Series A for cashing out, Series B for retirement: The get-rich-quick course for crypto founders

Source: Fortune

Original Title: Crypto founders are getting very rich, very fast—again

Compiled and organized by: BitpushNews

In the startup world, we’re used to stories where founders struggle for years before finally becoming multimillionaires when their company goes public or is acquired.

This kind of wealth legend is also playing out in the cryptocurrency sector, but the road to riches is often much shorter.

A typical case is Bam Azizi. He founded the crypto payment company Mesh in 2020, and this year completed an $82 million Series B funding round.

Normally, such funding should be fully invested in the company’s development, but this time at least $20 million went directly into Azizi’s own pocket.

This money came from a “secondary sale”—investors buying shares from founders or other early participants. This means that while the funding amount looks impressive, the actual money entering the company’s account may be much less. But for founders, they don’t have to wait years; they can achieve financial freedom almost overnight.

This isn’t necessarily a bad thing. A Mesh spokesperson pointed out that the company has partnered with PayPal and launched an AI wallet, and is developing well. But the problem is, in the current bull market, founders are cashing out early through secondary sales, making a fortune before the company has truly proven its value.

Multi-million Dollar Mansions

Azizi is not alone. Since the start of this bull market last year, bitcoin has soared from $45,000 to $125,000, creating countless wealth legends.

In mid-2024, crypto social platform Farcaster completed a $150 million Series A funding round, with at least $15 million used to acquire shares held by founder Dan Romero.

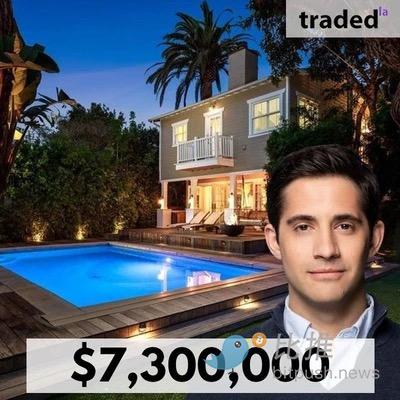

This former Coinbase employee never hides his wealth. In an interview with Architectural Digest, he gave a detailed tour of his $7.3 million mansion in Venice Beach, a four-building estate the magazine called an “Italian-style garden.”

While the renovation was a success, Farcaster’s development has been less so.

Reportedly, the platform’s daily active users are still under 5,000, far behind competitors like Zora. Romero did not respond to this.

Another beneficiary is Omer Goldberg. In this year’s $55 million Series A round for his security company Chaos Labs, $15 million went into his personal pocket. This company, invested in by PayPal Ventures, has become an important voice in blockchain security, but has also remained silent about this transaction.

Why Are VCs Willing to Pay?

According to industry insiders, in today’s hot crypto market and other popular sectors like AI, secondary sales have become increasingly common.

Top VCs such as Paradigm and Andreessen Horowitz often agree to buy founders’ shares in order to secure lead investment positions in promising projects.

For investors, this is essentially a gamble. The common shares they acquire have limited rights, far less than the preferred shares in conventional financing. But in an industry accustomed to “painting big pictures,” whether it’s wise to reward unproven founders so generously is debatable.

Veteran crypto observers are no strangers to this scenario. In 2016, countless projects easily raised hundreds of millions by issuing tokens. They promised to revolutionize blockchain technology and surpass Ethereum, but most have since faded away.

At the time, investors tried to use “governance tokens” to restrain founders, but one VC admitted: “They called them governance tokens, but they didn’t actually govern anything.”

By the 2021 bull market, the fundraising model began to resemble the traditional Silicon Valley approach, but early cash-outs by founders still persisted.

Payment company MoonPay saw its executives cash out $150 million in a $555 million funding round.

When the media revealed that the CEO spent $40 million on a Miami mansion, the market was already starting to cool.

Former star project OpenSea was similar, with the founding team cashing out heavily during fundraising. But as the NFT craze faded, the company has now had to seek a new direction.

“You’re Building a Community of Believers”

Why don’t VCs stick to more traditional incentive models—letting founders meet basic financial needs in Series B or C, but requiring them to wait until the company truly succeeds to reap huge rewards?

Veteran transactional lawyer Derek Colla points out the key: most crypto companies are “asset-light” and don’t require the massive capital investment seen in industries like semiconductors, so much of the money naturally flows to the founders.

He further explains: “This industry is extremely dependent on influencer marketing, and there are too many people willing to throw money at founders. Essentially, you’re building a community of believers.”

Secondary transaction expert Glen Anderson puts it more bluntly: “In hype cycles like AI and crypto, as long as you tell a good story, you can easily cash out.” However, he emphasizes that founders cashing out doesn’t mean they’ve lost confidence in the project.

Lawyer Colla believes that large cash-outs don’t dampen founders’ enthusiasm. He cites MoonPay as an example: although the founders were heavily criticized for the mansion incident, the company’s business is still developing healthily. Farcaster’s failure was not due to a lack of effort from its founder—“he works harder than most people.”

But he also admits that truly outstanding entrepreneurs choose to hold their shares long-term because they believe those shares will multiply in value when the company goes public. “Great founders never want to sell on the secondary market,” Colla concludes.

In this industry full of opportunities and bubbles, wealth comes and goes quickly. As a new wave of wealth creation sweeps in, perhaps we should consider: what kind of incentives can truly nurture great companies?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Spot ETF Set for Nov 13 Launch as SEC Delay Clause Removed

Quick Take Summary is AI generated, newsroom reviewed. Canary Funds removed the "delaying amendment" clause from its XRP spot ETF S-1 filing. This move uses Section 8(a) of the Securities Act, setting an auto-effective date of November 13. The ETF is planned to trade on Nasdaq and will use Gemini and BitGo as digital asset custodians. The strategy mirrors recent auto-effective launches of Solana, Litecoin, and Hedera ETFs.References CANARY REMOVES SEC DELAY CLAUSE — $XRP SPOT ETF NOW ON TRACK FOR NOVEMBER

'Dino' cryptos to soak up institutional funds bound for altcoins: Analyst

Price predictions 10/31: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, BCH

Bitcoin and Ethereum Options Worth $16 Billion Set to Expire, Could Trigger Market Turbulence

Traders Anticipate Market Swings as $13.5 Billion in Bitcoin and $2.5 Billion in Ethereum Options Approach Expiration Date