dYdX Aims for U.S. Expansion and Fee Reduction

- dYdX’s U.S. expansion anticipated by 2025.

- Significant reduction in transaction fees.

- Potential shifts in U.S. digital asset markets.

dYdX plans to enter the U.S. market by the end of 2025, focusing on spot trading and halving transaction fees. This major move, led by President Eddie Zhang, aims to capitalize on shifting regulatory landscapes and enhance market presence.

Points Cover In This Article:

ToggledYdX’s upcoming U.S. market entry is crucial due to significant fee reductions expected to alter competitive dynamics among exchanges.

The Expansion Strategy

The decentralized exchange dYdX plans to enter the U.S. market by late 2025. This strategic move focuses on spot trading with a notable reduction in transaction fees. The expansion aims to reshape the platform’s role globally by boosting its presence in one of the largest markets for digital assets.

Leadership Perspective

President Eddie Zhang stated, “This expansion into the U.S. represents the direction we’re trying to move in.” ( source ) The exchange previously limited U.S. presence due to regulations. With the upcoming move, spot trading will be a primary focus, backed by a potential fee cut between 50–65 basis points to gain a competitive edge.

Affect on Major Assets

The expansion is expected to affect major assets like Solana (SOL) and potentially ETH and BTC. This development could enhance the liquidity flow and trading volume on the platform. dYdX’s introduction in the U.S. market project stems from recent regulatory adjustments and its new $5M–$10M DYDX token buyback program, funded entirely by trading fees, is set from November 2025.

Operational Challenges and Adaptations

An eight-hour chain outage in October led to direct impacts, heightening the discourse concerning the protocol’s resilience. This incident also stressed the necessity for improved algorithmic changes in governance mechanisms, reflecting active community engagement. Moving forward, the emerging regulatory landscape presents challenges; however, dYdX is aligned with non-custodial, KYC-compliant practices, preparing for compliance in expanding perpetual trading, contingent upon regulatory approval.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prenetics increases its holdings by 100 bitcoins, bringing its total to 378 bitcoins.

Shiba Inu Price Prediction: SHIB Army Diversifies Into New Presales Like Noomez ($NNZ)

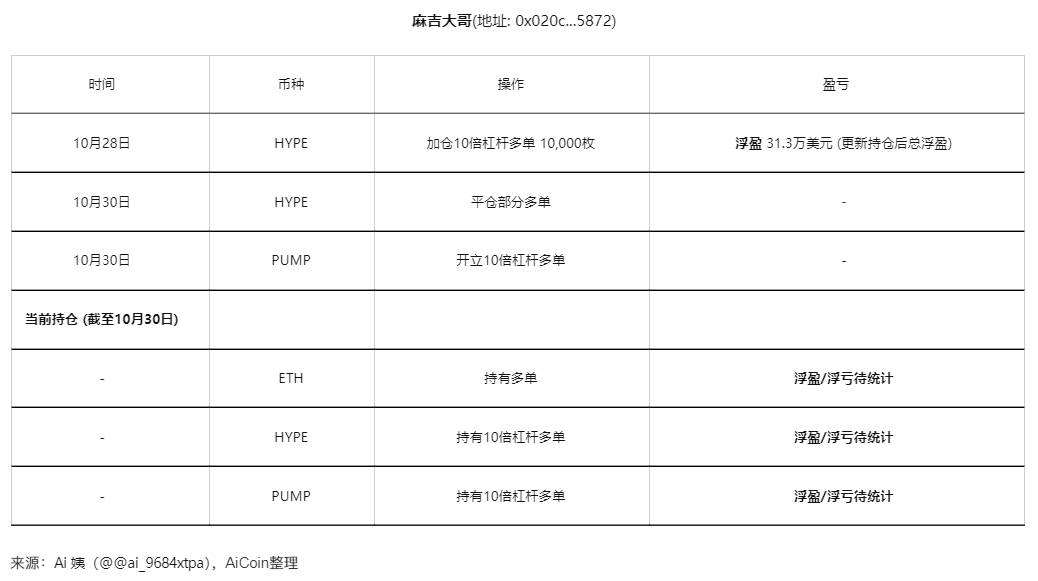

Full Disclosure of Crypto Whales' Moves in October: Myths, Tragedies, and Insider Suspicions