Ang kasalukuyang artikulo ay hindi sumusuporta sa wikang iyong pinili, ito ay awtomatikong inirerekomenda sa Ingles para sa iyo

Bitget Beginner's Guide—Understanding Perpetual and Delivery Futures

[Estimated reading time: 3 mins]

Bitget offers investors two main futures types: perpetual futures and delivery futures. Both are stablecoin-settled futures trading products that allow investors to go long or short and potentially profit from price volatility. In simple terms, perpetual futures have no settlement date and do not expire, while delivery futures have a fixed settlement date.

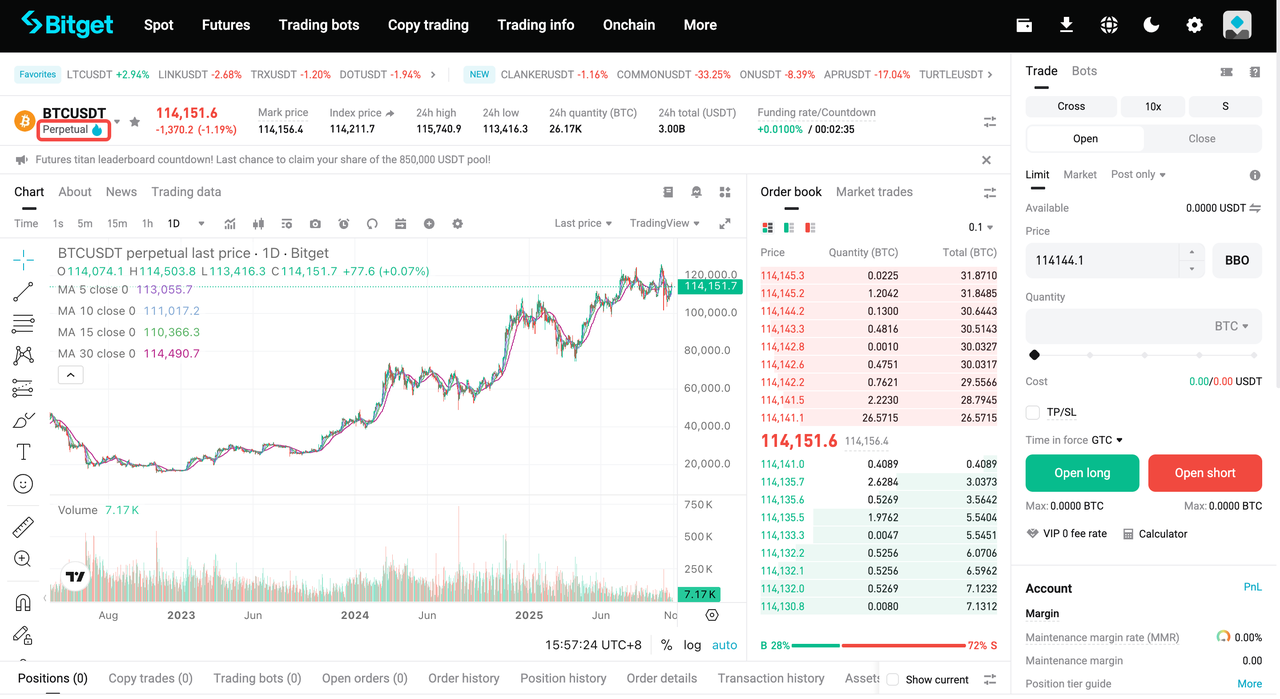

What are perpetual futures?

Bitget perpetual futures are derivatives with no expiry date. Investors can hold positions indefinitely. A funding fee mechanism helps keep the futures price aligned with the spot market price. Bitget offers USDT-M perpetual futures and USDC-M perpetual futures.

Key features:

1. No settlement date

• Unlike delivery futures, perpetual futures do not expire and can be held indefinitely.

2. Funding fee mechanism

• Funding fees are settled every 8 hours. The difference between the futures price and the spot price is offset by the funding fee payments between the long and short parties.

• When the funding rate is positive, longs pay shorts. When the funding rate is negative, shorts pay longs.

3. Margin trading

• Perpetual futures trading on Bitget supports high leverage (e.g., 125x) for both long and short positions, which can amplify potential returns and risks.

