How to Choose Elite Traders for Bot Copy Trading on Bitget

Bitget bot copy trading allows users to subscribe to top elite traders and copy their quant trading bots with a single click, enabling fully automated trading. Choosing the right bot elite trader is critical to long-term copy trading performance. This guide walks you through how to evaluate and select elite traders and bots in a rational and data-driven way.

Go to the bot copy trading page

Log in to the Bitget website or app, click the Trading tab in the top navigation bar, select Copy Trading, and then enter the Bot Copy Trading page. Here, you can browse all elite traders and publicly available top bots.

Key metrics to evaluate at a glance

| Ranking |

Metric |

Definition |

What to focus on |

Update frequency |

| 1 |

Total ROI |

Total historical ROI of the bot/elite trader (including realized and unrealized gains) |

Higher is better, but always assess consistency over time |

Real-time / daily |

| 2 |

Running time / bot duration |

How long the bot or elite trader's strategy has been operating |

Longer running time tends to be more reliable |

Real-time |

| 3 |

Short-term ROI stability |

ROI volatility over the past 7, 30, or 90 days |

Low volatility with sustained positive returns |

Every day |

| 4 |

Maximum drawdown |

The largest decline from a historical peak to a trough |

Lower is better; ideally below 30% |

Real-time |

| 5 |

Number of subscribers or copiers |

Current and total number of subscribers/copiers of the elite trader or bot |

Higher numbers indicate stronger community confidence |

Real-time |

| 6 |

Community feedback & reviews |

Feedback and profit-sharing experiences from real copiers |

Positive sentiment with no major liquidation complaints |

Real-time |

| 7 |

Bot type & market fit |

Bot types such as grid bots, CTA bots, Martingale bots, and signal bots |

Choose bots that align with your market outlook |

— |

| 8 |

Subscription fees |

Whether the elite trader or bot is free, one-time purchase, or subscription-based (monthly/quarterly) |

Evaluate cost-effectiveness and total expenses |

— |

Tips for beginners:

● Choose elite traders or bots with longer running times, lower maximum drawdowns (preferably under 25%), and a larger copier base for a more stable experience.

● If you are aiming for higher returns, you may consider more aggressive strategies with 30–45% drawdowns, but always isolate funds properly—using sub-accounts is strongly recommended.

How to compare and choose (a practical 3-step method)

