Nvidia Earnings Report: Record AI-Driven Growth, Market Rebound, and Strategic Outlook

Following Nvidia’s third-quarter fiscal 2025 earnings release, the U.S. stock market reacted enthusiastically—major indexes and tech peers like AMD, Micron, Amazon, Google, Meta, and Microsoft all experienced after-hour gains. This powerful earnings report has not only soothed prior valuation worries but also reinvigorated excitement toward stocks in the AI sector.

In this analysis, you’ll find a comprehensive breakdown of the latest Nvidia earnings report: headline financial results, detailed business segment performances, analysis of what’s fueling Nvidia’s growth, insider commentary on the so-called “AI bubble”, and exclusive forward-looking statements from the company’s leadership.This Nvidia earnings report guide is packed with data-driven insights and executive perspectives.

Wall Street Rallies on Nvidia Earnings Report: Broader Market Impact

On the day of the Nvidia earnings report release for its fiscal 2025 Q3, excitement rippled through the markets. Nvidia’s stock soared by more than 5% in after-hours trading. This trend quickly lifted related chip and AI stocks—AMD up nearly 4%, Micron (MU) over 3%, and even tech giants like Amazon (AMZN), Google (GOOG), Meta (META), and Microsoft (MSFT) registering gains. The Nvidia earnings report dispelled immediate fears of an AI valuation “bubble,” reinforcing the sector’s fundamental demand story.