|

Trading pairs

|

BTCUSDT, ETHUSDT, BGBUSDT, and more

|

|

Expiry date

|

USDT-M perpetual futures have no expiry date

|

|

Types

|

Settled in USDT. Futures are quoted in base currencies such as BTC, ETH, and BGB

|

|

Minimum order size

|

Minimum order size varies by futures trading pair

|

|

Fees

|

Funding fees and transaction fees

|

|

Position mode

|

One-way mode and hedge mode

|

|

Order placement

|

Place order by quantity or by cost

|

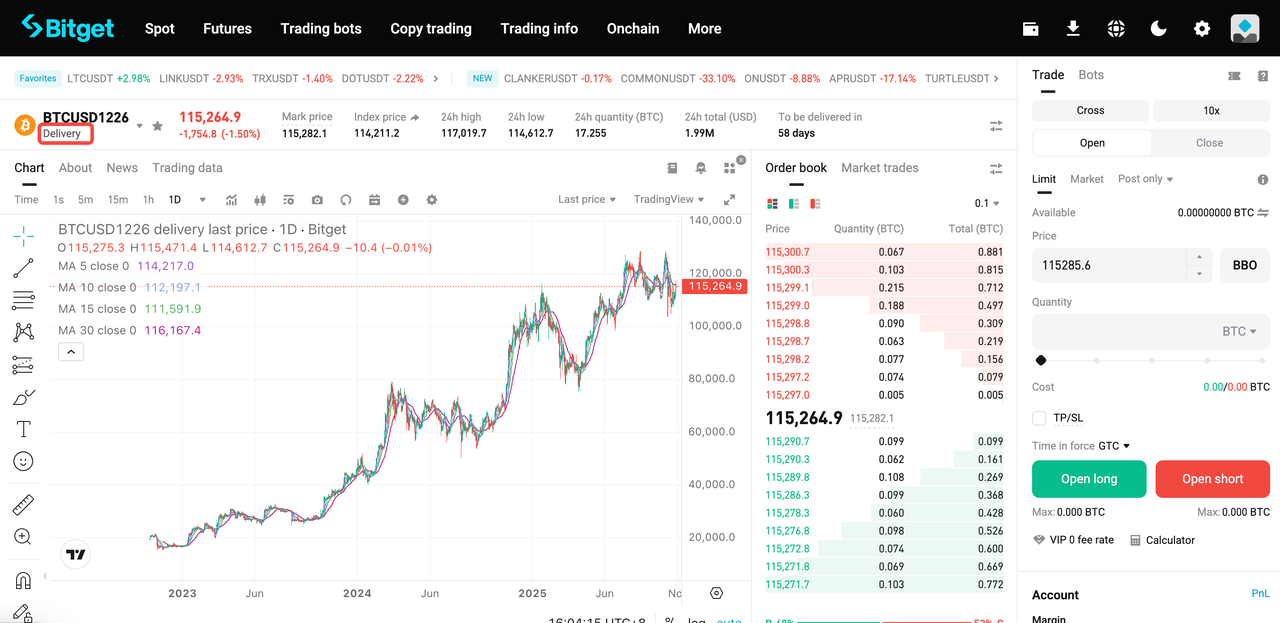

What are delivery futures?

Bitget delivery futures are derivative products where the buyer and seller agree to trade (buy or sell) a specific cryptocurrency at a predetermined price on a specified future date.

How Bitcoin delivery futures work (example):

1. Futures contract details:

• Settlement date: December 31, 2025

• Settlement price: $90,000

• Settlement amount: 5 BTC

2. Obligations:

• Seller: Must sell 5 BTC at $90,000, regardless of market price.

• Buyer: Must buy 5 BTC at $90,000, regardless of market price.

3. Settlement process: On the settlement day, the system automatically closes positions based on the weighted average price during the 30 minutes preceding settlement, helping prevent market manipulation. After delivery, the profit and loss are settled in USDT and the contract is terminated.

4. Early closing: You may manually close your position at any time before the settlement date.

Perpetual futures vs. delivery futures

Understanding the difference between perpetual futures and delivery futures is essential for choosing the right trading strategy. This comparison highlights how they differ in expiry, settlement, and pricing mechanisms. Click here to learn more about Bitget futures.

|

Comparison

|

Perpetual futures

|

Delivery futures

|

|

Expiry date

|

None; can be held indefinitely

|

Fixed settlement date

|

|

Settlement method

|

No physical delivery

|

Cash settlement upon expiry

|

|

Price peg

|

Pegged to index price by funding fees

|

Follows spot price directly

|

|

Funding fee

|

Regular payment (between longs and shorts)

|

None

|

|

Leverage

|

Higher (e.g. 125x)

|

Usually lower

|

|

Liquidity

|

Higher, active trading

|

Relatively lower

|

Key differences:

• Expiry date: The main difference is that perpetual futures do not have a settlement date. They can be held indefinitely unless liquidated, while delivery futures have a fixed settlement date.

• Funding fee: Since perpetual futures don't expire or have a delivery date, they rely on funding fees to stay aligned with the spot price.

FAQ

1. What are the main types of Bitget futures?

Bitget offers two main futures types: perpetual futures and delivery futures. Both allow traders to go long or short and potentially profit from price volatility.

2. What is the difference between perpetual and delivery futures?

The key difference is the settlement date.

• Perpetual futures have no expiry date and can be held indefinitely.

• Delivery futures have a fixed settlement date, after which the contract is settled automatically.

3. What are Bitget perpetual futures?

Perpetual futures are derivatives without an expiry date. Traders can hold positions indefinitely. A funding fee mechanism keeps the futures price close to the spot market price.

4. What leverage is available for perpetual futures on Bitget?

Bitget perpetual futures support high leverage—up to 125x, depending on the trading pair. Traders should use leverage carefully, as it amplifies both profits and losses.

5. What are delivery futures?

Delivery futures are contracts where the buyer and seller agree to trade a specific cryptocurrency at a set price on a future date. The contract is automatically settled on the settlement day.

6. Do delivery futures have funding fees?

No. Unlike perpetual futures, delivery futures do not charge funding fees because they have a fixed settlement date.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research and understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Ibahagi