Снижение процентных ставок ≠ бычий рынок, на этот раз рынок не реагирует на этот сценарий

Original source: Crypto Market Watch

Original title: Why did the market keep falling after the rate cut?

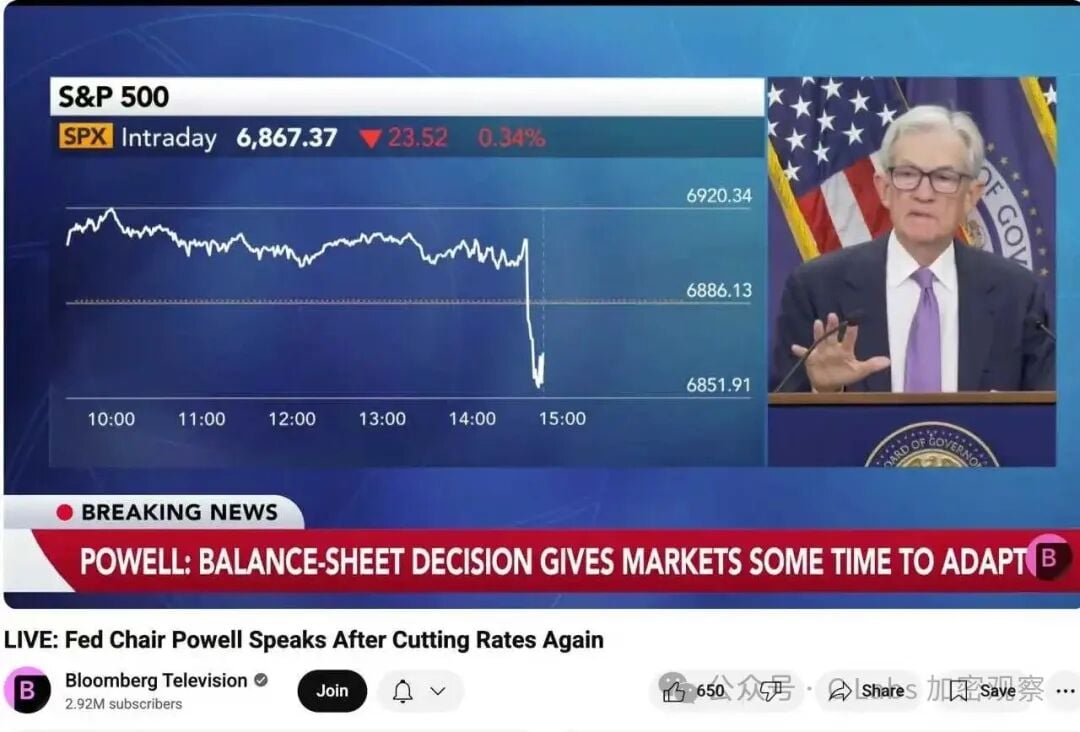

In the early hours of today in the East Eighth District, the Federal Reserve announced—a rate cut of 25 basis points, lowering the federal funds rate range to 4.00%–4.25%.

At the same time, the Federal Reserve also stated: Quantitative Tightening (QT) will officially end on December 1.

Logically, this should have been "positive news": rate cuts, ending balance sheet reduction, improved liquidity expectations. But the result puzzled many—why did stocks, cryptocurrencies, and even gold not rise, but instead fall across the board?

01. The market's "positive expectations" have long been priced in

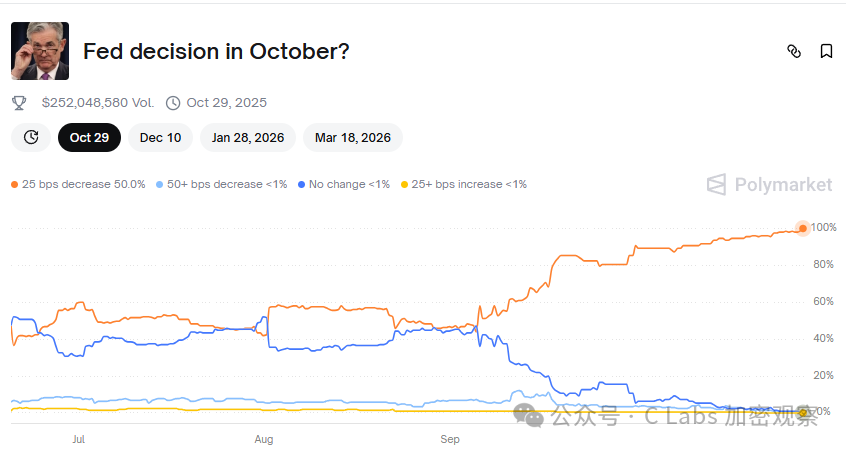

In fact, the market had already "bet" on this rate cut at the beginning of the month. According to CME FedWatch data, before the meeting, the market believed:

The probability of a 25bp rate cut was as high as 95%, and about 40% of investors expected the Federal Reserve to immediately announce the start of QE (balance sheet expansion).