Source: Google Finance

Major Figures From Nvidia Earnings Report: $57 Billion Fueled by AI Factories

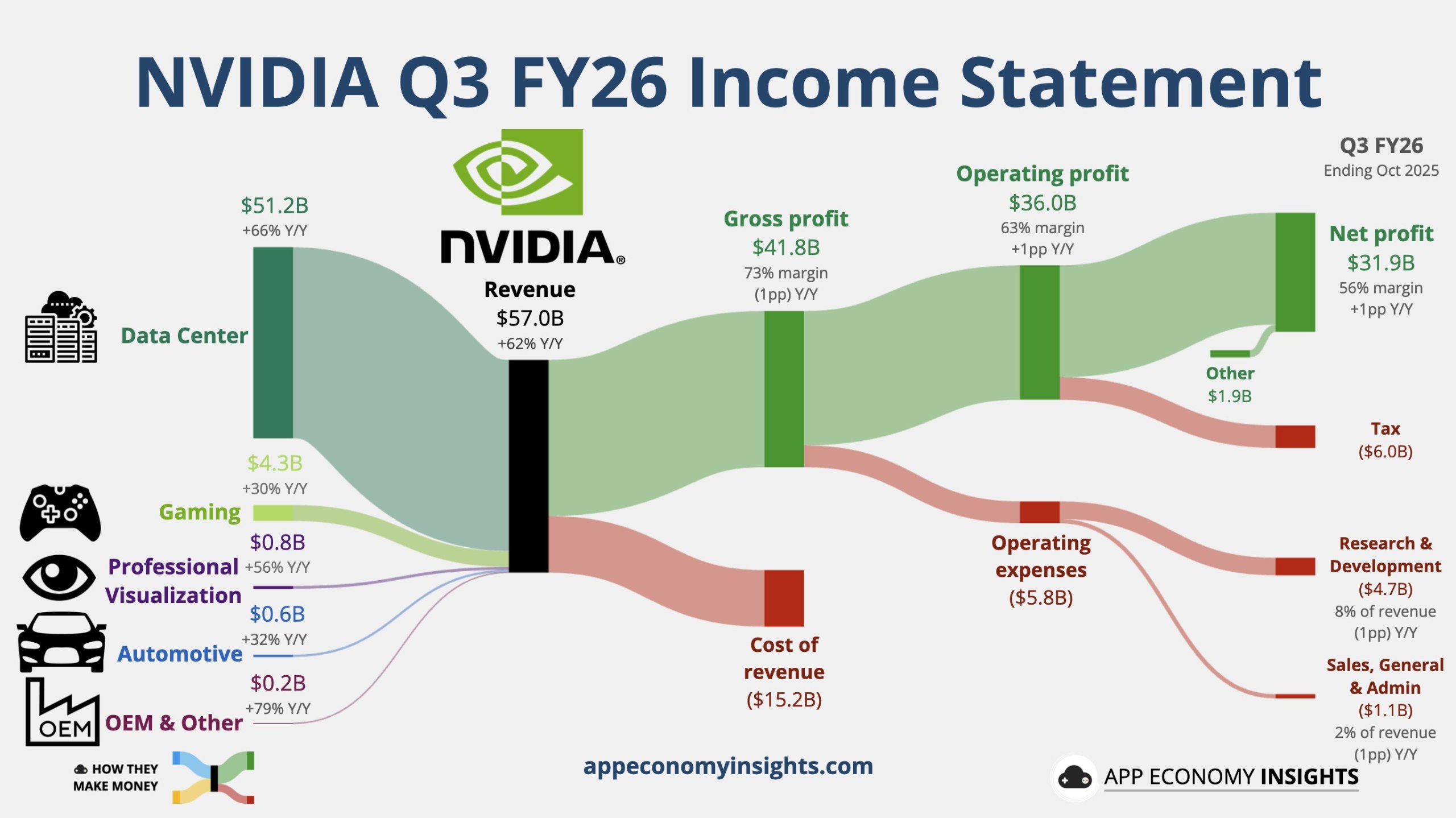

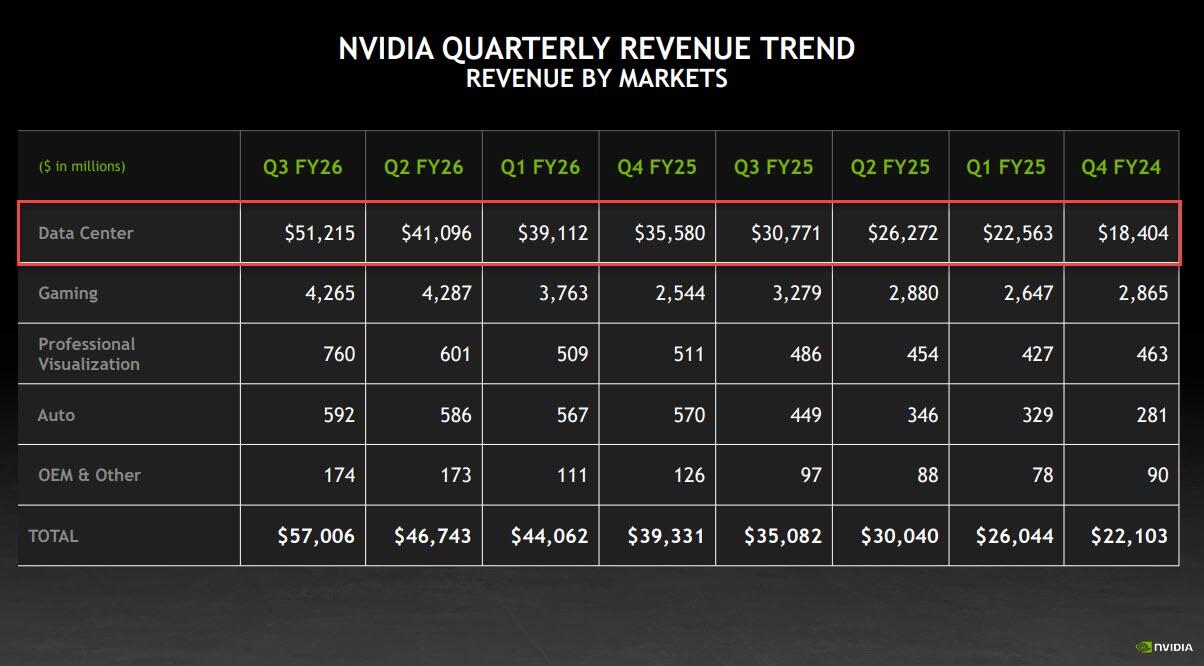

The headline number from the Nvidia earnings report is astonishing: $57.01 billion in third-quarter revenue, up a staggering 62% year-over-year, and beating both Wall Street and internal estimates by a significant margin. What stands out in the Nvidia earnings report is that nearly 90% of this revenue comes from its AI-centric data center segment—confirmation that Nvidia is the primary engine for global AI infrastructure.

Breakdown of key financial data from the Nvidia earnings report:

-

Data Center Revenue: $51.2 billion (+66% YoY), setting a new single-quarter record and far exceeding analyst forecasts

-

Gaming & AI PC Revenue: $4.3 billion (+30% YoY), reflecting synergies between next-gen computing and consumer demand

-

Professional Visualization: $760 million (+56% YoY)

-

Automotive & Robotics: $592 million (+32% YoY)

-

Networking: Soared to $8.2 billion (+162% YoY), fueled by NVLink, InfiniBand and Spectrum X

-

Adjusted Gross Margin: 73.6%, only slightly below the analyst consensus, and on track for recovery

-

Earnings Per Share (Non-GAAP): $1.30 (+60% YoY), exceeding expectations

-

Operating Expenses: $4.215 billion (+38% YoY), within guidance

This quarter’s Nvidia earnings report is notable not only for its scale, but for the quality: The company’s core businesses saw double-digit to triple-digit percentage growth, marking one of the strongest quarters in tech sector history.

A Deeper Look: Accelerating Revenue and Data Center Growth Break New Records

The most recent Nvidia earnings report marks the first time in two years that overall revenue growth and data center revenue growth have both accelerated quarter-on-quarter. Compared to the prior quarter’s YoY revenue growth of 56%, Q3 saw this climb to 62%, and data center revenue alone surged by $10.1 billion sequentially, or a powerful 24.6%.

