US investors consider crypto less as risk-taking drops: FINRA study

US investors are not considering buying crypto as much as they used to, as risk-taking behavior has dropped, according to a study from the Financial Industry Regulatory Authority.

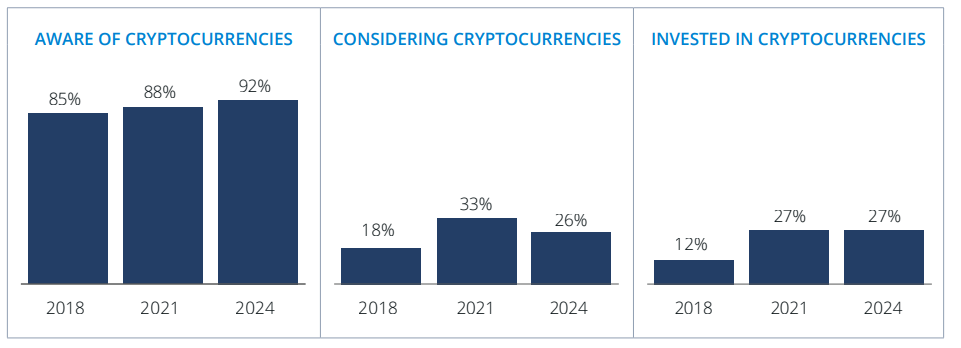

The percentage of crypto investors was unchanged between 2021 and 2024 at 27%, but the number of investors considering either purchasing more or buying for the first time dropped to 26% in 2024 from 33% in 2021, FINRA reported on Thursday.

The industry regulator found that those with “high levels of investment risk” dropped four percentage points to 8% between 2021 and 2024. The biggest drop was among investors under 35, which shaved nine percentage points to 15%.

People investing in crypto has been steady since the last study in 2024, but the number of investors considering adding it to their portfolios has decreased. Source: FINRA

Investment into crypto typically spikes during periods of high optimism in the wider macroeconomic environment, but uncertainty over interest rates , inflation, and the economy has likely seen investors turn to perceived safer assets .

Crypto flagged as risky but key tool for financial goals

FINRA’s study was conducted between July and December 2024 with 2,861 US investors and a state-by-state online survey of 25,539 adults. It found 66% of respondents flagged crypto as a risky investment, up from 58% in 2021.

However, a third of investors responded that they believed they needed to take big risks to reach their financial goals, which grew to 50% of respondents for those aged 35 and under.

Around 13% of investors, including nearly one-third of individuals under 25, also reported purchasing meme stocks and other viral investments.

Pace of new investors cools

The pace of investors entering markets has also declined compared to 2021. Only 8% of investors reported they had entered the market in the last two years to 2024, compared to 21% in 2021.

“The surge of younger investors who entered the market early in the pandemic, as reported in the 2021 NFCS, reversed direction as the pandemic ended, bringing the share of US adults under 35 who invest back down to the 2018 level,” FINRA noted.

Overall, FINRA found the results show a “modest trend toward more cautious attitudes and behaviors” relative to the 2021 survey.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Algo Slips 0.22% as Market Volatility and Investor Lawsuits Intensify

- ALGO fell 0.22% on Dec 7, 2025, marking a 60.15% annual decline amid broader market turbulence. - Investor lawsuits against Alvotech (ALVO) and agilon health (AGL) triggered 34-51.5% stock drops over alleged misrepresentations. - Rising litigation in healthcare/biotech sectors highlights investor demands for corporate transparency and regulatory compliance. - ALGO's decline reflects sector-wide risk aversion rather than direct legal ties, with analysts predicting prolonged caution until regulatory clarit

The Importance of Teaching Financial Skills Early for Lasting Wealth Accumulation

- Early financial education reduces cognitive biases like anchoring and overconfidence, improving investment decisions and wealth accumulation. - College-level programs enhance critical thinking, leading to measurable outcomes like higher credit scores and reduced debt in states like Georgia and Texas. - Long-term benefits include compounding returns, with Utah and Chile showing increased savings rates and retirement planning due to mandatory financial literacy. - Addressing systemic gaps, educated investo

The Federal Reserve's monetary decisions and their influence on Solana's price fluctuations

- The Fed's 2023-2024 tightening cycle, including QT and high rates, amplified crypto volatility, with Solana (SOL) showing heightened sensitivity to liquidity constraints. - Solana's price surged during December 2025 liquidity injections post-QT but remains vulnerable to Fed policy shifts, reflecting macroeconomic-driven crypto dynamics. - Ending QT created a net-positive liquidity environment for digital assets, potentially boosting Solana's TVL and institutional adoption amid easing monetary policy. - I

BCH has risen by 33.65% since the start of the year, driven by network improvements and growing attention from institutional investors.

- Bitcoin Cash (BCH) rose 33.65% year-to-date in 2025, driven by a network upgrade enhancing scalability and transaction efficiency. - Institutional investors are increasingly adopting BCH, citing its market cap and on-chain scaling focus. - A Southeast Asian retail chain now accepts BCH alongside local currencies, expanding its merchant adoption. - Analysts predict continued BCH growth, supported by institutional interest and expanding use cases in emerging markets.