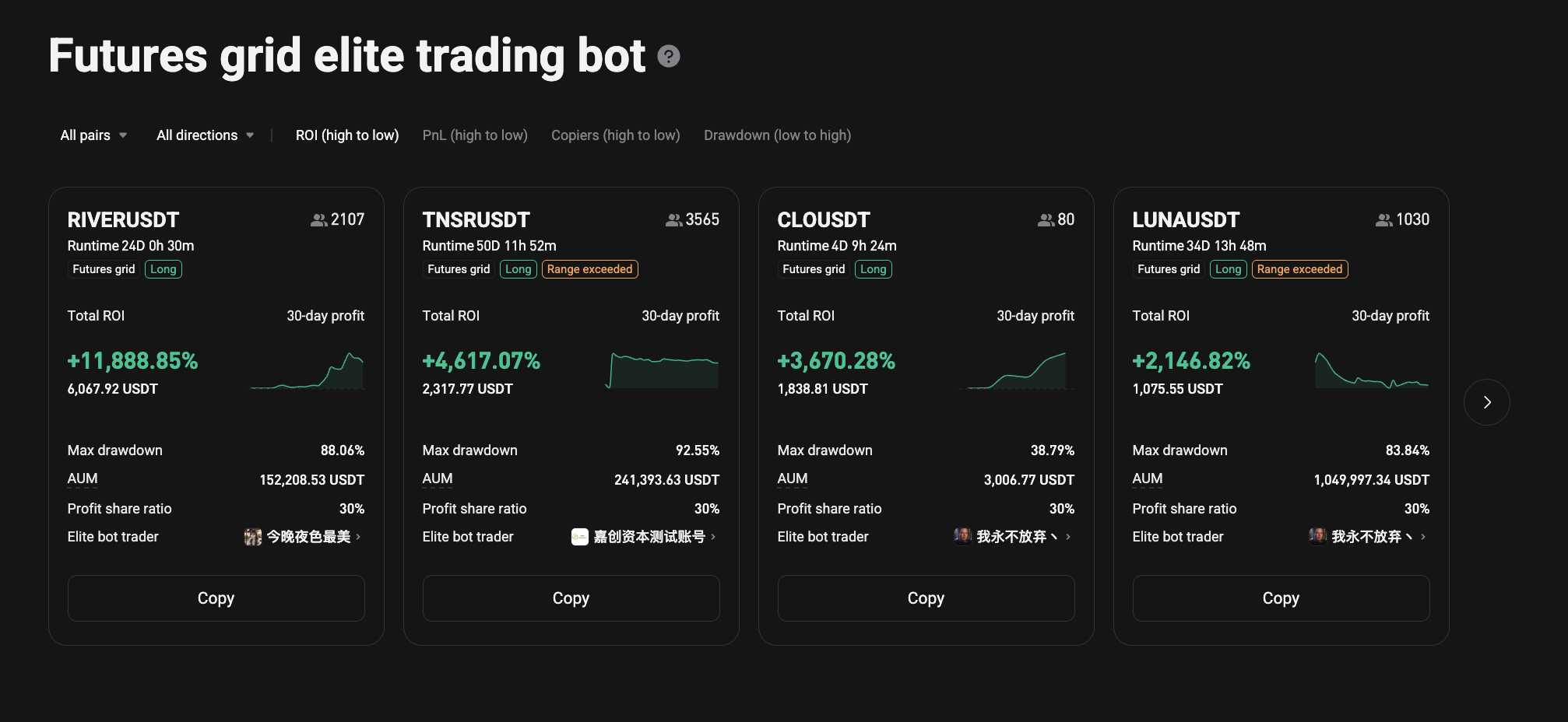

Step 1 — Quick screening

On the bot copy trading leaderboard, apply these filters:

● ROI (Sort by)