The data center’s stellar performance—driven by cloud AI training and inference demand—now represents Nvidia’s primary revenue driver. The majority of these sales are attributed to cloud hyperscalers (Amazon, Microsoft, Google, Meta), who collectively account for more than 40% of the company’s total.

Nvidia’s CFO, Colette Kress, made it clear that the Q4 revenue guidance does not include China’s data center income, underscoring how robust Nvidia’s momentum is in North America, Europe, and other regions even in the face of geopolitical headwinds.

Why This Nvidia Earnings Report Eases AI Bubble Concerns

CEO Jensen Huang directly countered ‘AI bubble’ narratives during the earnings call: “There’s a lot of discussion about AI bubbles. We see a fundamentally different situation.”

Key points diminishing bubble concerns:

-

Concrete, Foundational Demand: AI infrastructure spending is delivering tangible business outcomes across search, advertising—even empowering companies like Meta, RBC, Eli Lilly, and Salesforce to unlock efficiency and growth.

-

AI ‘Virtuous Cycle’ Emerging: Cloud GPUs are sold out; demand for training and inference is rising exponentially. Six-year-old A100 GPUs still operate at full utilization, a rare signal of practical, enduring usage.

-

Capital Allocation Aligned to Growth: Nvidia ends the quarter with $60.6 billion in cash, ensuring continued investment in ecosystems and future-proof AI platforms.

Analysts agree: better-than-expected numbers for both revenue ($65 billion, +65% YoY) and gross margin (expected to rise to 75% in Q4) are clear signals that AI infrastructure demand remains robust—with little evidence of overbuild or bubble dynamics.

The Triple Platform Shift: How Nvidia Became the World’s Most Valuable Tech Company

Shift 1: CPU-to-GPU Acceleration

With Moore’s Law slowing, industries are migrating compute workloads from CPUs to GPU-accelerated platforms. The Nvidia CUDA ecosystem now enables both traditional and state-of-the-art applications to run at exponentially greater efficiency and scale—a trend validated in the latest Nvidia earnings report.

Shift 2: From Machine Learning to Generative AI

The Nvidia earnings report highlights how advertising, search, and core web functions are being rebuilt on generative AI. Companies like Meta, using Nvidia hardware for its generative advertising models (GEM), have seen direct jumps in conversion rates.

Shift 3: Intelligent Agents and Physical AI

The rise of AI agents (OpenAI, Anthropic, etc.) and robotics/automation (Jetson, Omniverse) can be seen in real-world commercial deployments. Nvidia’s “AI factories" and digital twin solutions are creating measurable gains in productivity for sectors from pharmaceuticals to automotive to finance.

Investor Confidence Restored: The “Virtuous Cycle” of AI Infrastructure

One striking takeaway from the Nvidia earnings report is that demand is not speculative—it is operational. Cloud GPUs are “sold out”, and use rates remain at or near full capacity even for older products such as A100 GPUs. Nvidia posted $60.6 billion in cash and equivalents, maintaining ample capacity for research, strategic investments (e.g., OpenAI ties), and ecosystem growth.

Guidance for Q4 from the Nvidia earnings report is bullish:

-

Revenue estimate: $65 billion (+65% YoY)

-

Gross margin estimate: 75% (the best in six quarters)

-

Operating expenses: $5 billion, signifying expanded R&D and go-to-market efforts

Wedbush and Bloomberg analysts remarked that the Nvidia earnings report’s guidance “handily beat buy-side expectations” and allayed most market concerns regarding overcapacity or a speculative bubble.

Forward-Looking Strategy: $500 Billion in Orders and a Decade-Long AI Supercycle

The most forward-thinking element from the Nvidia earnings report comes from both CEO Huang and CFO Kress. They confirmed an order book for next-generation Blackwell and Rubin GPUs totaling $500 billion across 2025 and 2026—a figure poised to grow as new sovereign and industrial AI factories come online. This projection includes:

-

Strategic projects like xAI’s “Colossus 2” (the world’s first gigawatt-scale data center)

-

Pharmaceutical innovation sites (e.g., Eli Lilly’s AI drug research hub)

-

AWS-Humane’s flagship GPU installations (potentially 150,000+ units)

-

Numerous national AI centers and public sector deployments

Management highlighted that for these domains, “the total addressable opportunity is counted in the multi-trillions,” and demand for AI infrastructure will remain a principal growth driver for years to come.

Conclusion

The latest Nvidia earnings report not only resets the bar for semiconductor performance, but it also fundamentally reframes the AI debate: Demand is both broad and deep, spanning every major industry, and backed by real-world results and cash flow.

With records in revenue, profitability, and a half-trillion-dollar pipeline in advanced chip orders, the Nvidia earnings report affirms the company’s leadership as the backbone of the global AI transition. Ongoing innovation across gaming, professional visualization, automotive, and, above all, AI-centric data centers will continue to shape Nvidia’s trajectory—and provide investors with a unique window on the technology supercycle of the coming decade.