PayPal Stock Rises on ChatGPT Deal — But Can It Last?

PayPal stock is making headlines again — this time, for riding the wave of artificial intelligence. In late October 2025, shares of PayPal Holdings Inc. (NASDAQ: PYPL) surged after the company announced a high-profile partnership with OpenAI’s ChatGPT. The deal allows users to check out and complete purchases directly inside the ChatGPT interface using their PayPal accounts, ushering in a new era of AI-driven commerce.

The timing couldn’t have been better. Alongside the AI news, PayPal also delivered a stronger-than-expected Q3 earnings report, reinforcing the sense that the company might be turning a corner after a sluggish year. The stock’s double-digit rally was a breath of fresh air for long-suffering shareholders — but the big question now is: can this momentum last? Is PayPal's AI integration a real growth catalyst, or just a short-lived pop driven by market enthusiasm?

The Deal: PayPal Meets ChatGPT

PayPal’s recent partnership with OpenAI marks a major strategic shift toward AI-powered commerce. Through this collaboration, users of ChatGPT can now shop and complete purchases using their PayPal accounts — all within the chatbot’s interface. Powered by OpenAI’s new Agentic Commerce Protocol (ACP), the integration allows PayPal to offer seamless checkout, order tracking, and buyer protections directly inside AI-driven conversations. It’s a significant step toward what CEO Alex Chriss calls “frictionless, intelligent payments,” enabling users to move from product discovery to purchase in just a few taps.

Beyond convenience, the deal opens the door for millions of PayPal’s merchant partners to reach ChatGPT’s massive global audience. As conversational AI becomes more embedded in the customer journey, PayPal is positioning itself as the default payment layer for this emerging channel — not just in ChatGPT, but also across other AI platforms like Google Bard and Perplexity. It’s a bold bet on the rise of “agentic commerce,” and one that could redefine how users engage with digital wallets in the coming years.

PayPal Stock Pops — But What’s Behind the Rally?