As a result, the Federal Reserve only chose a "mild" rate cut.

In other words:

This rate cut is not "new positive news", but "below expectations".

When expectations are met but there are no surprises, the market often chooses to take profits. This is also a typical "buy the rumor, sell the news" scenario.

02. Stopping balance sheet reduction ≠ Starting liquidity injection

Many people see "QT ending" and think it means "massive liquidity injection" is coming. But in fact, the Federal Reserve's statement this time was very cautious:

"We will end balance sheet reduction, but will not start a new asset purchase program for now."

That is:

From the "tightening" phase, to the "wait-and-see" phase.

In financial market language, this means:

Liquidity is no longer deteriorating, but it is not improving either.

And for the investment market to rise, just "stopping the decline" is not enough—"incremental funds" are still needed. This is the biggest gap at present.

03. The rate cut has not been transmitted to the "actual funding rate"

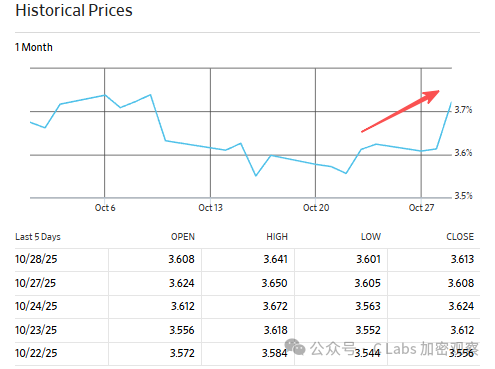

Theoretically, a rate cut will lower short-term rates and reduce funding costs. But this time the situation is a bit special—although the nominal policy rate was cut by 25 points, medium- and long-term funding costs did not fall in sync.

For example, the five-year Treasury yield rose from 3.6% to 3.7%:

The ten-year Treasury yield soared to over 4%:

What does this mean? It means that real market liquidity is still tight, and investment institutions have not felt that "there is more money". The Federal Reserve's rate cut is still just "talk", and has not really "flowed into the market".

04. The hidden worry behind the "rate cut": economic downward pressure remains high

From a more macro perspective, this rate cut by the Federal Reserve is actually a "defensive operation". Recent US economic data shows:

-

Real estate and manufacturing have experienced negative growth for two consecutive quarters;

-

The job market is slowing, with the unemployment rate rising again to 4.6%;

-

Corporate profit growth has almost stalled.

This means that the Federal Reserve has chosen to slightly loosen monetary policy to buffer downside risks between "maintaining growth" and "controlling inflation".

But this operation also sends a signal:

The US economy may have entered a "mild recession period".

In this case, the market would rather lock in profits first than easily increase positions in risk assets.

05. Summary: Rate cut ≠ bull market, liquidity is the core variable

This rate cut, the market's reaction actually gives the clearest logic:

Short-term policy easing ≠ abundant liquidity ≠ asset price increases.

What can truly drive a full reversal in the stock and crypto markets is the central bank restarting asset expansion (QE), or fiscal stimulus combined with large-scale capital inflows.

Before that, a rate cut is only "neutral to slightly positive"—it can stabilize confidence, but is not enough to trigger a new bull market.

The market does not want a 25-point rate cut, but a real liquidity injection.

Before that, 'risk assets' still have to wait.

Дисклеймер: содержание этой статьи отражает исключительно мнение автора и не представляет платформу в каком-либо качестве. Данная статья не должна являться ориентиром при принятии инвестиционных решений.

Вам также может понравиться

Fortify Labs открывает прием заявок на участие в акселераторе Web3 2026 года

Официальный токен TRUMP (TRUMP) в движении: ожидается ли двузначный прорыв?

Можно ли получить airdrop Polymarket, используя AI-агентов для исполнения стратегии на закрытии торгов?

Когда AI Agent учится самостоятельно осуществлять платежи: PolyFlow и x402 переписывают движение ценностей в интернете

x402 открыл канал, а PolyFlow расширил этот канал в реальный бизнес и мир AI-агентов.