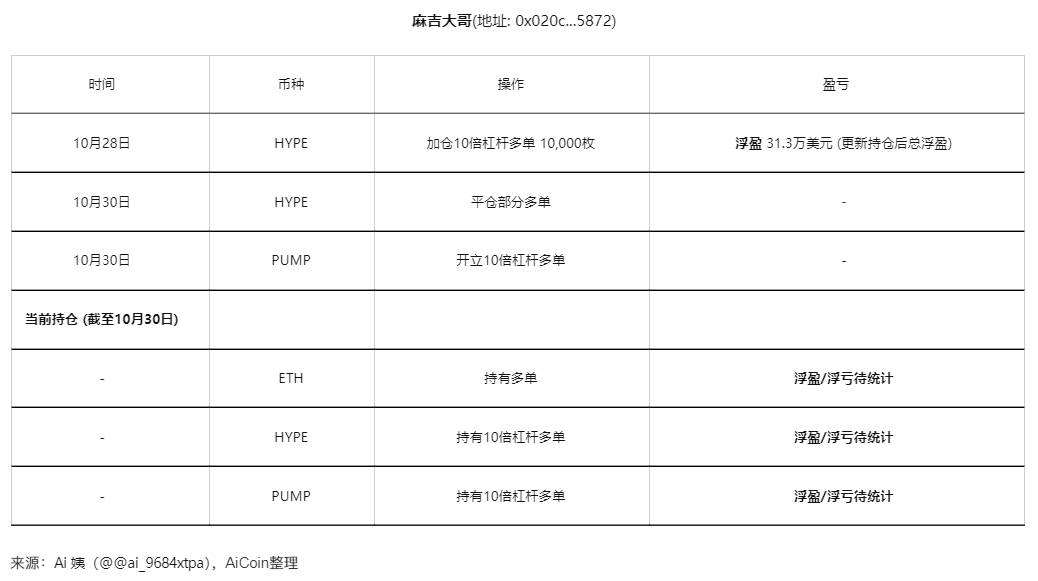

● After being liquidated, Brother Machi changed his trading strategy. After losing $12.56 million in principal on October 11, he switched to opening smaller positions, transferring a total of $1.85 million to Hyperliquid, with the current address holding only $1.13 million, including about $680,000 in unrealized profit from his ETH and HYPE long positions.

● On October 28, Brother Machi added 10,000 HYPE long positions, bringing his HYPE (10x leverage) long position to 60,000 tokens, with a position size of $2.83 million and an unrealized profit of $313,000 (+110%).

3. 10.11 Insider Whale: The Market Mystery of Precision Shorting

Mysterious Shorting Operation

● On October 11, the cryptocurrency market experienced the largest liquidation day in history, with total liquidations reaching $19.133 billion and 1,618,240 traders liquidated. Amid this plunge, a whale profited handsomely from precise shorting, attracting widespread market attention.

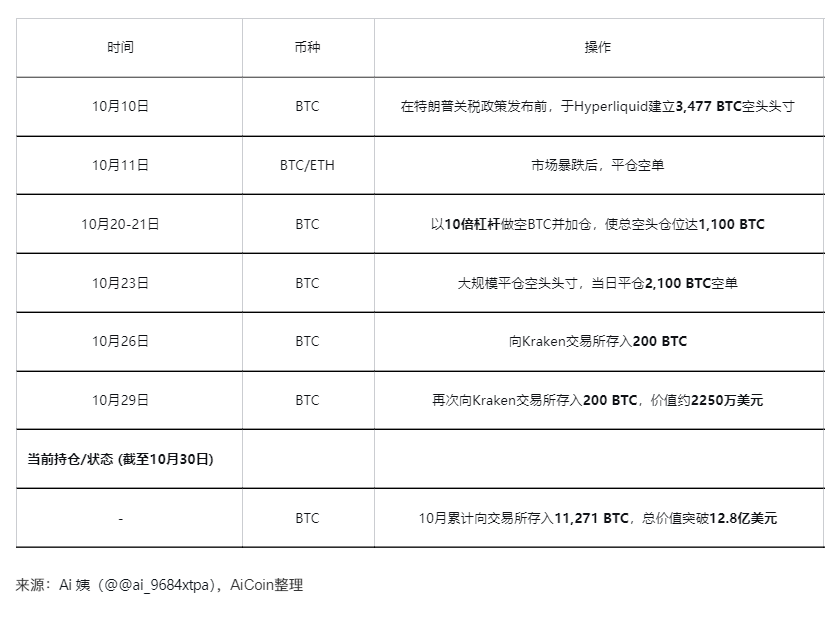

● On October 10, this whale began his "insider-style shorting performance." He first deposited $80 million into Hyperliquid, opening a 6x short position of 3,477 BTC; in addition, he deposited $50 million USDC into Binance.

● Subsequently, he increased his short positions, raising his BTC short position to 3,600 BTC, and targeted ETH, depositing $30 million into Hyperliquid to open a 12x short position of 76,242 ETH.

● On the evening of October 10, the whale's short positions continued to increase, reaching about $1.1 billion, with the BTC short position valued at $752 million and the ETH short position at $353 million.

Huge Profits and Subsequent Moves

● As the market fell due to Trump reigniting the tariff war, the whale's short positions turned profitable. Data shows that the whale who previously shorted BTC and ETH withdrew $60 million USDC back to Arbitrum, earning $72.33 million in the past 24 hours.

● On October 20-21, the whale acted again, shorting BTC with 10x leverage and further increasing his position to a total short position of 1,100 BTC. On October 23, he closed a large portion of his short positions to take profits, closing 2,100 BTC shorts that day for a profit of $6.44 million.

● On October 26 and 29, the whale deposited 200 BTC each time into Kraken exchange. This was his 11th transfer to exchanges in October, with a cumulative deposit of 11,271 BTC, totaling over $1.28 billion in value.

Identity Speculation and Market Doubts

● As for the whale's true identity, there is no conclusion yet. However, according to Lookonchain analysis, a Bitcoin OG who has been actively switching to Ethereum may be associated with Trend Research under Li Hua Yi.

Because the whale's operations coincided closely with political events, it has sparked widespread discussion about insider trading in the market, also highlighting the disadvantaged position of ordinary investors in the face of potential information asymmetry in the crypto market.

4. Market Insights and Risk Warnings from Whale Movements

Risk Warnings from Whale Operations

While whale operations are worth watching, directly "copy-trading" them is extremely risky:

● Information Asymmetry: By the time retail investors spot whale positions through on-chain monitoring, the best entry point is often already missed, dooming copy-trading to a natural disadvantage.

● Capital Gap: Whales have the advantage of capital scale and lower entry costs, which ordinary investors cannot replicate. Monitoring shows that some copy-traders, due to higher entry points, once faced unrealized losses exceeding $846,000.

● High Leverage Risk: "100% win rate" is a narrative label under specific market conditions; high leverage amplifies returns but also means huge liquidation risks if the market moves against the position.

Outlook

The October operations of the three whales showcased different trading philosophies and outcomes:

● "100% Win Rate Whale" demonstrated the importance of flexible position management and strict risk control. His decision to hold onto a losing SOL position shows a differentiated strategic layout.

● "Brother Machi"'s painful experience reveals the dangers of high-leverage trading, especially during periods of extreme market volatility.

● "10.11 Insider Whale"'s precise operations have raised questions about information fairness in the market and highlighted regulatory blind spots in the crypto space.