News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Near blessing, AI-driven, a glimpse of SenderAI's future prospects

远山洞见·2024/11/25 09:40

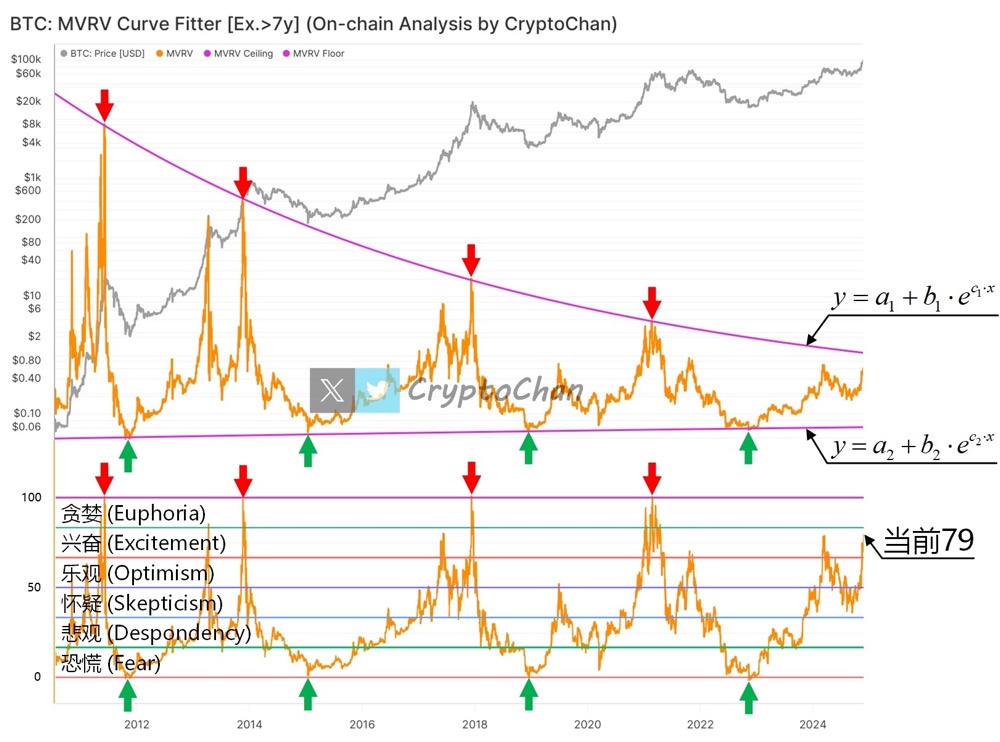

Precision tool for identifying market bottoms? Bitcoin MVRV indicator reappears, currently scoring 79