● Runtime

● Max drawdown < 35%

● Copiers: > 500

Step 2 — Shortlist and compare

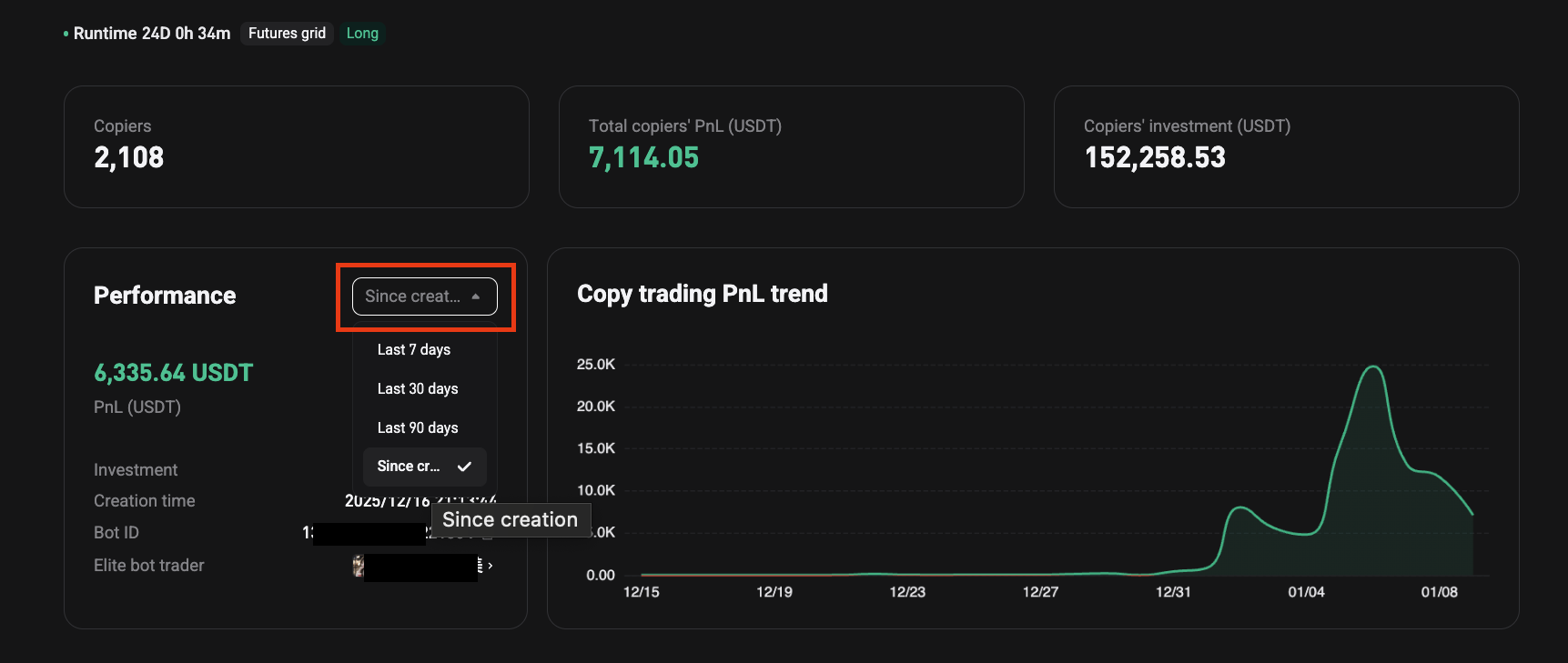

Open the profiles of 3–5 elite traders/bots you're interested in and compare:

● Is the profit curve trending upward smoothly? (Be cautious of sharp, jagged swings.)

● Is the ROI over the last 1–3 months still strong? (Many elite traders start strong but fade later.)

● Do the bot's target coins match your market outlook? (e.g., BTC/ETH vs. altcoins)

● How well did the bot recover after significant drawdowns? (Did it regain momentum and make new highs?)

Step 3 — Verify and start small

● Check actual user reviews and profit-sharing posts/results.

● Start with a small test amount (about 5–15% of your total funds) and copy for 1–2 weeks to observe TP/SL execution and slippage.

● Set your own TP/SL and a maximum copy amount to manage risk.

Common pitfalls to avoid

● Only chasing the highest total ROI: Many "high-return" bots perform well short-term but may get liquidated later.

● Ignoring running time: A bot that returns 300% in one month is likely not sustainable.

● Going all-in at once: Diversify by copying 3–5 elite traders/bots with different strategy styles.

● Overlooking profit share ratios: Some strong elite traders charge higher profit shares, which users might overlook. However, if returns outweigh the cost, they can still be solid long-term choices.

Conclusion: What fits you is best

In Bitget bot copy trading, there's no single "best" elite trader—only the combination that best fits your needs. Use these benchmarks as a reference:

● Longer running time generally means greater stability

● Total ROI (e.g., futures grid ROI ≥ 80–150%, spot grid ROI ≥ 20%)

● Max drawdown ≤ 30%

● Positive ROI over the last 3 months

● A large number of copiers and mostly positive reviews

● Most copiers' profit curves show an overall upward trend

● Bot type suitable for the current stage of the market.

After choosing an elite trader, set an appropriate copy ratio/amount, enable auto-copy, and review performance regularly. If needed, change bots or adjust your SL limits. Wishing you steady performance with Bitget bot copy trading!

Risk warning: Cryptocurrency trading involves high risk. Past bot performance does not guarantee future results. Assess your risk tolerance carefully and follow strict risk management.

- Introduction to Bitget Bot Copy Trading2026-01-07 | 5m

- Making Your First Bitget Stock Futures Trade2026-01-06 | 5m

- Introduction to Bitget Stock Futures2026-01-06 | 5m