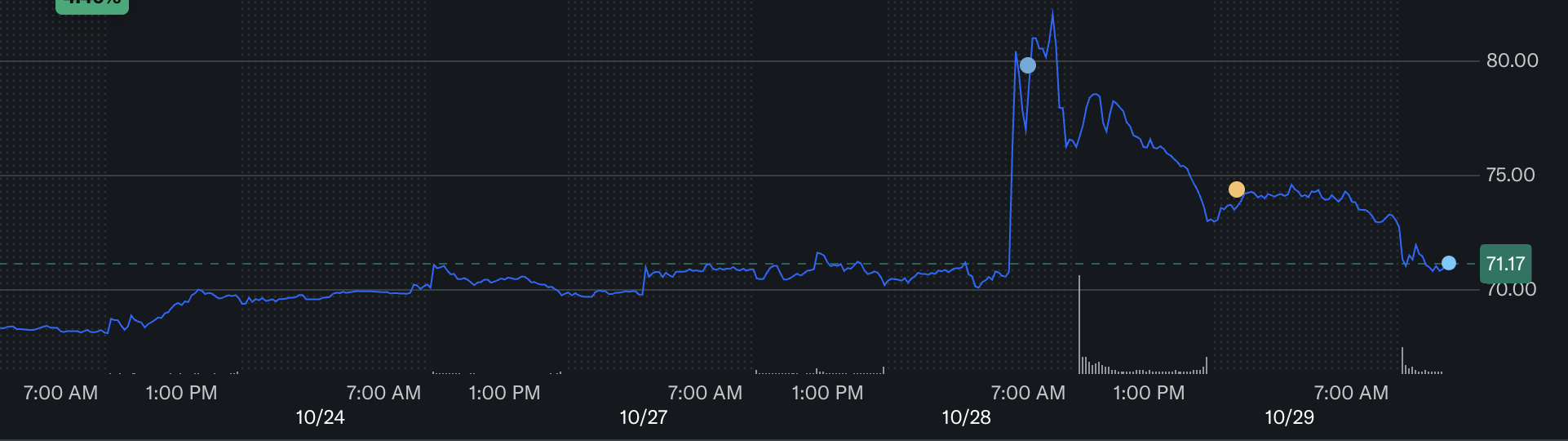

PayPal Holdings, Inc. (PYPL) Price

Source: Yahoo Finance

PayPal stock surged following its high-profile integration with ChatGPT, jumping as much as 15% in pre-market trading on October 28, 2025. The stock peaked above $81 — a level it hadn’t seen since early in the year — before settling up around 8% by market close. This marked one of PayPal’s best single-day performances in months. The rally was fueled by a potent combination: investor excitement over the company’s AI ambitions and stronger-than-expected third-quarter earnings released the same day.

Still, the market’s reaction wasn’t purely euphoric. Analysts largely viewed the AI partnership as a smart move, positioning PayPal within an emerging commerce trend. But they also flagged some caveats. For one, PayPal isn’t likely to be the sole payment provider in ChatGPT — competition will remain fierce. Moreover, the actual impact on revenue and transaction volume is still speculative. While the market applauded PayPal’s willingness to innovate, many investors are waiting to see whether this early momentum can convert into sustainable growth.

The Fundamentals: Earnings, Engagement, and Execution

Behind the headlines about AI, PayPal’s recent quarterly report revealed steady progress in its core business. In Q3 2025, the company posted revenue of $8.4 billion, up 7% year-over-year and ahead of Wall Street estimates. Adjusted earnings came in at $1.34 per share, beating consensus forecasts of around $1.20. These numbers marked the company’s strongest quarter this year and provided much-needed reassurance to investors after a prolonged period of underperformance.

One of the standout metrics was Venmo’s resurgence. The peer-to-peer payments platform saw 14% year-over-year growth in payment volume and is now expected to generate roughly $1.7 billion in revenue this year — a meaningful contribution that PayPal hasn’t spotlighted in the past. The company also reported steady expansion in Buy Now, Pay Later (BNPL) usage and improving transaction margins, thanks to a strategic focus on higher-quality payment volumes. Under new CEO Alex Chriss, PayPal is shifting from aggressive user growth toward operational efficiency. The company initiated its first-ever dividend this quarter and authorized significant share buybacks, signaling a stronger commitment to shareholder returns. With raised full-year EPS guidance now in the $5.35–$5.39 range, PayPal appears to be building a more profitable, focused foundation for future growth.

PayPal Stock Price Prediction: Where Could It Go Next?

After its recent rally into the low $80s, PayPal stock has regained attention — but its future trajectory remains uncertain. Analyst targets vary widely, from $68 to $105, with most forecasts landing in the $80–$90 range. Here’s a breakdown of the three major outlooks:

-

Bullish case ($95–$105): PayPal gains meaningful transaction volume through its AI integrations, Venmo accelerates as a revenue driver, consumer spending rebounds, and the company exceeds earnings expectations while expanding margins.

-

Base case ($80–$90): The ChatGPT integration shows moderate traction, core metrics grow steadily, and PayPal meets its 2025 guidance while maintaining buybacks and operational focus.

-

Bearish case ($68–$75): AI commerce adoption is slower than hoped, competition limits PayPal’s role within ChatGPT, margins tighten due to reinvestment, and macroeconomic weakness drags on consumer spending and branded checkout volumes.

With sentiment cautiously optimistic, the next few quarters — especially holiday performance and AI rollout updates — will likely determine whether PayPal stock can push higher or slide back into old patterns.

Conclusion

PayPal’s partnership with ChatGPT has reignited investor interest, offering a compelling narrative that ties the company to the future of AI-driven commerce. Combined with solid Q3 earnings and a renewed focus on profitability, the move signals a shift from defense to offense — and gives shareholders a reason to hope for sustained growth.

Still, the path forward isn’t without hurdles. The success of PayPal’s AI ambitions will hinge on consumer adoption, merchant engagement, and the company’s ability to execute in a competitive payments landscape. With macroeconomic pressures still in play, investors should stay optimistic — but also watch closely to see if this momentum translates into long-term results.

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.