CryptoChan·2024/11/25 07:16

Zircuit Launches ZRC Token – Pioneering the Next Era of Decentralised Finance

Daily Hodl·2024/11/25 07:08

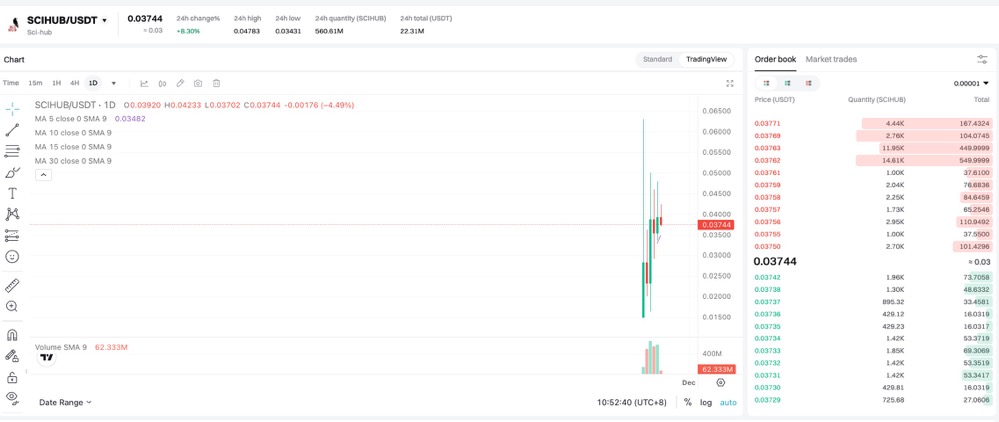

CryptoRock: Why I'm All in $scihub - Confessions of a Rebellious Hacker

推特观点精选·2024/11/23 03:09

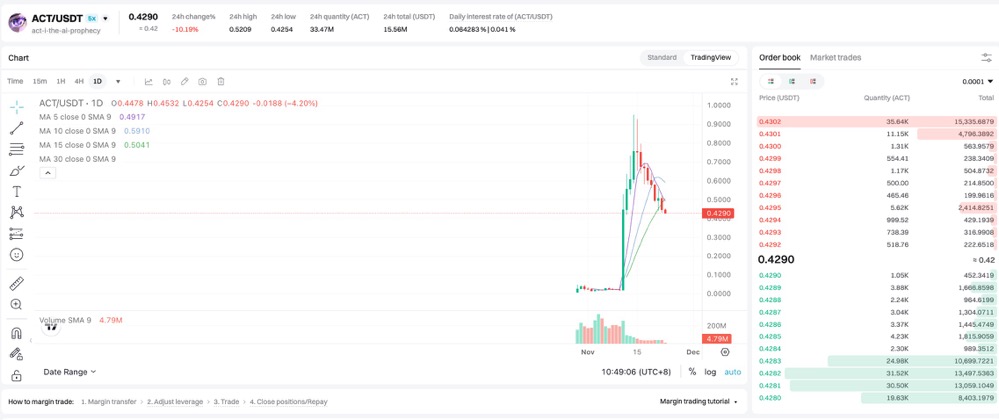

Meta Gorgonite: Why the potential of $ACT is far from exhausted

推特观点精选·2024/11/23 02:50

Zeus: Robust fundamentals of Aptos - Stripe and Circle support, promising future

Twitter Opinion Selection·2024/11/23 02:44

Yuyue: A Detailed Explanation of the Origin and New Narrative Leader of DeSci + Meme $RIF

推特观点精选·2024/11/23 02:43

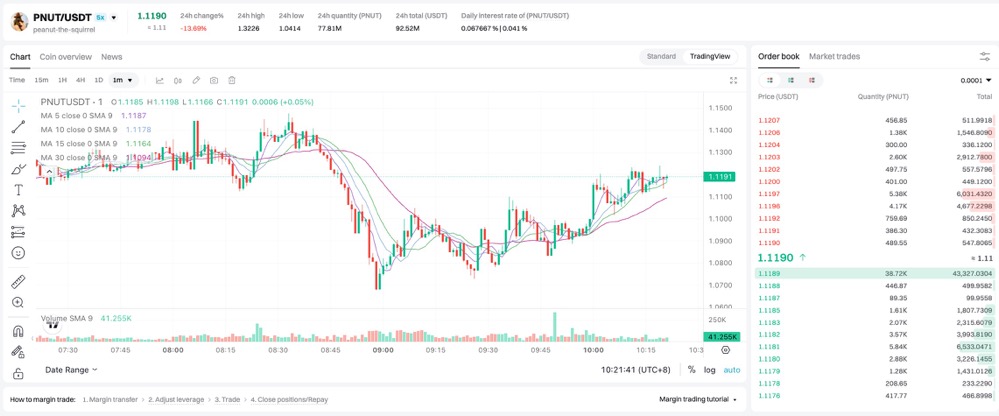

Sun and Moon Xiao Chu: Why do I continue to increase positions during the pullback of $PNUT and $ACT

Twitter Opinion Selection·2024/11/23 02:24

Flash

- 18:16Data: If ETH breaks through $4,098, the cumulative short liquidation intensity on major CEXs will reach $1.389 billions.According to ChainCatcher, citing data from Coinglass, if ETH breaks through $4,098, the total short liquidation intensity on major CEXs will reach $1.389 billions. Conversely, if ETH falls below $3,711, the total long liquidation intensity on major CEXs will reach $746 millions.

- 18:07Bitwise: The market is in a state of panic, making it the perfect time to accumulate Bitcoin.Jinse Finance reported that Bitcoin's recent weak performance appears to have dampened market enthusiasm, with Google search interest dropping to a multi-month low. The latest market sentiment index reflects typical bear market characteristics, with cautious sentiment dominating the entire crypto market. The Crypto Fear & Greed Index has dropped to 24, reaching the "fear" level, which is the lowest point in the past year and a sharp decline from last week's 71. This drop is similar to the sentiment seen in April this year when Bitcoin briefly fell below $74,000, and also echoes the market downturn cycles of 2018 and 2022. Despite the sharp decline in sentiment, Bitwise analysts believe the current situation is more suitable for "buying the dip" rather than retreating. The company's Head of Research André Dragosch, Senior Researcher Max Shannon, and Research Analyst Ayush Tripathi stated that the recent adjustment is mainly driven by external factors, and historically, such extreme sentiment often signals a good entry point before a strengthening market.

- 18:07The yield on the US 10-year Treasury has fallen below the key psychological level of 4% for the first time since April.Jinse Finance reported that the yield on the US 10-year Treasury bond has fallen below the key psychological level of 4% for the first time since April.