BTC Market Pulse: Week 50

Bitcoin rebounded from the mid-$80K region and stabilised near $91K, setting a cautiously constructive tone after last week’s drawdown. Buyers were active at the lows, though broader conviction remains uneven across on-chain, derivatives, and ETF signals.

Overview

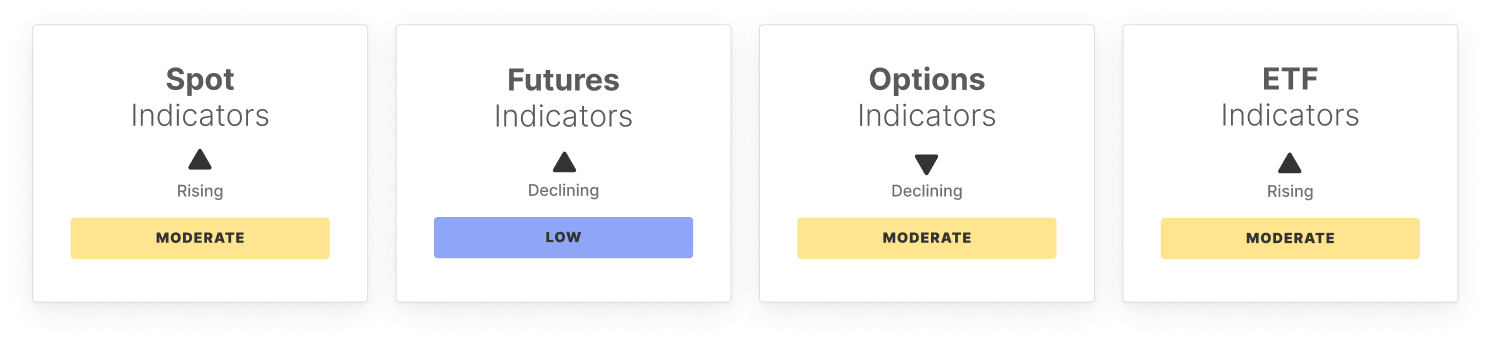

Momentum firmed as the 14-day RSI climbed from 38.6 to 58.2, while spot volume rose 13.2 percent to $11.1B. However, Spot CVD weakened from -$40.8M to -$111.7M, pointing to stronger underlying sell pressure.

Derivatives remained cautious. Futures open interest fell to $30.6B, perpetual CVD improved slightly, and funding turned more supportive with long-side payments up to $522.7K. Options showed mixed sentiment: steady OI at $46.3B, a sharply negative volatility spread at -14.6 percent, and a high 25-delta skew at 12.88 percent, indicating demand for downside protection.

ETF flows added a clear headwind. Netflows flipped from a $134.2M inflow to a $707.3M outflow, signalling profit-taking or softer institutional interest. Yet ETF trade volume rose 21.33 percent to $22.6B, and ETF MVRV increased to 1.67, pointing to higher holder profitability and some potential for distribution.

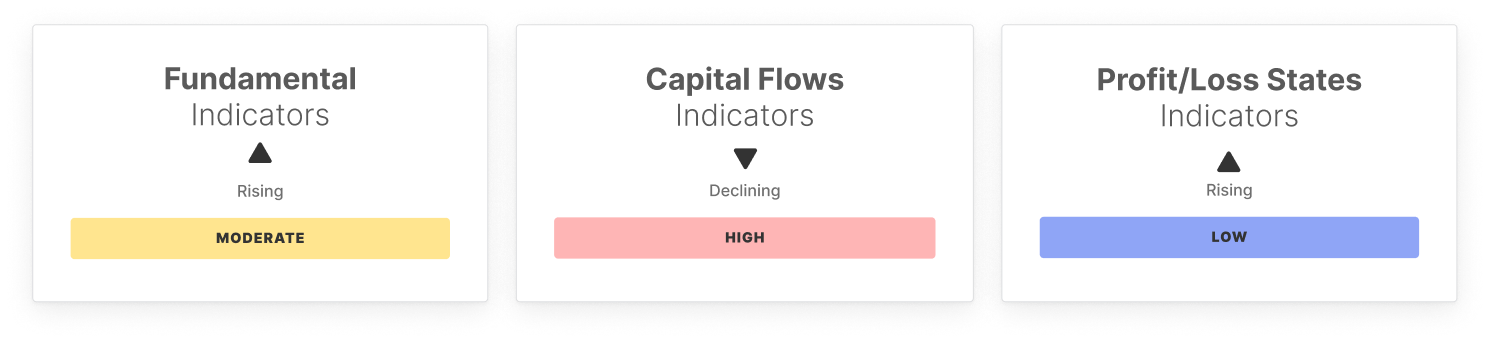

On-chain activity showed mild stabilisation. Active addresses rose slightly to 693,035, sitting near the low band. Entity-adjusted transfer volume increased 17.1 percent to $8.9B, suggesting healthier throughput. Fee volume dipped 2.9 percent to $256K, reflecting lighter block-space demand.

Supply dynamics remain cautious. Realised Cap Change fell to 0.7 percent, well below its low band, signalling softer capital inflows. The STH-to-LTH ratio rose to 18.5 percent, and Hot Capital Share stayed elevated at 39.9 percent, indicating a market still dominated by short-term participants. Percent Supply in Profit increased modestly to 67.3 percent, consistent with early-stage recovery. NUPL improved to -14.6 percent but remains deeply negative, while Realised Profit to Loss slipped to -0.3, signalling ongoing loss-realisation.

Overall, Bitcoin shows early signs of recovery momentum, yet sentiment and positioning remain cautious, highlighting a market still rebuilding confidence after recent volatility.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive Interview with HelloTrade: The "On-Chain Wall Street" Backed by BlackRock

After creating the largest bitcoin ETF in history, BlackRock executives are now reconstructing Wall Street on MegaETH.

US SEC Chairman Makes Bold Prediction: The Era of Global Financial On-Chain Has Arrived

SEC Chairman Atkins stated that tokenization and on-chain settlement will reshape the U.S. capital markets, creating a more transparent, secure, and efficient financial system.

With a $1 billion valuation, why couldn't Farcaster pull off a "decentralized" Twitter?

Farcaster acknowledges that decentralized social networking faces challenges in scaling, shifting its focus from a "social-first" approach to wallet business.