Bitcoin Updates: Institutional Trust in Bitcoin Rises as $231 Million Moves into Custody

- BitGo transferred $231M BTC to 10 new custodial wallets, signaling rising institutional demand for secure crypto storage amid market activity. - The 2,612 BTC inflow (0.13% of total supply) aligns with broader capital reallocation into custody infrastructure, potentially supporting market-making strategies. - XRP ETFs like TOXR drive $666M in inflows since November, reflecting institutional adoption trends similar to Bitcoin's post-ETF surge. - Regulatory clarity and pending ETF applications could amplif

BitGo Moves $231 Million in Bitcoin to New Custodial Wallets

Over the past week, BitGo has shifted approximately $231 million in Bitcoin, totaling 2,612 BTC, into ten newly created wallets. This significant transfer, identified by LookIntoChain's on-chain analytics, highlights a notable increase in assets held within custody-enabled addresses and points to changing liquidity patterns in the cryptocurrency sector.

First reported by COINOTAG News on December 2, this activity demonstrates BitGo’s ability to handle large-scale, institutional transactions and its ongoing role in facilitating major crypto transfers. The migration of funds into fresh custodial wallets suggests that demand for secure storage solutions is rising, especially as market activity intensifies.

LookIntoChain’s transparent tracking of custody inflows allows investors to monitor liquidity shifts without speculation about the motives or timing behind such moves. Experts note that these types of transfers often precede strategic decisions, such as market-making, long-term holding, or compliance with regulations, though BitGo’s specific intentions have not been disclosed.

Institutional Interest Grows: XRP ETF Launches and Market Impact

This surge in Bitcoin custody coincides with a broader wave of institutional engagement in digital assets. On December 1, 2025, 21Shares introduced its XRP ETF, trading under the symbol TOXR, becoming the fifth major XRP-focused exchange-traded product in a competitive landscape. Unlike the coordinated launch of Bitcoin ETFs in January 2024, XRP ETFs have entered the market in phases, fueling ongoing momentum and price action.

Since mid-November, this staggered rollout has attracted $666.61 million in total inflows, contributing to a 12% weekly increase in XRP’s value.

The pipeline for XRP ETFs remains strong, with pending applications from WisdomTree, Volatility Shares, and ProShares. Should these products receive approval, they could further boost institutional participation, echoing the rapid adoption seen with Bitcoin ETFs. Nevertheless, XRP has faced challenges, dropping 40% from its July 2025 peak and currently trading near $2.20 amid broader market turbulence.

Regulatory clarity following Ripple’s settlement with the SEC has improved XRP’s standing, but uncertainty persists as the Federal Reserve prepares for its next meeting, where there is an 85% chance of a 0.25% interest rate reduction.

Shifting Crypto Landscape: Custody and ETFs Reshape the Market

BitGo’s recent $231 million Bitcoin transfer reflects a larger movement of capital into secure custodial platforms. The 2,612 BTC moved—representing about 0.13% of Bitcoin’s total circulating supply—may indicate preparations for market-making or arbitrage opportunities. At the same time, the evolving XRP ETF market demonstrates how institutional-grade investment vehicles are transforming crypto liquidity, offering regulated custody and transparency that were previously unavailable to direct token holders.

Looking forward, the relationship between advanced custody solutions and the growing demand for ETFs will play a pivotal role in shaping the crypto market. If BitGo’s actions signal a broader institutional shift toward secure Bitcoin storage, it could strengthen the asset’s reputation as a reliable store of value. However, ongoing volatility in both Bitcoin and XRP will challenge the durability of these new inflows. As the digital asset ecosystem continues to evolve, the integration of custody services and structured investment products may fundamentally alter traditional approaches to investing.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

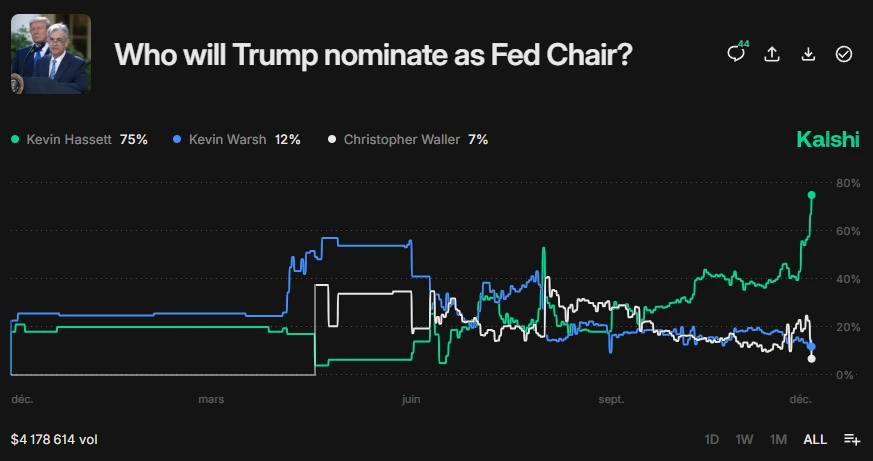

Trump’s Fed Chair Announcement Likely This Week: Is It the Needed Crypto Bullish Catalyst?

XRP Price News: Breakout or Breakdown?

Huione Pay Halts Withdrawals After Run on Banks, Users Fear Major Losses

Bitcoin News Update: Vanguard Shifts Stance on Crypto Amid Growing Demand and Regulatory Clarity

- Vanguard Group, managing $11 trillion, will let clients trade regulated crypto ETFs from Dec 2, 2025, reversing long-term skepticism toward digital assets. - The firm supports Bitcoin , Ethereum , and major crypto ETFs but excludes memecoins and won't launch its own crypto products, prioritizing low-cost, regulated offerings. - This shift reflects growing retail/institutional demand and maturing regulatory frameworks, aligning with SEC-approved spot crypto ETFs showing liquidity and stability. - By joini